From the desk of the Devil’s Advocate…

You’ve undoubtedly seen the ubiquitous Capital One ad campaign featuring celebrities asking that now famous question “What’s In Your Wallet?”

If you’re new to the loyalty program game, you might be surprised to learn that in the points and miles community, the Conventional Wisdom says the answer to that question is most definitely not a Capital One credit card. In fact, most seasoned loyalty program travelers rarely have any Capital One cards in their collection, let alone in their wallet for everyday spend.

But why is that the case? Are there any good reasons to apply for a Capital One card? Can we get any value out of Capital One points? Are there any Capital One products worth using for day-to-day spend? Or are the Conventional Wisdomers right that we’re better off focusing our precious credit inquiries and monthly spend elsewhere?

Let’s take a look and see if perhaps a Capital One card might be useful to keep in your wallet after all.

How does Capital One stack up to better known travel cards?

Since most Conventional Wisdomers promote higher end cards such as the Chase Sapphire Preferred or the Starwood Preferred Guest card from American Express as the best options for travel, we’ll make this an apples-to-apples comparison and focus solely on Capital One’s premium travel card, which is the Venture Rewards card.

As an aside, Capital One also offers a separate 1.5% cash back card, but I’d choose the 2% Fidelity Investment Rewards American Express card or perhaps the new 1%+1% Citi Double Cash card over Capital One’s offering since they both offer a higher cash back return on all purchases. Capital One also offers travel rewards cards for businesses along with lesser personal cards with no annual fee, but again, we’re trying to make an equivalent comparison.

With the Venture Rewards card you earn the Capital One mileage currency, which are no longer dubbed No Hassle Rewards miles but are simply referred to as “miles” (someone should explain the concept of “branding” to Capital One). Note that the old No Hassle Rewards program still applies to Capital One bank accounts but not the credit cards, so we’re referring to the current program here.

The Venture Rewards card currently offers a signup bonus of 40,000 miles for spending $3,000 on the card within the first 3 months. That’s comparable to most of the major travel cards, including the Chase Sapphire Preferred bonus of 40,000 Ultimate Rewards points or the 40,000 point signup bonus of Barclay’s Arrival Plus World Elite card. Of course, the value of those points is also of great interest, but we’ll get to that in a moment.

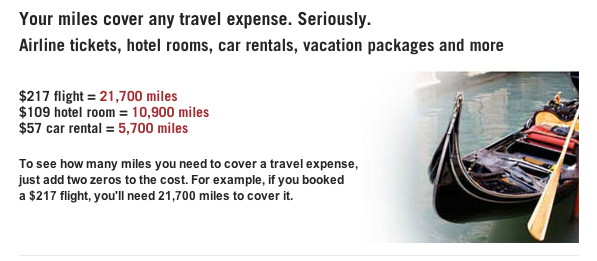

Capital One emphasizes that their miles have no blackout dates, which is no doubt aimed at the frustration many mileage collectors have when they can’t find availability for their miles. This is because Venture Rewards miles can be redeemed for essentially nearly any flight, hotel, or car booking at a fixed rate of 1 cent per mile. This means a $300 flight can be had for 30,000 Venture Rewards miles.

Most inexperienced folks get excited by this marketing point, but the fact is all the other major bank programs also have methods of redeeming their points directly for travel expenses at a fixed rate. Ultimate Rewards, Membership Rewards, ThankYou Points, and so on all offer this option but also have the ability to transfer directly to airline and hotel partners at what is often a higher effective rate. Of course, in exchange for that higher rate, customers have to be flexible in their travel plans and find availability where it exists.

Venture Rewards has a few other benefits that generally match the other major programs, such as the ability to pool points within a household and the usual warranty program and auto rental insurance. Originally the fact that Capital One cards had no foreign transaction fees was a major benefit, but that feature has now been matched on most of the better known travel cards as well.

How is it better?

Here’s the big upside: the Capital One Venture Rewards card offers 2x miles on all purchases. Everything. No exceptions.

Since the miles have a fixed value of 1 cent per mile, that means we’re getting 2 cents per dollar spent, which makes Venture Rewards a straight-up 2x play. The only other travel rewards card on the market with a similar ratio on all purchases is the Arrival card.

Just like the Arrival card, Venture Rewards redemptions can be made directly against any travel expense on your billing statement. You do not have to book your travel through Capital One (and you generally shouldn’t since you won’t get as good of a redemption and you’ll be forgoing portal bonuses and the like). Online Travel Agencies (OTA’s) such as Expedia and Hotels.com count as travel expenses, so you can still get the discounted hotel rates often offered through those channels. Not bad.

“Yeah, yeah, yeah,” sniff the Conventional Wisdomers. “So far you’ve only shown us how the Venture Rewards card is basically equivalent to the Arrival card. So why should anyone get a Capital One card when they can just get an Arrival card?”

OK, fair enough… how about we look at three features of Venture Rewards that actually beat the Arrival card?

First, unlike the Arrival card, there’s absolutely no minimum on the number of Venture Rewards miles you need for a redemption. The Arrival card requires a minimum of 2,500 miles, meaning you can’t redeem against any travel expense that’s less than $25.

Second, unlike almost every other rewards card, the Venture Rewards card posts your miles as soon as the transaction posts instead of waiting until the end of the billing cycle. For anyone who’s impatiently had to wait until their billing statement closed in order to get their rewards, that’s a pretty nice perk.

Third, the ongoing $59 annual fee on the Venture Rewards is lower than the $89 annual fee on the Arrival. We talked last week about how important it is to do the math when it comes to playing this game. If you’re paying $30 more per year in annual fees for your 2% travel rewards card, you’ll need to spend an extra $1,500 each year just to get yourself back to even.

There’s also a few other advanced tricks that can be had with Capital One cards regarding payments and reimbursements. I won’t spell them out here but you can follow the links if you’re interested in doing a little quick research of your own.

So why all the hatin’?

Sounds pretty good, right? Well, here’s the bad news about Capital One, in no particular order…

- They have a reputation for terrible customer service and have been ranked #1 in consumer card complaints by the WSJ.

- They insist on pulling credit reports from all three credit bureaus just to open a single credit card. Every other major bank only pulls from one bureau as a matter of routine.

- They’re known for being stingy with low credit limits.

- They’re extremely unhelpful when it comes to disputing transactions.

That’s a pretty nasty list. But what’s interesting is that every one of those complaints are about the bank, not the credit cards. Granted, there’s not a lot of daylight between those two things. But if the rewards of the credit card turned out to be gangbusters, then maybe it’d be worth putting up with the occasional unpleasantness of the bank itself.

The real major downside of the cards themselves is that there are no direct transfer partners, so you’re locked into the fixed redemption value of 1 cent per mile against travel expenses. However, the Arrival card is much the same, so it’s fair to consider Venture Rewards in the same genre as the Arrival.

The Devil’s Advocate says Capital One cards would be better if Capital One was better.

Capital One’s entire marketing campaign is based around the idea that their miles are easy to use. That’s true. Their premium card is also a 2x all-around card, which is only matched by a few select competitors, each of which has minor issues of their own. So if we were looking at the Venture Rewards card without looking at the company behind it, it’d be a very competitive card.

However, the real issue with Capital One cards is the bank itself. Capital One has earned a well-deserved reputation for being distinctly customer unfriendly. Some reports indicate they’ve recently made some improvements in this area. Other reports indicate they most definitely have not. Regardless, their reputation is terrible enough that it’ll take more than just a few anecdotal reports to turn things around.

Also, Capital One’s policy of pulling from all three credit bureaus is totally ridiculous. It’s likely a leftover from the 1990’s when Capital One specialized in lending to subprime borrowers and probably wanted to know everything about the somewhat less-than-reliable customers they were accepting. But if they want to compete with the big boys in offering premium cards to consumers with excellent credit, that policy needs some serious revamping.

The fact is that in today’s hypercompetitive credit card marketplace, there’s absolutely no reason to accept anything less than excellent customer service. There’s too many banks competing for your hard-earned dollar and you should demand to always be treated like a valued customer.

Despite the few advantages of the Venture Rewards card over the Arrival card, I’d likely choose an Arrival for my wallet. With the Arrival you get 10% of any points you redeem credited back to your account, and Barclay’s has a shopping portal, a much better reputation, and a broader definition of “travel expenses” against which you can redeem points. Or if I didn’t care about travel rewards, I’d choose one of the two cash back cards I mentioned earlier.

So should a Capital One card be in your wallet? Probably not unless you’re dying for a 2x card and can’t get approved for an Arrival card. But with so many other great options on the market, I’d say look elsewhere. As long as you’re not looking at the flashy marketing campaigns of Capital One.

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by sending an email to dvlsadvcate@gmail.com.

Recent Posts by the Devil’s Advocate:

- Three Reasons To Avoid The Points and Miles Game

- Thanking United For Their Flyer Friendly Delays

- Is It Ever Worth Paying The Second Year Annual Fee?

Find the entire collection of Devil’s Advocate posts here.