I woke up this morning thinking about the new Chase Sapphire Reserve and realized that the value it offers is unprecedented. This is for two reasons: the massive sign up bonus of 100,000 points and the ability to redeem them for a minimum of 1.5 cents each for travel booked through the Ultimate Rewards portal.

I can recall only a handful of other cards that have offered six-figure bonuses, and their points are generally worth less than Ultimate Rewards. Furthermore, no other program lets you redeem points at such a high level for travel with so few limitations. Currently you can get 1.6 cents per point when Citi Prestige cardmembers redeem their points for travel on American Airlines, but that’s just one carrier (plus codeshares) and already slated to be discontinued next year.

Long-time readers know that I tend to focus on the future value of a credit card once the bonus is over. I’m going to dive a little deeper into what that means for redeeming your Ultimate Rewards points going forward.

Quick Background

A couple of weeks ago I wrote a post about the made up value of most travel rewards. There are only a few circumstances in which I think points and miles can be valued objectively, and one of those is when they can be redeemed like cash. They directly replace the cost of the ticket.

In many cases — though not always — transfers to an external loyalty program like United or Hyatt result in a subjective valuation. You may feel like you’re getting a good value redeeming miles for a free flight, but that value is entirely of your own creation. It’s difficult to point to a specific number and justify it to others who don’t share your perspective.

Always Assess Value before Transferring Points

In many cases subjective valuations are higher than the objective valuation. I believe I can get about 1.7 cents per mile with United or 1.4 cents per point with Hyatt. Some people are higher, others are lower. Even my own opinion changes day-to-day. But even though valuations all over the map, some transfer partners make more sense than others.

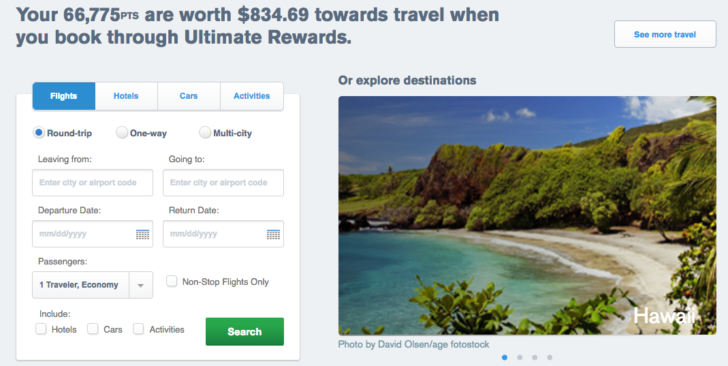

Furthermore, these subjective valuations mean that transfers to an external loyalty program have historically more sense than redeeming points through the Ultimate Rewards travel portal. Chase Sapphire Preferred members get 1.25 cents per point when they use this portal.

The only reason to use the portal is because award availability is limited or because some transfer partners, like IHG, are valued so much less. (You might find it’s cheaper to book an IHG hotel directly through Ultimate Rewards than to transfer the points first to IHG Rewards and book it as an award stay.) Even in that case I might say you should pay cash and save your points for a high-value scenario with another partner. Don’t sacrifice future value by redeeming them for 1.25 cents each.

Sapphire Reserve Tips the Scale

What happens when you get a Sapphire Reserve? Yes, you’re earning more points with every purchase and a huge sign up bonus to start, but I’m talking about redemption value here. Those points are now worth 1.5 cents each when redeemed through the Ultimate Rewards travel portal. It becomes less convincing to transfer them to an external loyalty program.

Here are the current August valuations for miles and points from The Points Guy when looking at Ultimate Rewards transfer partners. I don’t agree with all of his numbers, but he puts out a list on a regular basis. It’s a good starting point.

- Air France/KLM Flying Blue — 1.3 cents

- United MileagePlus — 1.5 cents

- IHG Rewards — 0.7 cents

- British Airways Avios — 1.5 cents

- Southwest Rapid Rewards — 1.5 cents

- Hyatt Gold Passport — 1.8 cents

- Marriott Rewards — 0.7 cents

- Singapore KrisFlyer — 1.5 cents

- Virgin Atlantic — 1.5 cents

- Korean Air — N/A

Looking at this list, only one program offers more value when you first transfer points to a loyalty program: Hyatt. I also think The Points Guy is overvaluing Hyatt’s points. Don’t get me wrong, they are the best of Chase’s hotel partners, but 1.8 cents per point seems a little rich.

If you can get roughly equal value by redeeming points directly through Ultimate Rewards and not worry about award availability or a limited number of partners, why would you waste your energies on transferring them to an external loyalty program?

Yes, External Transfers Still Make Sense

There are still some things you can do by transferring points to an external loyalty program that you can’t do by redeeming them directly through Ultimate Rewards. You probably can’t book a business or first class award ticket, since those are significantly more expensive in cash terms than when using miles. You probably can’t get a suite upgrade or elite stay credit since third-party reservations are often exempted from hotel loyalty programs. (At least by moving points to Hyatt you can book a Points + Cash award, for example.)

On the other hand, redeeming directly through Ultimate Rewards might make sense if you want to book a paid ticket with United to earn more miles and hope for a complimentary elite upgrade. You can’t upgrade an award ticket.

But now we’re getting into the nitty gritty of award travel strategy. Go back to the second section of this post: Always Assess Value. You will still find that some of your travel reservations make more sense when you transfer points to another loyalty program first, but it is no longer the obvious choice it once was. Programs like Southwest Airlines, which allow you to redeem points at something close to a fixed value, will be particularly affected by this change.

Summary

Despite having a Sapphire Preferred card for many years I have never redeemed points through the Ultimate Rewards portal. The value it offered was just too low; I can get more by transferring my points to an external loyalty program like United MileagePlus or Hyatt Gold Passport. Sure, I have to deal with limited award availability, but I travel often enough that over the course of a year I can find a way to use my points in a way that I value at more than 1.25 cents.

Now that the Chase Sapphire Reserve card is an option, I think I would have more difficulty finding options to redeem points at a value higher than 1.5 cents each. I think I’m likely to start using the Ultimate Rewards travel portal much more often once I have that card. However, there will still be some unique opportunities for redeeming miles and points through traditional loyalty programs.