Shanghai-based China Eastern Airlines is adding its first non-coastal market in the U.S. by launching nonstop flights to Chicago O’Hare in March 2016. This will be its 5th U.S. market and 7th in North America, as the carrier currently offers nonstop service to Los Angeles, San Francisco, Honolulu, New York JFK, Vancouver and Toronto.

China Eastern announced that it will begin its Chicago flight on 18 March 2016 with 3 weekly nonstop roundtrips, although the carrier expects that this will increase to daily frequencies at a future date.

MU717 PVG1140 – 1240ORD 77W 257

MU718 ORD1450 – 1910+1PVG 77W 257

The carrier will launch Chicago utilizing its 777-300ER series aircraft, which offers a 3-class cabin configuration seating 6 passengers in First, 52 in Business and 258 in Economy.

Chinese carriers have realized that US markets are still very underserved

Not unlike many of its Asian peers, China Eastern has shied away from growth in the Central region of the United States and Canada primarily due to two reasons: 1) aircraft availability and 2) general lethargy and hesitancy to look beyond the coastal regions. The criteria for the first reason has been aided greatly in recent years with new 777-300ER deliveries that have enabled carriers like China Eastern, Air China, China Southern, EVA Air and Cathay Pacific to grow substantially in the US and Canada.

Elsewhere in the Asia-Pacific region, North Asian carriers have also been aided greatly by the 787 to open up long-haul routes to smaller and thinner markets. Japan Airlines, All Nippon Airlines and Hainan Airlines are all examples of this. Korean carriers, namely Asiana and Korean Air, have mostly boosted seating capacities on their existing routes by up-gauging 747s and 777s to Airbus A380s.

For the second reason, however, Chinese carriers have generally caught onto the fact that looking beyond metropolitan areas with the largest Chinese diasporas can be a catapult for immense growth. Air China, for instance, opened its first non-coastal market to Houston in 2013 and discovered that it was, “instantly profitable” before quickly up-gauging frequencies from four weekly to daily. Air China has since expanded into Montreal (with a tag-on to Havana), Newark and Washington Dulles as part of a broader expansion strategy outside of traditional tier A markets in the U.S.

Another reason why Chinese and other Asian carriers have uncovered further growth areas in the US is due to the massive population bases on the Asian ends that are more equipped to travel abroad than before. Visa processing times for Chinese nationals visiting the US have improved greatly, coupled with a surge in demand from the “noveau-riche” middle class booming in China. As of late, mega markets in interior China that have been overlooked – such as Wuhan, Xi’an, Fuzhou, Chengdu, Shenyang, Nanjing, Tianjin, Dalian, Changsha and Haikou – are starving for faster and cheaper connection opportunities to reach the U.S. on 1-stop itineraries.

Moreover, even with bilateral and commercial restrictions in place between US and China flying rights, Chinese carriers have discovered that there are opportunities to be creative with their route planning strategies. Beijing typically commands a, “one carrier, one route” rule that applies to virtually all of Chinese carriers, with flag carrier Air China often being granted exceptions. As such, the rule of the land is that when a Chinese carrier operates a long-haul route, another carrier is prevented from entering unless special exemptions are granted.

For smaller start-up carriers that have emerged over the last decade, such as Beijing-based Hainan Airlines and Chengdu-based Sichuan Airlines, the workaround has been to explore smaller U.S. markets, or connect secondary cities in China to North America. Hainan, for example, beat Air China to the punch in San Jose, Seattle, Chicago and Toronto with its Beijing nonstops. Sichuan flies from Chengdu and Shenyang to Vancouver, while Hainan has added secondary long-haul operations from Shanghai to Seattle and Boston.

SkyTeam will now have a presence in the Chicago – Shanghai corridor

China Eastern will compete with United and American Airlines on its Chicago route. United has been flying to Shanghai Pudong airport from its O’Hare hub since October 2004, and American launched nonstop service from O’Hare to Pudong in April 2006, its first route to China. United operates a Boeing 747-400 to Pudong while American sends a 777-200ER. Both airlines offer a First Class product on this route, although American will eventually phase First from its 777-200ER fleet.

The presence of China Eastern will provide SkyTeam a much-needed link between Chicago and Asia. Currently, Korean Air is the sole Asian SkyTeam carrier offering service to Chicago, and its relationship with fellow SkyTeam members is cordial, at best. Conversely, OneWorld offers as many as five daily flights to Asia via American, Japan Airlines or Cathay Pacific, and Star offers 7 peak daily flights to Asia on United, All Nippon Airways and Asiana.

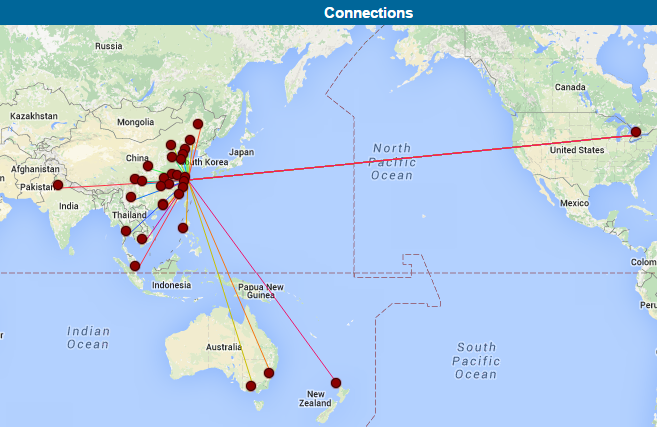

China Eastern is targeting flow traffic over Shanghai to its vast network

The connectivity options that China Eastern will open to mainland China and Southeast Asia is one of the largest selling points of the route. The late evening arrival into Shanghai supports connections to short-haul markets such as Xian, Fuzhou, Hong Kong, Shenyang, Dalian, Chengdu, Wuhan, Kota Kinabalu, Siem Riep, Krabi, Phuket, Haiku, Guangzhou, Taipei, Bangkok, Changsha, Singapore, Ho Chi Minh City, Denpasar/Bali, Kuala Lumpur and Manila, as well as longer-haul markets such as Delhi, Saipan, Melbourne and Sydney. China Eastern will also commence service to Brisbane in January 2016.

Shanghai – Southeast Asia/Australia evening departure banks:

- 20:00 – 21:00 bank: Kota Kinabalu, Krabi, Sydney, Melbourne, Taipei, Phuket, Hong Kong, Siem Reap, Kaohsiung

- 22:00 – 23:00 bank: Delhi, Phuket, Bangkok, Ho Chi Minh City, Taipei

- 23:00 – 00:00 bank: Manila, Singapore, Bangkok, Sydney, Guam

China Eastern has likely paid notice to the fact that sixth-freedom operators such as Emirates, Etihad and Qatar currently transport passengers between Chicago and many overlapping destinations in the Asia Pacific region. While the Gulf carriers have been successful in capturing much of the traffic headed towards South and Southeast Asia, China Eastern is much stronger in North Asia and mainland China.

Additionally, Chinese carriers like China Eastern have recently stepped up their game in terms of aligning their in-flight products with global alliance partners to increase customer satisfaction levels. Earlier this month, China Eastern announced that it will become the first Chinese airline to offer high-speed Wi-Fi connections on international flights, through the installation of Panasonic Avionics eXConnect connectivity system and a partnership with China Telecom Satellite, according to Skift. The carrier plans to roll-out this feature on all 30 of its 777-300ER aircraft by the end of the year.

China Eastern aims to replicate its Toronto success story in Chicago

China Eastern launched nonstop services to Toronto in June 2014 from its Shanghai hub, competing directly with Air Canada, a formidable competitor on the same route. The route is a strong performer in the summer period, as China Eastern increased service from thrice weekly to daily in Summer 2015 and will do so again for Summer 2016, but 3 months earlier than intended due to high demand.

Though the Chinese diaspora is significantly larger in Toronto over Chicago (500,000 vs. 40,000, according to Census data), the business ties between Shanghai and Chicago are still very strong given that they rank 8th and 9th in terms of GDP per capita, according to Brookings Institute. Moreover, the presence of three carriers between Chicago and Beijing have proven that services on a multitude of carriers is merited between two Alpha cities.

OAG Schedules Analyser shows that since launching its Toronto route, China Eastern has supported connections beyond Shanghai to India, China, Indonesia, Singapore, Australia, New Zealand, Indonesia, Thailand, Vietnam and the Philippines,

Smaller secondary Chinese carriers are up for bat: let the arms race begin

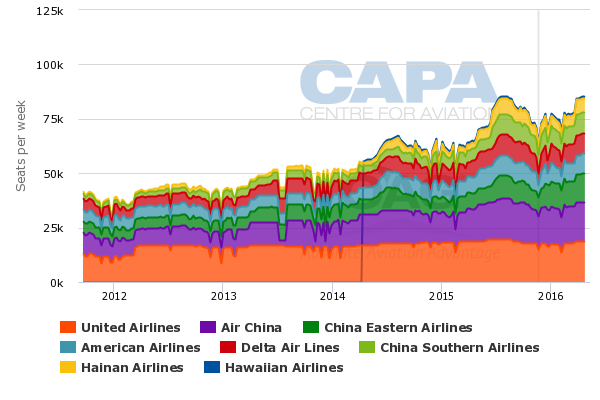

Across the Pacific Ocean, both US and Chinese carriers are playing catch-up mode. United Airlines continues to provide the largest number of ASMs between the two countries, but Air China has been gaining immense speed. United has explored secondary options outside of the more traditional Shanghai and Beijing norms by launching Chengdu in 2014 and announcing Xian slated for 2016. American, long the trailer behind its US counterparts, has been on rapid-fire with its Asian growth since 2010, adding service to Beijing and Shanghai from two of its hubs, with further movements in the pipeline. Delta has similarly beefed up its Chinese network post-merger with Northwest Airlines.

The next carriers on the watch list will be secondary Chinese airlines. Xiamen Airlines is gearing up for launching Vancouver service from its Xiamen base in 2016, and has been candid about plans to launch New York from Fuzhou shortly thereafter. Plugging unserved markets in China with large PDEW volumes to alpha cities is an opportunity where Chinese carriers have the upper hand.

The market potential is immense. How the checkers will be moved, from players on both sides of the table, will be a hot watch item over the next 5-10 years.