Today, American Airlines and United Airlines expanded their fares to include Basic Economy in many markets. In doing so, they join Delta in offering the fares in multiple markets, but with additional restrictions.

Delta was the first legacy airline to introduce these Basic Economy fares, and the only restrictions they placed were that seat assignments would occur at the airport and that these fares would not be eligible for upgrades.

American and United took these restrictions further, stating that travelers could not take on a carry-on bag and would have to board in the last boarding group. There are some caveats for each airline, but I won’t go into them here – instead you can click on each airline’s link and see what each airline offers.

I’d argue that this is a poor development for travelers, because many Basic Economy fares for flights in the future are the same price as the lowest fares out today, yet come with fewer benefits. If you want to keep those benefits, you’ll likely pay anywhere from $20-$50 per leg of the journey. These fares aren’t cheaper – they’re just giving you less for the same price.

The Rise of Bank Points for Economy Class Travel

Over the past year, we’ve seen how bank points, like Chase Ultimate Rewards, Citi ThankYou Points, and American Express Membership Rewards, have become great ways to book economy class travel.

If you have a Chase Sapphire Reserve, you can redeem points at a rate of 1.5 cents per point toward flights. When you can earn 5x points with a Chase Ink card at office supply stores or on a Chase Freedom at rotating quarterly categories, as well as 3x points with a Sapphire Reserve on travel/dining, as well as 1.5x points with a Freedom Unlimited on every purchase, that can add up to great return toward economy class travel.

If you have an American Express Business Platinum card, you can use Amex Pay With Points on your selected airline in economy for 1 cent per point and receive a 50% rebate (making it a “2 cents – but not really 2 cents – per point” value). Combining that with an Amex Everyday Preferred card, which can earn up to 4.5x points per dollar, can yield another great return.

If you have a Citi Prestige card, you can currently book American Airlines flights at 1.6 cents per point and other airlines at 1.33 cents per point. That will soon go down to 1.33 cents per point on all airlines. Combine that with the Citi AT&T card, which offers 3x points on online retail purchases – again, a great return for economy travel.

When you consider the difficulty finding domestic saver award space with the lower price of fares, along with increased earning potential and redemption value of bank points, you have a good reason to spend bank points rather than airline miles on domestic economy travel.

How Bank Point Travel Portals Treat Basic Economy Fares

I was curious to see which bank point programs allow Basic Economy fares to be booked. If they do, do they warn you about the fares? And if they do, can you bypass a Basic Economy fare for a regular fare?

In looking through the options, it seems that each bank program travel portal treats all airlines with Basic Economy the same. That means that if you want to use Chase Ultimate Rewards points, the Chase website will show you similar caveats for American Basic Economy fares as with United Basic Economy fares.

Unfortunately, it seems that all bank point portals show Basic Economy fares instead of regular fares, and none of them allow you to bypass Basic Economy fares for regular fares online.

What may be even worse is that only Chase explicitly mentions the restrictions that you get with Basic Economy Fares.

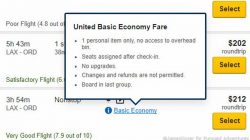

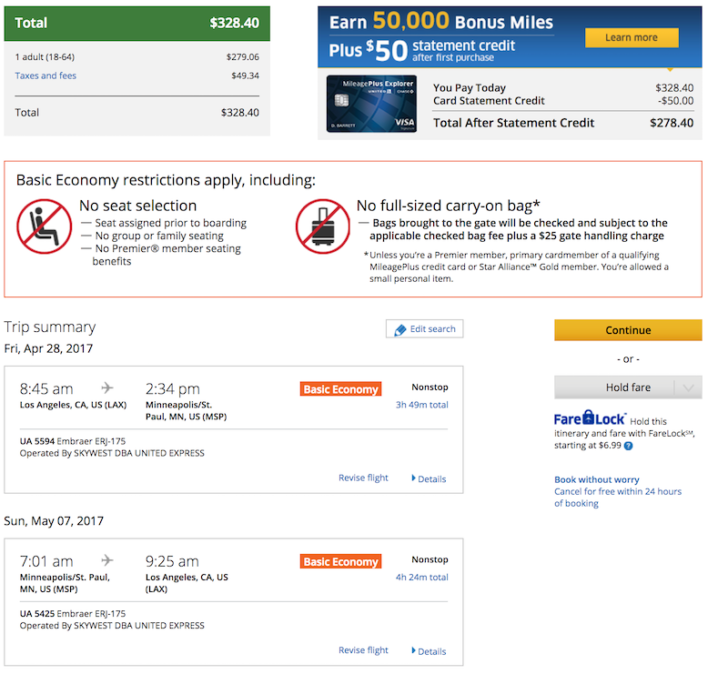

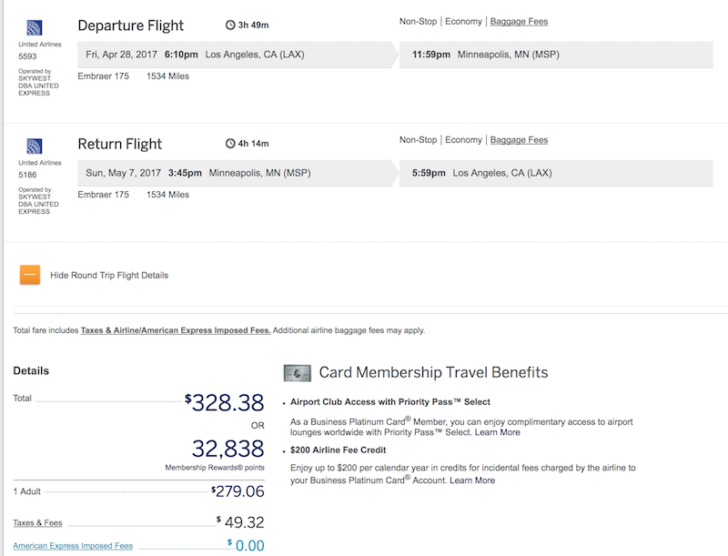

For example, a brief search for a United Basic Economy fare showed me this one from Los Angeles to Minneapolis roundtrip:

The total price is $328.40 for a Basic Economy fare. The restrictions are clearly written on the United website.

Bypassing Basic Economy with Chase Ultimate Rewards

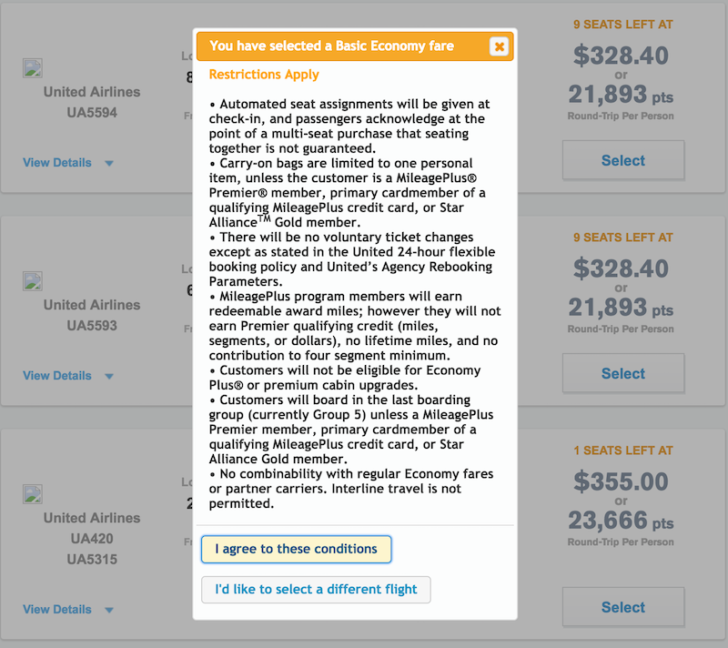

I then searched on the Chase website. I was able to find the same Basic Economy fare, but unable to find a method online to book a regular economy class fare. Chase did show this warning when selecting the fare.

Since I couldn’t figure out a method to bypass online, I tried to phone it in. The number for Chase is 1-855-234-2542. I was immediately connected to a travel specialist, who asked for my credit card information and flight I wanted to book. I specifically gave her the fare class of the regular economy fare I wanted (in United’s case, it was a ‘T’ fare that was bookable through the United website). After a few minutes on hold, she was able to find a regular economy class, but the price was higher than the price on the United.com website.

I tried this with other flights with the United agent, and in only one instance was she able to find a flight where the regular economy fare was the same price as United’s website.

Frankly, this could have been agent error, but it’s worth a shot to try.

Avoiding Basic Economy with Amex Pay With Points? Be Careful!

When searching the American Express site, I searched for the same flight on United. Unfortunately, nowhere does it say the term “Basic Economy” – that’s unfortunate!

I tried calling the AmexTravel number and was immediately connected to an agent, but was told that she could only see what the website had. One suggestion was to try searching Premium Economy, but that only brought up a Delta Comfort Plus seat instead. I attempted to transfer myself to the Business Platinum service line, but had 27 (!!) customers ahead of me and gave up.

Beware of Basic Economy With Citi Thank You Points

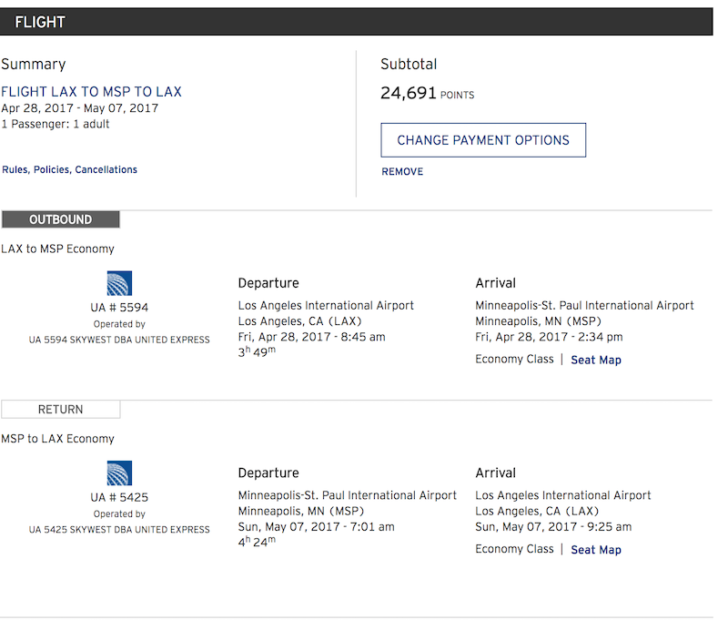

Lastly, I tried searching the same flight through Citi’s Thank You portal. A $328.38 flight in United’s Basic Economy should cost 24,691 points, and that’s exactly what I found when searching online:

I called Citi at 1-800-THANK-YOU and went through the prompts to book a new ticket over the phone. When I connected to an agent, I explained the situation and requested the specific flight with the specific fare code. Within 2 minutes, the agent found the flight with the proper price. Success!

Recap

At the beginning of this experiment, I asked two basic (heh) questions. Here are the answers:

- Do the bank program travel portals warn you about Basic Economy? Chase – yes! Citi and Amex – not really.

- Can you bypass a Basic Economy fare for a regular economy fare? Online – no. Over the phone: Citi – yes! Chase – probably? Amex – probably not, though proof is left to the reader.

Like most of my ideas, someone smarter than me already had it. Frequent Miler wrote a piece in late January studying this question. This was before the wider rollout of American and United fares today, but I can say that the major findings hold – Basic Economy sucks if you’re booking a paid fare with your bank program points, and calling it in does not always work.

Basic Economy is a Silent Devaluation of Bank Points

Programs like Citi Thank You Points, Chase Ultimate Rewards, and American Express Membership Rewards provide members with the opportunity to use points on any flight. However, a lot of members are not interested in Basic Economy and want to have the option to easily book a regular economy fare. Programs like Citi and Amex still have to learn how to properly display the restrictions of Basic Economy!

So long as there is no option online for a member to use their points to bypass booking Basic Economy, it is a silent devaluation. This could either mean that a member can’t use their points for a particular flight, or has to wait on hold to book it over the phone.

On one hand, this does play up the value of rewards like Barclay’s Arrival card, or Capital One Venture card. On these cards, you can make any travel purchase (including from the airline website) and use points retroactively to refund your purchase.

The issue that I have with these is that these are effectively 2% cash back cards that can only be used on travel. They can’t be leveraged for higher return, either through the possibility of transfers to airline program or with increased earning through spend category multipliers (e.g., no extra points for using the card for dining, travel, etc.). There is not much to them that would convince me to use them over a regular 2% cash back credit card.

I hope that bank programs like Amex Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou realize how poor a change Basic Economy is for many members and implement a way to easily book regular economy fares online. One can hope ….