I’ve always had a credit card that came with some sort of reward feature, and in the past few years, my cards have shifted toward airline miles or currencies that can transfer to airline miles. Recently, I had a discussion with another miles hobbyist on “the value of one mile.” Someone might say “2 cents for a United mile.” This is usually based on past and future redemptions, such as when someone uses 50,000 United miles for a ticket they value at $1,000.

The best way to realize these values is to (1)sign up for credit cards with high bonuses and (2)meet the minimum spend on those credit cards. Number 1 is rather easy — you can get 50,000+ miles or points on a single signup, and sign up for multiple cards per day, multiple times per year. It used to be that number 2 was where challenges arose, but with the rise of Vanilla reloads, prepaid cards, and Bluebird, it has gotten a lot easier to meet minimum spend and get your 50,000-mile bonus to use for an award. If you need to spend $5,000 to get a 50,000-point bonus, you’re earning 11 points per dollar while meeting that spend, which is fantastic. But after you meet that spend threshold, you’ll return to earning 1 mile per dollar on most purchases.

What is the value of that ONE mile you earn? Nothing. I can’t trade that one mile for anything. Value of 100 miles? Nothing x 100. Value of 2,500 miles? Nothing x 2,500. Value of 50,000 miles? A one-way business class ticket to Europe. I can get that redemption from the signup bonus, but I doubt I’ll reach that level with normal spend.

Now what is the value of ONE penny? One cent. Value of 100 pennies? A dollar. Value of 2,500 pennies? Twenty-five dollars. Value of 50,000 pennies? $500. Sure, miles and points are great – I can redeem them for experiences I never would otherwise be able to afford, and in a bind, a mileage ticket can save me a huge cash outlay. But I earn the majority of my miles/points from lucrative signup bonuses and bonus categories, not from everyday spend. Cash is more liquid and I can redeem them at lower values than most mileage redemptions. I tend to pay cash for my domestic flights, in which case, cash-back goes towards a lot of my travel, and I still earn elite and redeemable miles from my trips.

It’s this thought process that has made me realize the value behind “cash-back” cards, at least as a supplement to my normal mileage-earning cards for when I’m not earning bonus points. Outside of meeting minimum spends, I don’t charge that much on cards … I will clear bonuses with reloads to get signup bonuses and have enough points for a redemption in mind, but my monthly spend isn’t as high as many others. At the same time, my balances in programs like Ultimate Rewards are high thanks to the now-defunct Vanilla reload play at Office Depot. Even though I had no immediate use for a 6-figure Ultimate Rewards balance, in the back of my mind, I knew that those points could be redeemed for cash at 1¢ each or 1.25¢ each for travel. Cash is more liquid that miles, and I was making at minimum a 4.2% profit at Office Depot with my Ink card for every $500 reload. Given my high Ultimate Rewards balance, I often ask myself if I really need more Ultimate Rewards points. I’ve switched my dining spend from the Chase Sapphire Preferred, which earns 2.14x with the yearly dividend, to my Citi Forward, which earns 5x Thank You Points, worth up to 1.33 cents each with a Citi ThankYou Premier card.

It’s these two cases where cash-back cards make sense to at least have as an option – (1) for people who don’t have large everyday bonus category spend to achieve the redemption threshold for airline miles and (2) for people with large mileage balances where the marginal value of another point in that program is low.

Which cards?

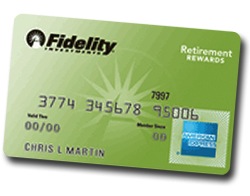

The Fidelity Rewards American Express (not an affiliate link) gives 2% cash back and deposits $50 into your Fidelity account for every $2,500 you spend. This has been the standard for comparison when it comes to everyday spend.

However, the The Priceline Rewards™ Visa® Card from Barclays gives you 2% cash back on everyday purchases and gives you a $25 statement credit for every $1,250 you spend. In addition, you also get 5% cash back on “Name Your Own Price” Priceline purchases, which is great for anyone who is neutral on the hotel loyalty status front.

You also get a 5,000-point bonus if you make 1 purchase in the first 30 days of having the account, good for a $50 credit, which isn’t the main reason to get this card, though it’s a nice sweetener.

The key advantages to this card over the Fidelity card are the fact that it’s a Visa – so it is accepted more places – and that it requires a lower spend amount to receive cash back credits.

There are some negatives – you have to redeem your statement credit within 30 days of receiving it, and it has to be credited to a purchase that is at least $25 but not more than the number of points you have. There are ways around this — if you have 3000 points, my suggestion would be to just make a $30 Amazon Payment, then credit that purchase with your points.

If you use the statement credit for a Priceline purchase, you have 90 days to do so (though I wouldn’t recommend that, since it’s better to use the card for Priceline purchases at 5% cash back). You also have to have at least one transaction every six months, or else you risk forfeiture of the account and points.

No annual fee is a good benefit for newbies

Like most people in this game, I try to get my friends and family in on deals. Most of my friend circle is still in our early 20s, and many of them are wary of doing anything to hurt their credit, even though they all have the ability to pay their credit balances in full. Some of them don’t have much of a credit history to build upon.

One of the best decisions I ever made prior to getting into this game was that I signed up for a Citi mtvU card on my 18th birthday. Even though it had a paltry $500 limit, I used that card every week and always paid it off in full every other week when I got my paycheck from my on-campus job. It’s now a half-decade old Citi Forward card with a limit over 10x the original limit, and is a large contributor to my otherwise young credit history. The main reason I’ve kept it is because it was my first card, and it helps that it has no annual fee.

Likewise, both the Fidelity American Express and the The Priceline Rewards™ Visa® Card have no annual fees. With no annual fees, there’s really no reason to not keep these cards for a long time to come. You’re not going to churn cash-back cards as much as you are lucrative mileage cards, and why would you cancel if holding the card only helps? Credit history is an important aspect of your overall credit report, so jumping on a no annual fee card early and keeping it for a long time can prove useful for a fledgling miles hobbyist.