Update: It seems $1,400 was an overestimate based on an incorrect interpretation of the program terms. However, it’s still possible to get over $700 from this card.

There’s been a lot of discussion in the blogosphere lately about a possible change to Citi’s ThankYou Points program, a benefit of the Citi ThankYou Premier card, namely the addition of British Airways and Singapore Airlines as transfer partners. While some people were very excited, I ignored it. I didn’t exactly have plans to blow a whole stash of ThankYou points between now and April 1, I figured I could easily wait a week to see just what, if anything, would be announced.

Now there I’m reading at View from the Wing that Citi’s PR staff is trying to keep bloggers from sharing the details, either because the rumors are false or because they’re trying to keep it under wraps. Neither one makes much sense to me. Let people have their rumors. If it is true, then it will be announced publicly soon enough. If not… they’ll get tired of talking about it.

But why is everyone so excited? Well, for those with big Avios point stashes or who have elite status on American, it certainly makes sense. Avios points are a great when redeemed on American Airlines and Alaska Airlines, two British Airways partners. As long as you fly in more or less a straight line and don’t mix carriers, Avios is often a great bargain for domestic U.S. trips, and I’ve helped a couple people find award space for their points in the last few months.

Other than that, I’m not sure. I have plenty of United miles and Ultimate Rewards points that I can use if I ever really need to fly on Singapore. As for using Avios to fly internationally, yeah right. I refuse to pay BA’s fuel surcharges on principle, and personally can’t afford it, so that’s not going to happen. I also see no reason to divert my business to American since I have 1K status with United.

Using ThankYou points to buy revenue tickets

But ThankYou points do have their uses when redeeming them for revenue tickets, and as someone who pays for his own tickets, this is important. It lets me continue to earn redeemable and elite qualifying miles without actually having to pay. That way I can earn my elite status and the various benefits and bonuses that come with it.

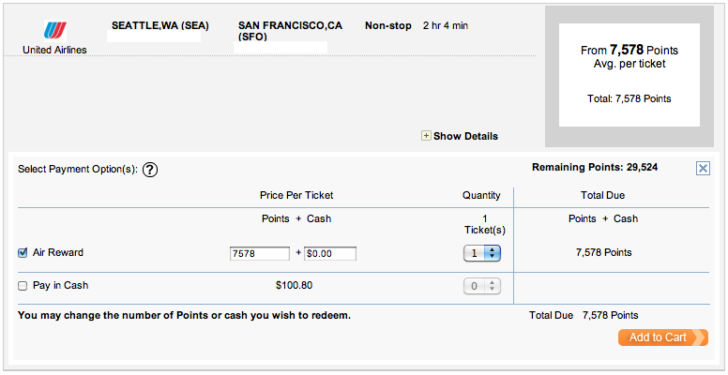

Normally award tickets don’t earn you anything. You’re spending miles to get the ticket, so they’re not going to give you miles back. But ThankYou points are different. Each is worth 1.33 cents when you book tickets through their online reservations portal, and that portal is just like Orbitz, Expedia, or any other online travel agency. If you can buy a ticket for $133 from United or Orbitz, you can buy it for 10,000 ThankYou points instead. No additional taxes or fees beyond what you’d normally pay. Any airline you want.

Since United miles can only be earned through Chase’s MileagePlus Explorer or by transferring Chase Ultimate Rewards points, this means I now have a new bank to hit up and pad my MileagePlus balance, albeit indirectly. There are still offers for 50K point sign-up bonuses, like this one at Million Mile Secrets, which is worth $665 in free travel.

I just did this a couple weeks ago, booking some tickets for Megan and I to visit my parents in the Bay Area. In fact, I used ThankYou points to redeem my first award ticket EVER. That’s right. Since I’m always trying to earn elite status or book cheap flights that accrue more miles than the flight itself cost, I don’t have time to fly on planes that aren’t offering me a prize at the end. My miles go toward trips for my family instead.

It’s true I’m getting to a point where I have so many miles I can’t keep this up much longer, and I will be booking some nice award tickets for us this fall. But only after I’m sure my status is safe for another year. 😉

$1,400 or $665 in free travel using Citi’s ThankYou Premier card?

In general I find the benefits of the Citi ThankYou Premier card confusing. They weren’t very clearly explained in the online offer or in the pamphlet that came in the mail, and the dual ThankYou point/Flight point system seems unnecessarily complicated. I am a simple man who likes simple programs. Ultimate Rewards is simple. But I will do my best to provide an argument for getting the ThankYou Premier card. I personally wouldn’t hold it long enough to pay the steep $125 annual fee, but some people have been very passionate defenders.

First, the flight points. When you book an airline ticket using your ThankYou Premier card, you will earn ThankYou points as usual on the purchase as well as flight points equal to the distance flown on that particular trip. So using this card makes a lot of sense for purchasing international and transcontinental flights, but maybe you should use something else for short hops up and down the coast. Flight points are redeemed just like ThankYou points, but you have to redeem them at 1:1 along with ThankYou points.

If I understand this system correctly–and please correct me otherwise–you would be wise to reach the $2,500 spending threshold for the bonus by purchasing $2,500 in long-distance flights. This would give you 52,500 ThankYou points (50K bonus + 2.5K from spending threshold). It is very possible that you could get 52,500 or more flight points through $2,500 in purchases. Four cheap roundtrip tickets to Europe from the West Coast would do the trick.

This would leave you with 52,500 in each column, or 105K points total that you could redeem for free flights. At a redemption rate of 1.33 cents per point, that’s just under $1,400 in free airfare. And you would be eligible for free elite domestic upgrades, elite qualifying miles, redeemable miles, and everything else you don’t get on award tickets.

Second, the companion benefit. In theory you can get one free domestic companion ticket each year when you buy your own ticket through Citi’s online travel partner, Spirit Incentives. Yes, the name sounds like a scam, but they also do the booking when you redeem points for a flight, and that showed up in my United account instantly.

Still, I have never tried to accumulate flight points or taken advantage of the companion ticket, nor have I read about anyone doing so. I would love to hear an example of how it worked. Did both people earn redeemable and elite miles on the trip? Were the tickets any more expensive to start with? How much of this did I get right?

I’ve already used up most of my ThankYou points balance, but Megan is going to reach her minimum spend requirement soon, and we’re thinking of continuing to use that card for future long-distance flights so we can try the flight point double-dip strategy. And of course, we can each claim the other as a companion. 🙂

Conclusion

As you can see, the Citi ThankYou Premier card is a great way to get someone else to buy your ticket. And that’s any ticket for sale, not just the ones airlines deign to release for award seats. You still earn elite and redeemable miles, the booking process is incredibly simple, and the benefits seem valuable. Just don’t get the Preferred version of the card, which has poorer benefits as well as a smaller bonus.

It’s unfortunate the Premier card has such a high fee and the benefits aren’t well explained upfront. It’s a very unique product that requires some extra effort on the part of the marketing department. But for any of you like me, who want to fly revenue tickets as much as possible, this card makes a lot of sense. I’ll see how things work out this year and report back.