Update: This offer is no longer available.

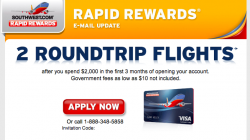

Barclaycard has a new card in town and it is trying to get your attention by offering you double the sign up bonus for a VERY limited of time! The new card is the Barclaycard Arrival Card, which is Barclaycard’s attempt to compete with cards like the Chase Sapphire Preferred and the Capitol One Venture card. It offers some of the bells and whistles as the competitors’ cards and comes in two different options: No fee or low $89 annual fee (waved for the first 12 months) and the card is offering a 2x Bonus sign up offering, giving you between $200 and $400 cash back for signing up and spending just $3000 in the first 90 days!

Both cards are nearly the same; however, they earn miles at a slightly different rate. The NO ANNUAL FEE card earns 1 mile per dollar spent and 2 miles on travel and restaurants. The Annual fee card offers 2 points per dollar spent everywhere! The idea behind this card is to get you traveling and let you choose how you spend your miles and where you spend them! Unlike other cards, which limit your travel options, this card will allow for points to be redeemed for almost anything, travel related!

Miles on the Barclaycard Arrival cards are currency. Each point is worth 1 cent and can be redeemed in multiples of 2,500, which is the equivalent of $25. Since miles really equal cash, it means the no annual fee card offers 1-2% cash back on all purchases and the $89 annual fee card (the annual fee is waved for the first 12 months) is truly a #DoubleWideDelight offering 2% cash back on ALL purchases!! The catch is, after spending money on travel, miles are used to reimburse your credit card for charges made. To be reimbursed for travel costs or to use your miles, simply follow these three simple steps.

- Buy a plane ticket, stay in a hotel, buy a bus ticket, rent a car, book a cruise, or anything else Barclaycard defines as travel.

- Request a statement credit within 90 days of the purchase of the travel related item

- Within 7 days of the request you will be refunded whatever you spent (granted you have enough miles!).

The other great part of the program is you can use partial miles. Meaning if you buy a $500 plane ticket but only have 25,000 miles, Barclaycard will provide you with a $250 statement credit! No longer are you stuck on the ground due to a lack of miles! In addition, unlike most mile redemptions, you will actually earn the miles you fly into your own frequent flyer account! Since the card is not affiliated with any frequent flyer program, you will get to earn miles while flying free!

This card is awesome because it earns 2x points per dollar spent on travel and dining. When it comes to earning points on travel, it is even easier because unlike most cards, it does not limit travel to only airlines and hotels. Instead, Barclaycard defines travel as: A travel purchase and redemption is defined as: Airlines, Travel Agencies & Tour Operators, Hotels, Motels & Resorts, Cruise Lines, Passenger Railways and Car Rental Agencies as defined by the merchant category code. A Dining purchase is defined as: Restaurants and Fast Food Restaurants as defined by the merchant category code. This means earning points and redeeming points is EASY!

Then, when it comes time to redeem your miles, you can get a 10% carry forward bonus! Miles can be redeemed for travel, cash, or a slew of merchandise or gift cards online through the Barclaycard award portal, however if miles are redeemed for travel, 10% of your miles will be rewarded back to you! So if you spend 25,000 points, you will get a $250 statement credit + 2500 will be rewarded back to your account after your claim is processed! So depending on how you look at it, you are now earning 2.2 points per dollar spent!

This card is also a GREAT card to travel with because it comes with NO foreign transaction fees and offers peace of mind and security of

- MasterCard Global Service providing worldwide, 24-hour assistance with lost/stolen card reporting, emergency card replacement and emergency cash advances

- Up to $200,000 travel accident insurance

- Reimbursement for expenses if your baggage is delayed or misdirected

- Trip cancellation/interruption coverage

Again, this card comes in two versions: The annual fee and the no-annual fee version.