Sometimes it’s easy to argue against Conventional Wisdom. For instance, I honestly do believe app-o-ramas have limited value. I think it sometimes does make sense to Pay With Points, and I’m almost certain Wyndham is just frothing at the mouth to screw us all over again a few short months from now.

Then there are other times that arguing against the Conventional Wisdom is awfully tough. I’m always game to try, but it’s hard to convince myself that I’m honestly going to stop chasing mistake fares, or that the never-ending unannounced changes to Delta SkyMiles don’t really matter, or that Christopher Elliott isn’t just making things up as he goes along.

But of course that’s part of the fun — the challenge of arguing a viewpoint I might not actually believe. It’s a great exercise and very gratifying when I do win someone over. Heck, on occasion I’ve even won myself over. Though I’m probably not the toughest audience, as I greatly admire my own writing and I’m willing to give myself the benefit of the doubt in an argument. Did I mention I’m also humble?

Anyway, when Scott suggested I write about Plenti, the new Amex loyalty program that’s been met with a collective shrug from the points and miles community, I knew it would be one of those tougher assignments. But I resolved to dig as deeply into the program as I could to find the positives, even if it took hours and hours. Or at least until I fell asleep to infomercials reminding me I need to lose some weight and make easier omelets.

So here we go… here’s why Plenti is actually a great new loyalty rewards option.

Nice logo.

Isn’t it? I’m not sure what’s up with those sideways “V’s” but they look pretty. I think they’re supposed to be birds or something, flying in with lots and lots of rewards. They’re like the carrier pigeons of loyalty points.

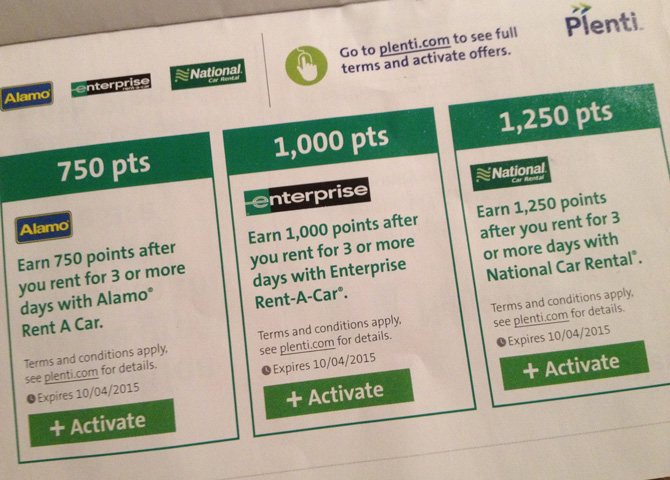

Also, Plenti is handing out these exciting promotional pamphlets at their in-store partners, and they’ve been kind enough to include with their partner offers a green “Activate” button right in the pamphlet.

Can someone explain to the Plenti marketing department how a program called “Photoshop” can be used to delete elements that might be appropriate for a website but maybe don’t make sense in other mediums, such as “print”? And perhaps we could also mention that some signage might be the perfect complement to these pamphlets so it doesn’t look like someone’s advertising their college band with 50 handmade flyers lying haphazardly in a pile on a fold out table at Rite Aid?

But hey, if that’s not enough, remember that Plenti currently boasts over 8 partners.

And I’m conveniently ignoring those of you who just mentioned you only shop at 3 of these partners on a regular basis. Maybe 2.

OK, how about we lose the sarcasm? What’s actually great about Plenti?

Well, fine. Ruin my fun, why don’t you? But all right, let’s start with the basics. Plenti is…

- Stackable. You can use any credit card you want and earn Plenti points, so any points you get are on top of your usual rewards. It’s an automatic double dip.

- Free. There’s no charge to join Plenti and earn Plenti points. In other words, it’s pretty much like every other loyalty program ever.

- (hang on, I’m trying to think of another one…)

I suppose the best feature of Plenti is that you can make certain aspects of it somewhat automatic. For instance, AT&T is a partner that offers 1 Plenti point per $1 spent on wireless services, which includes your monthly phone bill. So if you already use AT&T, that’s something you could just set and forget and let the Plenti points pile up.

Unfortunately several of the other partner offers appear to be “one time only” deals, such as earning 5,000 Plenti points for signing up with Direct Energy or 1,650 points for a new subscription with Hulu. Neither of those partners offer Plenti points on an ongoing basis, which I guess means there are actually only 7 Plenti partners that aren’t one night stands.

Hey, but another way to automate Plenti points is to tie Plenti to your grocery store rewards program. Once they’re linked, you’ll be eligible to participate in Plenti’s “household offers” which give bonus Plenti points when you buy certain products at the grocery store. You’ll still have to manually activate the offers online before you shop, but when you checkout you can use your usual grocery store rewards card and the Plenti points will automatically be added.

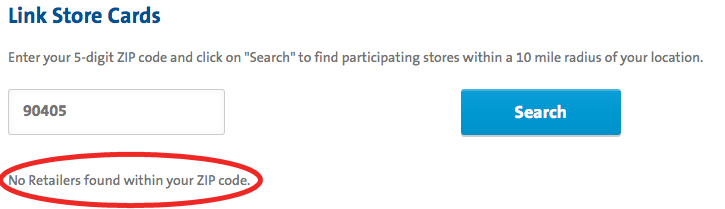

I decided to try and link my Plenti account to a grocery store in my area. You type a zip code into Plenti and it’ll give you a list of all the grocery rewards programs in a 10-mile radius. I live in Los Angeles, the second largest city in the United States of America, so I knew there would be plenty of options…

Hmmmmm. Did I mention Plenti is stackable? Oh, I did. Okay then…

What about those partner offers? And that Plenti shopping portal?

Thank you! Yes, that’s a great point! Plenti features what they’re calling “partner offers” because they wanted to make it sound just similar enough to “household offers” for it to be confusing. These are basically bonus offers from the nine over 6 partners which allow you to earn extra Plenti points.

For instance, Macy’s is offering 2x Plenti points on all purchases during their Memorial Day Sale.

Every purchase counts, whether it’s in store or on macys.com and you don’t even have to register for it. It’s automatically applied when you add your Plenti number to your online order or show them your Plenti card at the store.

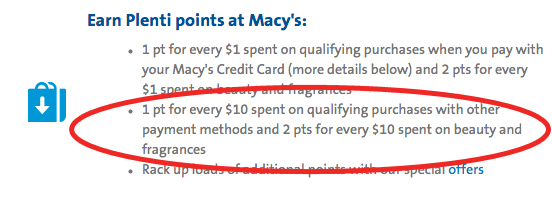

Twice as many Plenti points as usual? That sounds great! By the way, how many Plenti points do we normally get at Macy’s?

What? We only get 1 point per $10 spent unless we use a Macy’s credit card? So 2x is only two-tenths of a point per $1? That’s utterly useless!

(Sorry, I just remembered I’m supposed to be telling you how great Plenti is. My apologies. I lost my way for a moment there. OK… I mentioned it’s stackable, right? Good, good.)

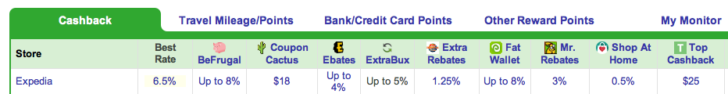

How about the online shopping portal? There’s several hundred stores there. Let’s take a look at that. I see Sears and Best Buy and Home Depot. That sounds promising. In fact, I’m noticing Expedia and Travelocity and a number of other travel providers that you can’t find anymore on many other portals. Even 1 Plenti point per dollar at Expedia is better than nothing, right? Unless there are any cash back portals offering more…

Hold on. Those are all better than Plenti! In fact, now I’m realizing that when our friend Doctor of Credit wrote a few weeks ago that Plenti payouts aren’t “even remotely competitive with the top site” he actually meant they weren’t even remotely competitive with the top 10 sites.

What can I do with all these Plenti points anyway?

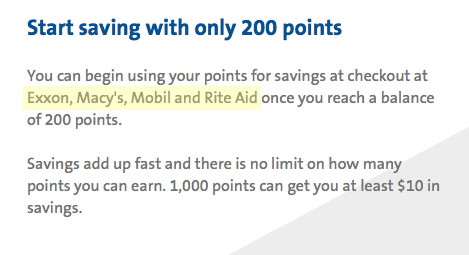

So now that we’ve spent $50,000 on Ryan Seacrest Distinction clothing at Macy’s in order to get 10,000 Plenti points, what exactly are they worth? Well, that’s the good news, because the Plenti website says 1,000 Plenti points can get you “at least $10 in savings.”

Sounds to me like Plenti points are worth a minimum of 1 cent per point. That’s not terrible considering it’s on top of any other rewards points I already got (because did I mention it’s stack– okay, I did, right, sorry). So I can take those 10,000 Plenti points and get $100 off next month’s AT&T phone bill.

Except… wait a minute. Zoom out on that previous image…

Are you kidding? You’re telling me I can’t even use these points at all of the “over 6 partners”?! That there are only 4 places that will take these stupid things and two of them are gas stations???

Wow. I just… wow. Just wow.

I give up. Even the Devil’s Advocate can’t make this Plenti turd seem worthwhile.

I honestly had no idea how much Plenti blew. The whole thing feels like someone at Amex made a drunken wager that they could launch a loyalty program that offered absolutely no value and make it successful. It was probably the same bonehead who pitched DIVX as a terrific idea for Circuit City or the mastermind who honestly believes CurrentC is going to beat out ApplePay by being vastly more clunky and less consumer friendly.

Look, there’s certainly a place for a coalition loyalty program in this country, but this ain’t even close to it. In Canada they have a program called Air Miles that has 120 partners with hotel chains like Hilton and IHG plus stores such as Old Navy and Staples all combined into one loyalty currency. Plenti is just like that, except it’s a totally useless version of it.

If there’s one positive here, it’s that it wouldn’t be particularly difficult for Amex to improve this program. The basics are fine. Just add a lot more national partners, make the currency more useful, and throw in some better offers and you’d have a decent program. In other words, change it completely and it might just work.

Unfortunately in today’s day and age you don’t usually get a second chance to make a first impression to the consumer. If Amex had launched this program properly, there’d be a lot more potential upside, but now they’ll be clawing their way just to try and make it work. So my prediction is that in a few years we’ll be reading about Plenti dying a quiet death, having never lived up to its potential.

But hey, did I mention those “V” birds in the logo are pretty?

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- People Lied, Redbird Died! So Who Do We Get To Blame?

- Is the New 30% Rebate on Amex Pay With Points Better Than We Think?

- Devil’s Advocate Turns 1 Year Old. Let’s Give Something Away!

Find the entire collection of Devil’s Advocate posts here.