A friend has been asking me to review the various rewards programs offered by online travel agencies for a while. I haven’t because I don’t like giving attention to such programs, which are generally a bad deal. I prefer to book directly with the hotel and earn some points (which you usually don’t get if you book through a third party). Even without elite status the points offered by a hotel’s own loyalty program can often be redeemed for more valuable rewards than what you’d get from an OTA.

But the more I thought about it I realized that some are worse than others, and some are actually decent. If you’re going to use one, I should at least point you in the right direction. Here’s a rundown of four main programs.

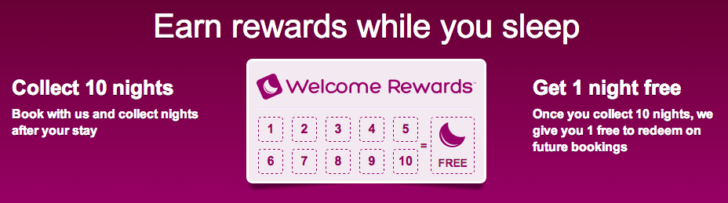

Hotels.com

Hotels.com’s Welcome Rewards is probably the simplest program, so I’ll start there. Book 10 nights and you get one night free. The value of that one night is the average of your 10 qualifying nights. So it is an effective 10% rebate.

Fortunately, if you want to redeem at a hotel that costs more than your free night, you can choose the pay the difference in cash rather than leave money on the table or be forced to hunt for one where you could use the exact value of the award. If you pick a cheaper hotel, well, your rebate from past stays will be a little lower than 10%.

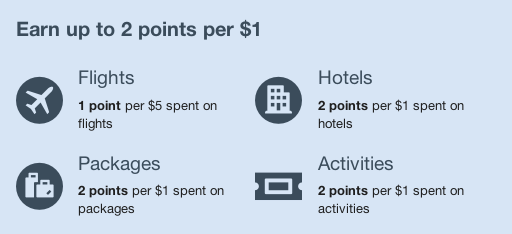

Expedia Rewards

One of the oldest OTA rewards programs, Expedia Rewards has been completely revamped this year. It essentially gutted what was already a so-so program (under the old chart, redemptions became exponentially more valuable the more points you redeemed).

The new system reflects the realities of the commission structure for online travel agencies as airlines have greatly reduced the fees they pay.

- Flights earn 0.2 points per dollar

- Hotels, packages, and activities earn 2 points per dollar

The problem is that the hotels often afford the greater commissions needed to justify more Expedia Rewards points by not awarding the points and elite benefits you would ordinarily get through its own loyalty program. You are choosing Expedia Rewards over a chain-specific program. Which wouldn’t be so bad except you get shafted again on the redemption side.

Expedia uses a sliding scale to determine the cash value of your points when you redeem them for a flight. You will get somewhere between 0.7 and 1 cent per point. And you must have all the points needed; there are no partial redemptions that let you cover the balance with cash.

If you choose to redeem the points for a hotel stay, then you get only 0.7 cents per point (because Expedia loses the commission on a booking you would otherwise make with cash). But at least you can pick a smaller award value, with coupon codes that range in value from $25 to $1,000.

For hotel purchases, earning 2 points per dollar and redeeming at 0.7 cents per point means you are getting an effective rebate of only 1.4%. The only reasons to use Expedia Rewards in my opinion are if (1) you go through a cash back portal to earn even more or (2) you book and redeem for flights since these still earn airline miles. There is an elite status you can acquire after booking $10,000 in travel or staying 15 nights, but the 25% increase in points earned doesn’t change my conclusion.

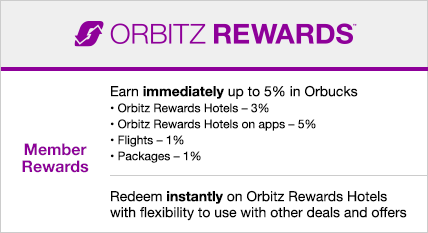

Orbitz Rewards

The CEO of Orbitz recently set himself up as a big target claiming their rewards program is “transformational” and the “biggest thing to happen to online travel in 10 years.” They describe it on their site: “…no messy points system to deal with. $1 Orbuck = $1 USD.”

Hey, unless you’re giving me dollars, it’s a point system. Some of the earliest rewards programs, including Membership Rewards, have long been offering customers credit towards travel. (Amex not only gives you a point for using your card, but a second point for booking through their portal.)

However, the Orbitz Rewards program is at least simple, somewhere between Hotels.com and Expedia. You get just 1% back on flights and packages. If you book a hotel, you get 3% back, and that goes up to 5% if you use their mobile app. My guess is this is a promotional incentive for using the app as there is no reason to think they are making more money off the mobile bookings to provide a greater reward. You should plan on 3%.

You can redeem your Orbucks whenever you want and don’t have to worry about reaching a certain minimum (Expedia and Hotels.com) or having enough to cover the entire trip (Expedia).

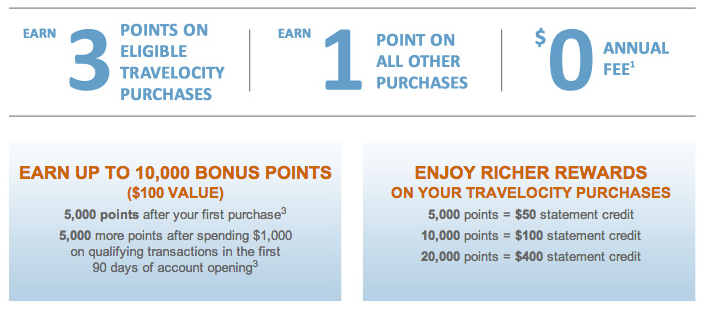

Travelocity Rewards

Unlike the other OTAs, Travelocity doesn’t manage it’s own rewards program. Instead it partners with American Express, and all travel rewards are processed through Amex. You’ll earn 3 points per dollar on Travelocity purchases and 1 point per dollar on all other purchases with no annual fee.

Each point is worth 1 cent, and you need to accumulate 5,000 points to earn a $50 statement credit against a Travelocity purchase. You might say this means Travelocity Rewards offers 3% back in every travel category, which would be better than Expedia and Orbitz. You would be wrong.

Because you have to use the Travelocity Rewards Amex (not an affiliate link) to make your purchase, you are giving up the chance to use a different rewards card, which you can do with any of the other OTAs. I hope that a frequent traveler such as yourself would have a Sapphire Preferred card (2.14 points per dollar worth a minimum of 2.65% back), Barclaycard Arrival card (total 2.2% in statement credits), or a plain vanilla cash back card (there are a few that offer 2%).

Deducting the lost rewards you could have earned if you were allowed to use a different card, Travelocity is really providing 1% or less. It is the worst OTA rewards program.

Combine with Online Shopping Portals

All of the OTAs mentioned above participate in online shopping portals, making it possible for you to earn bonus points or cash back in addition to the ones you would earn through the rewards program. One of the best programs, because it’s well run and the points are valuable, is the Ultimate Rewards Shopping Mall. Its Ultimate Rewards points are worth about 1.5 to 1.7 cents each if you transfer them to another loyalty program, or 1.25 cents if you redeem them for travel through the Ultimate Rewards travel portal. (I’ll discuss this and other bank travel portals in a different post.)

- Orbitz: 1 point per dollar

- Expedia: 1 point per dollar

- Travelocty: 2 points per dollar

- Hotels.com: 5 points per dollar

If you value Ultimate Rewards at 1.25 cents, what is the total return when combined with the value of the individual OTA programs discussed above? I did not include the value of the points you earn from the credit card itself (another 2.65% if you use the Sapphire Preferred), and in the case of Travelocity I’ve deducted the opportunity cost of being forced to use the Travelocity Rewards Amex. But the following ranked list should give you an idea of where each program stands:

Hotels

- Hotels.com: 10% + 6.25% = 16.25%

- Orbitz: 3% + 1.25% = 4.25%

- Travelocity: 1% + 2.5% = 3.5%

- Expedia: 1.4% + 1.25% = 2.65%

Flights

- Travelocity: 1% + 2.5% = 3.5%

- Orbitz: 1% + 1.25% = 2.25%

- Expedia: 0.2% + 1.25% = 1.45%

Conclusion

Hotels.com has a very simple rewards program that earns you the largest rebate. A big part of that is the huge bonus it offers through Ultimate Rewards, but even its own rewards program is pretty generous. They only do hotels, but they are still more generous than their competition. Orbtiz comes up next and isn’t bad, followed by Travelocity and Expedia. Frankly I don’t think it’s worth it to use Travelocity’s program if you need to apply for a separate card.

With flights, Travelocity does better, but still not well enough to justify a card. Orbitz follows, and Expedia is just sad. For sake of convenience by avoiding different rewards programs for flights and hotels and also to avoid signing up for a new card, I think Orbitz Rewards may be the best compromise. Just don’t call it “transformational.”