The Barclaycard Arrival Plus™ WorldElite MasterCard® is one of my favorite credit cards, and one I use almost everyday. It seems kind of odd that in a miles and points world, I prefer a card that earns cash back, but it’s strong for several reasons.

A great card in the first year

If you’re new to the card, the signup bonus is 40,000 points for spending $3,000 in 90 days (I get a credit if you sign up for the card through my link). The $89 annual fee is waived the first year. That signup bonus is good for $400 toward any travel redemptions (ranging from flights to hotels to trains to cabs to rental cars). Just pay for the travel charge with your Barclaycard Arrival Plus MasterCard and use points to take the charge off your statement.

But when you redeem points for a travel charge, Barclay actually gives you a 10% rebate on the redemption, so redeeming 40,000 points gets you 4,000 points back, worth another $40.

On the spending side, you get 2 points per dollar on every charge, and with the 10% rebate, points are worth about 2.2 cents each, making it better than a 2% cash back card, the usual benchmark. Sure, you have to redeem the points on travel charges, but there have been a few times I’ve booked awards that I’ve had to refund later on, and I was still able to use points to take the taxes and fees off my statement before refunding. It basically acted as a statement credit in those instances.

If you’re someone who loves using AviancaTaca Lifemiles, this is actually a better card than the Lifemiles Visa, since buying Lifemiles shows up as a travel charge.

Lastly, the card comes with an annual TripIt Pro subscription, worth $50. I’ve enjoyed having it the past year, though I’m not sure I would have paid $50.

A great shopping portal for a specific use

The Arrival card also gives you access to the Barclay RewardsBoost shopping portal, which currently has a 4X portal bonus on American Express Gift Cards. As I mentioned in my FTU presentation, you can buy up to $5,000 of personal American Express gift cards every 14 days, and save on shipping fees by signing up for a trial premium shipping plan for 90 days. You don’t have to use the Arrival card to buy the Amex gift cards to get the portal points, but since it’s my preferred card, I do use it. That means with a 4x portal bonus and 2x credit card rewards, I get 6x points, worth about 6.6% back.

While Amex gift cards don’t have PIN functionality, you can turn around and use them to buy Visa/Mastercard gift cards with PIN elsewhere, and it makes it easy if you’re able to personalize your Amex gift cards with you name on them. The increased cash-back acts as a “discount” on the fees you have to spend to get the Visa/Mastercard gift cards.

Still great for the second year and on – if you use it wisely

I’ve had the card for well over a year now, and my $89 annual fee just hit. For reference, there are several 2% cash back cards that have no annual fee whatsoever, like the Fidelity American Express card. However, the Barclaycard Arrival card has two things that make it better – the 10% rebate (making it a 2.2% back card) and the RewardsBoost portal, giving you >4% back on American Express gift cards, better than any of the recent TopCashBack or BigCrumbs bonuses (I get a credit if you sign up for either service through my referral link).

If you were to just take into consideration the extra 0.2% back and the $89 fee, you would have to spend $44,500 per year for the extra 0.2% to cancel out the fee. Anything above that would make the Barclaycard Arrival card better than the Fidelity American Express.

But what if you added the American Express portal bonus into consideration? The highest I’ve seen in recent memory in BeFrugal‘s portal which gives 3% cash back (I get a credit if you sign up for BeFrugal through my link). That means that the Barclay portal is worth at least 1% more. On a single $5,000 gift card order, that’s worth $50 extra. If you make two $5,000 American Express gift card orders, you’ve essentially made an extra $100 cash back, wiping out the $89 fee. Of course, I can’t guarantee that the 4x portal bonus will stick around forever …

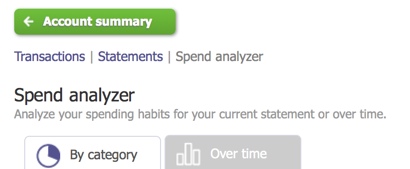

If you’re like me and have the second annual fee showing in your account, you can see how much you’ve spent in the past 12 months by going into your Barclay Arrival account, clicking “View Activity & Statements” on top, and clicking “Spend analyzer.” You can see your spending patterns over a series of time periods, including 12 months. I’ve already paid off my annual fee, and plan to keep this card another year.