Two years ago I compared the various rewards offered by different third-party online travel agencies: Orbitz, Expedia, Hotels.com, and Travelocity. Since that time Expedia has updated their program (again) and made it less valuable (again), while acquiring Orbitz and Travelocity. Travelocity doesn’t even have a rewards program anymore. And though I didn’t include them at the time, Priceline has been on its own buying spree, mostly diversifying into other aspects of travel. I think it’s time to do another analysis of which OTAs offer the best bang for your buck.

Hotels.com Rewards

Hotels.com Rewards remains the simplest program despite the change in name (formerly “Welcome Rewards”). Book 10 nights and you get one night free. The value of that one night is the average of your 10 qualifying nights. It is an effective 10% rebate.

If you want to redeem at a hotel that costs more than your free night, you can pay the difference in cash rather than compromise on a cheaper property. If you do pick a cheaper hotel, your rebate from past stays will be less than 10%.

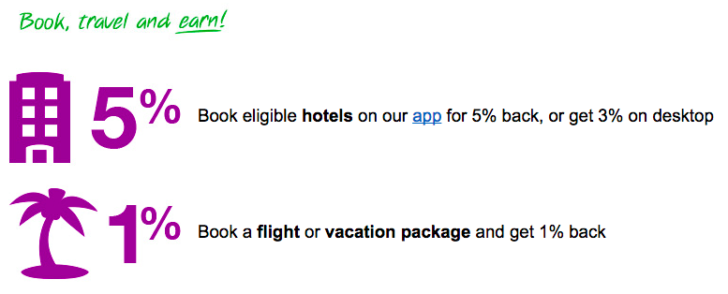

Orbitz Rewards

Orbitz customers earn “Orbucks” that are essentially dollar-value credits for future purchases from Orbitz. The key highlights are 5% back on hotels booked through the mobile app, 3% back on hotels booked on a personal computer, and 1% back on flights.

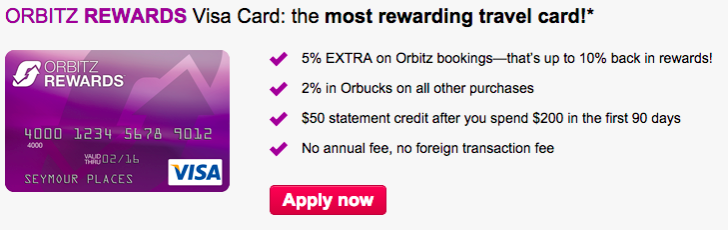

Although you can use the Orbitz Rewards Visa to earn additional rewards, it’s not necessary to participate in the program. The credit card earns an additional 5% rewards on purchases from Orbitz and 2% everywhere else, making it lucrative as long as you don’t mind redeeming those credit card rewards through Orbitz.

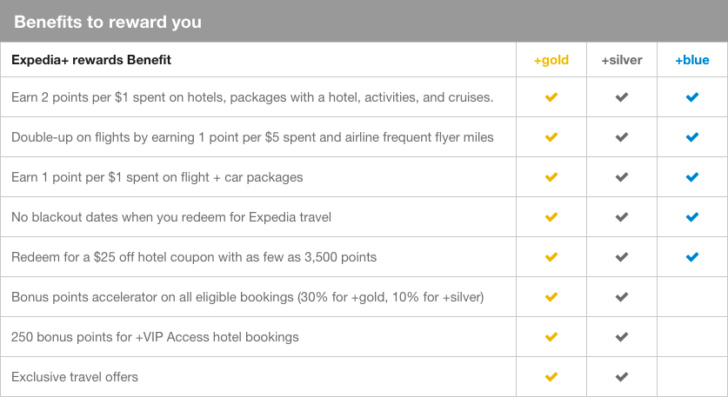

Expedia+ Rewards

Expedia+ Rewards promises that you’ll earn at least 2 points per dollar on hotels or packages that include a hotel, and 1 point per $5 on flights (effectively 0.2 points per dollar; that’s a 10-fold difference between earning rates on flights and hotels). If you’re a frequent customer, you can earn even more.

What are these points worth? Get a $50 hotel coupon for 7,000 points or a $50 flight coupon for 8,000 points. Because the rewards are lower with flights, and because you have to cover the entire ticket cost with points — potentially leaving credit unused — I don’t recommend it. However you earn your points, redeem them on hotels. With this assumption, the effective return is 1.42% back on hotel reservations and 0.14% back on flights.

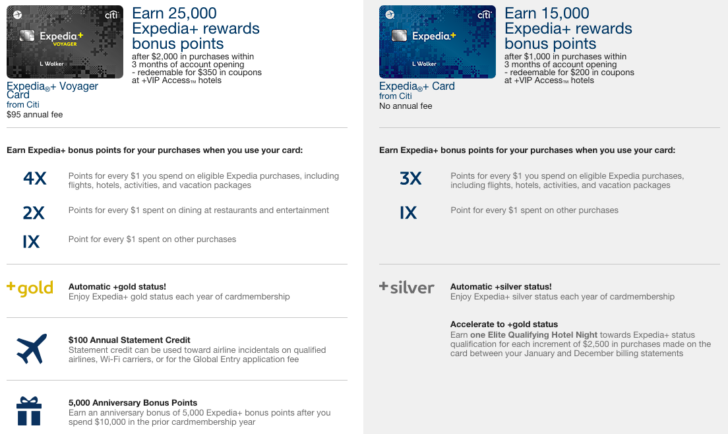

If you get the new Expedia Rewards credit card from Citi, you can earn up to an additional 4 points per dollar on everything at Expedia, 1-2 points elsewhere, and instant status with Expedia+. With this factored in the effective return improves to 8.57% on hotel reservations or 3% on flights.

What Expedia+ really delivers are the features of a traditional loyalty program, with three tiers of status and a variety of benefits at a network of hotels they’ve assembled themselves.

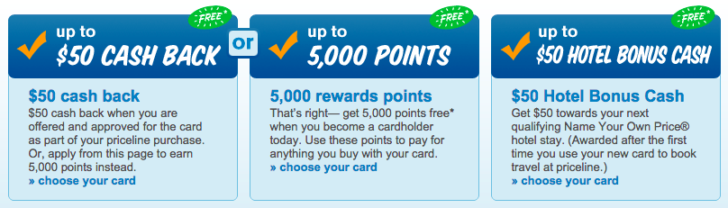

Priceline Rewards

Priceline doesn’t really have a rewards program. At best it’s an opportunity to earn random credit toward your bid, in the hope that it’s more likely to be accepted. I’m not sure what strategy Priceline uses to determine if you receive bonus credit in the first place, and it’s difficult to know if your bid would have succeeded with or without that credit added on.

But because Priceline is such a behemoth I figured it worth including it in this review. There is a Priceline Rewards credit card that earns 5% back on Priceline purchases and an additional 1% back on other purchases. This is better than the Travelocity Rewards credit card that I can no longer find. For those who are good at strategic bidding, this is a worthwhile consideration.

Earning More through Shopping Portals

All of these travel agencies include the option to earn more by beginning your purchase through a shopping portal. Other choices may exist, but here I’ll list Ebates, which offers a cash rebate depending on the purchase details.

- Hotels.com: 4%

- Orbitz: 1.25%

- Expedia: 4% (select hotels)

- Priceline: 3 to 4.5%

Summary

In general there are few, if any, rewards for purchasing flights through an online travel agency. In my afterword below, I point out that booking airfare through a third party is probably a bad idea anyway for logistical reasons. I’ll limit my comparison to the rewards earned for hotel stays.

| Online Travel Agency | Hotel Rewards | Credit Card | Shopping Portal | Maximum Rewards |

|---|---|---|---|---|

| Hotels.com | 10% | N/A | 4% | 14% |

| Orbitz | 5% | 5% | 1.25% | 11.25% |

| Expedia | 1.42% | 4% | 4% (with limits) | 9.42% |

| Priceline | N/A | 5% | 3-4.5% | 9.5% |

My original recommendation two years ago was to use Hotels.com for the highest rewards if you only plan to book hotels, while Travelocity had the best rewards for flights. Because Travelocity required a separate credit card to earn anything, I pointed many people to the runner up, Orbitz. Orbitz was also the second best choice for hotels. That pattern holds true in 2015.

Expedia and Priceline just don’t appeal to me. Priceline doesn’t really have much of a program to begin with. Expedia is far too complicated. The main benefit of an OTA is that I get to choose any hotel I want, but Expedia has created its own special collection that gets better rewards than the rest.

Obviously using co-branded credit cards can improve the returns from OTA loyalty programs, but remember this prevents you from using another rewards card. The Chase Sapphire Preferred earns 2 points per dollar on travel and can easily be converted to cash or transferred to a variety of airline and hotel loyalty programs where they might be more valuable. Note that Hotels.com has very generous rewards that allow you to continue using your credit card of choice. This puts its maximum return at something closer to 16%.

Should You Use an Online Travel Agency?

Assuming you’ve found a good deal, I still don’t recommend online travel agencies to most people because they can create significant limitations, while their main benefit — comparison shopping — is something you’re quite capable of doing on your own with a little effort.

If you book a flight through an OTA, you’ll usually pay the exact same price as if you went to the airline, though a few airlines are beginning to impose surcharges to cover their (meager) commissions. The main advantage of using an OTA is that they do a better job of booking tickets with multiple carriers. They may also mistakenly underprice fares and are slower to remove mistakes from their systems. The main disadvantage of using an OTA is that they control the ticket, so if there’s a delay or schedule change then the two start pointing fingers. I think this disadvantage greatly outweighs the potential advantages.

If you book a hotel through an OTA, you’ll usually pay the same or less as if you went to the hotel directly. Many hotels have best rate guarantees, and OTAs have their own contracts that promise them the best rates. Commissions are much greater than for airfare, so it’s not unusual to see further promotional discounts. But there is some nuance, as if you go to the hotel you might be able to choose from a greater variety of rates with different cancellation policies, or you’ll be able to use various discounts or corporate codes that the OTA doesn’t accept. The disadvantages and advantages here depend on your personal travel habits.

And on that note, I’m curious about your own thoughts on these programs. Do you often book through online travel agencies or shopping portals when you need a hotel stay? What do you see as their advantages or disadvantages relative to each other and traditional hotel loyalty programs?