Today, Boeing announced a massive loss of $1.7 billion from its core operations. The loss exceeded Wall Street predictions and Boeing says that they will cut 16,000 jobs or 10% of its workforce. The workforce cuts will be made through buyouts, natural attrition and layoffs.

The “Perfect Storm”

Moviegoers should remember the movie – The Perfect Storm where a fishing boat is in the confluence of three storms. That analogy is exactly what is going on in the aircraft manufacturing industry affecting both Boeing and Airbus. Here is what the storm looks like for Boeing:

- The Boeing 737MAX debacle,

- Quality control issues in the KC-46 and 787 production lines,

- Aircraft order cancellations due to the 737MAX grounding,

- Aircraft orders for other aircraft due to the downturn in passenger flights and

- Loss of production due to the health shutdown that cost the Company $137 million.

“The demand for commercial airline travel has fallen off a cliff,” said Boeing CEO Dave Calhoun. “The pandemic is also delivering a body blow to our business.”

Passenger airline traffic has fallen by an average of 90% and two-thirds of the world’s airlines are parked on the ground. The now “surplus” parked aircraft are on top of the entire Boeing 737MAX fleet that has been grounded for safety issues with no recertification date on the horizon.

Order Cancellations and Production Cuts

Boeing had a horrible sales year for 2019. They saw the order book at the end of 2019 with a net aircraft order of -85 aircraft. That means that the customer aircraft cancellations exceeded the order for new aircraft. The chart below shows that the order book for the first quarter of 2020 is worse than the entire year of 2019.

For the first quarter of 2020, Boeing’s net orders were -307 aircraft. There are two main drivers for the aircraft cancellations:

- Loss of confidence in the 737MAX programs which as a 2020 order status of -191 and

- The downturn of the airline industry due to the current economic environment.

Yesterday, I reported that Southwest Airlines recorded its first loss in 11 years. Southwest is a 100% Boeing 737 operator and they have deferred delivery of 107 aircraft or 55% of its outstanding 737 orders. Order cancellations are spread across all of Boeing’s airliner models that have necessitated across the board production cuts. This downturn couldn’t come at a worse time for Boeing as it is trying to get the 777X airliner through airworthiness certification.

The 777X Program

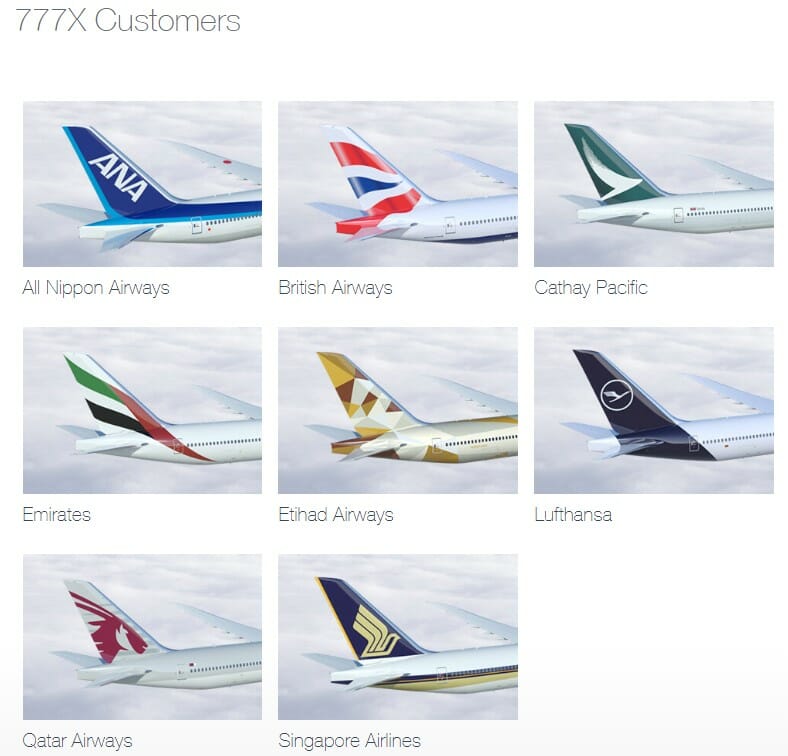

The 777X program was designed to replace the Very Large Aircraft (VLA) segment of airliners – Boeing 747 and Airbus A380 that use four engines. The 777-9 can fly 400 passengers using two, highly fuel-efficient engines. Operators looking for the 777-9 as a replacement aircraft for their 747 and A380 are:

Unless the airline industry can make a quick recovery, some of these 777-9 orders may turn into order deferrals and cancellations. American Airlines just received a new Boeing 787 from the factory and flew it to a parking location for storage.

Final Thoughts

This is certainly bad news for Boeing however, they are not alone. The aviation downturn also affects the order book for Airbus. Both manufacturers have had financial losses for certain aircraft programs – The 737MAX for Boeing and the A-380 for Airbus. Both companies are having to deal with the downturn in passenger aviation that could see more order deferrals and cancellations. History has shown that when the airline business is in financially stressful times like recessions, it typically takes three or four years for the industry to completely recover.