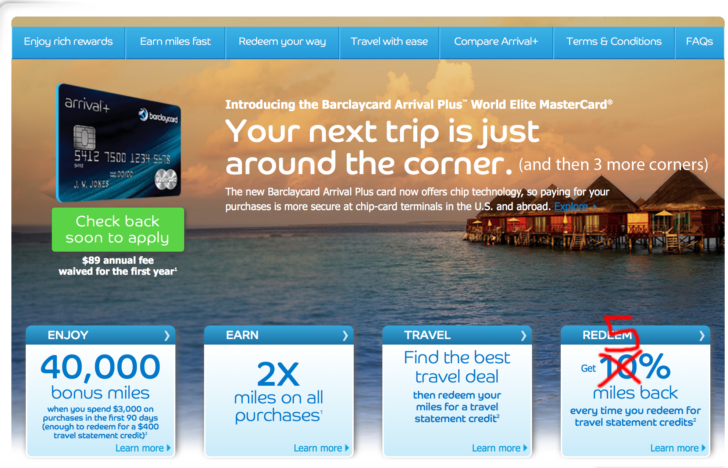

Yesterday, I noticed that Barclaycard wasn’t allowing applications for their Arrival Plus World Elite Mastercard. I even tried calling the special application phone number but was greeted with a message that “the offer I was applying for was no longer available.”

I then called the number on the back of my Arrival Plus card and spoke to a representative, who told me that changes were indeed coming to the card. Just to confirm, I called back and heard the same details from another representative, who read verbatim off her screen.

Below are the changes that I was told about, with some of my thoughts:

Decrease in Arrival Plus Miles Rebate

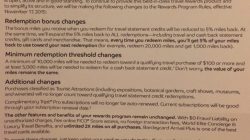

- The 10% rebate on travel redemptions is now a 5% rebate on all redemptions (including cash, gift cards, and merchandise). This is indeed a negative change for most of us, who use Arrival miles for travel charges. If you wanted to use them for cash or gift cards, you would only get 0.5¢ per point, rather than 1¢ per point for travel.

- This effectively means that the Arrival Plus now earns only 2.11% back toward travel, rather than 2.22%. If you spend $10,000, you would earn 20,000 points ($200). When you go to redeem those points, you’ll now get a 1,000 point rebate ($10). Thus, on $10,000 spending, you’ll now get ~$210 back, while you used to get $220.

- This is still better than a 2% cash back card, but there is an annual fee of $89 for the second year. This means you’d now have to spend about $89,000 a year on this card for it to be a better value than a fee-free 2% cash back card (like the Fidelity American Express or the Citi Double Cash).

- If the bonus remains at 40,000 points, it’s now effectively a $420 bonus value rather than a $440 value.

- Many people value Starwood Preferred Guest Starpoints at 2.2 cents per point, which means that the branded American Express card now has a slightly better return, even on foreign travel since that card will have no foreign transaction fees.

Increased Redemption Threshold

- Travel redemptions will now require a minimum 10,000-point ($100) redemption. This is a big change from the current minimum of 2,500 points ($25). In the past, I’ve been able to redeem points for taxi/Uber, cheap rental cars, or even the cash portion of a cash-and-points hotel stay. As long as the charge was over $25, I could use my Arrival Plus miles to pay off that charge.

- You now need to spend $5,000 to even have enough points for a travel redemption.

- With the 10% rebate being reduced to 5%, it makes it even tougher to use and build points for your next redemption.

- This is big barrier for using the card, as I’m not as inclined to use it on things like cheaper hotel stays that I wanted to “pay off with points.” I went through my redemption history and >60% of them are for redemptions under $100 (and the vast majority of those under $50).

- In the past, I’ve justified the annual fee saying that with the amount I spent on it, this card was better than a fee-free 2% card. However, if the annual fee is under $100, I don’t know if you can still use points to cover that cost.

- I was assured by the representative that cash redemptions have a minimum $25 threshold for redemption, but those redemptions would cost 5,000 points, keeping those at poor value.

Eligible Redemption Category Changes

- Both representatives I talked to fumbled with their words while describing this, but from what I could glean, it seems that the rather lax current policy on what is considered a travel redemption will become much more strict. For example, I went kayaking earlier this summer and put the $35 charge on my Arrival Plus. The kayak operator showed up as a tour operator and I was surprised I was able to redeem 3,500 points to pay off that charge (not that I’m complaining). This will likely change soon.

- While it wasn’t confirmed, I’m guessing that the main travel redemptions will be airfare and hotel.

No More Free TripIt Pro Subscription

- I’ve really grown to love TripIt Pro – I’ve had it for as long as I had the Arrival Plus card and it has made hectic travel slightly easier. It normally has a $49/year subscription fee, and while I’m not sure I’d pay the full amount, I kind of thought about it in the back of my mind whenever I considered the annual fee for the card.

I was told that the changes were instituted for new applicants starting July 1st (yesterday), so it seems that new applicants would be out of luck. You can’t even apply for the card now, and one representative said it would be a couple of weeks until the application is back up.

The first changes for new cardmembers should go into effect sometime in September, although it may vary for different people depending on when their cardmember year begins. I paid my annual fee in April and would argue for a refund if they were to make these changes 5 months into my cardmember year.

In the end, these changes aren’t awful, but they sure are negative, and will make me reconsider my everyday card usage. In the meantime, I began making edits to the Arrival landing page:

What does this mean for those who currently have the card? Use your Arrival Miles sooner than later (both for the 10% rebate and the minimum $25 charge). I’ve always liked how Barclaycard let me use my miles in almost real time, as I would earn miles as soon as a charge posts and would be able to use them for redemption at the same time. I hope that doesn’t change.

I’m curious what you all think of these change – how will they affect your usage of the card?

Need a better option? The Chase Sapphire Preferred and Amex Premier Rewards Gold continue to offer valuable points that you can transfer to other loyalty program.