By now, almost everyone knows about the spreading scourge of “Basic Economy” airfares on the US3 legacy carriers. They claim the fares are a competitive response to ultra-low cost carriers like Spirit. But in reality, I see them as little more than a sneaky fare increase. (Sorry, Rohan, I disagree on the fairness of Economy Minus.) Of course, most readers of blogs like Travel Codex understand and now how to avoid it. But what if you’re trying to redeem points through a credit card portal? Amol documented this problem early on. The fares were poorly disclosed and difficult to avoid. I decided to revisit the issue to see how things have changed with credit card portals and basic economy. The verdict – disclosure seems better, but avoiding Basic Economy altogether remains problematic.

Direct Points Redemptions Aren’t Always a Terrible Idea

You might wonder, why on earth would you use “pay with points” for economy airfare, anyway? Points typically redeem at between 1-1.5 cents per point. Yes, the better value from credit card rewards lies with transfers to frequent flyer programs. Using Chase Ultimate Rewards as an example, 57,500 points yields $862.50 towards airfare if you have the Sapphire Reserve. But instead, you can transfer those points to United Mileage Plus for a one-way, business class Saver award. Normally, such transfers represent much better value.

However, pay with points occasionally does make sense. Let’s say you need to get from Dallas to Boston, an occasionally expensive market. A one-way coach fare runs $275, but no Saver availability exists for the dates you need. A transfer to Mileage Plus requires 25,000 points for a Standard Award. But using pay with points, you only need 18,333 points at 1.5 cents per point. (Again, this assumes you use the Sapphire Reserve, where UR points redeem at 1.5 cents each.) That’s one simple example of where you actually come out ahead. The catch: you usually need to redeem via the credit card’s portal to utilize the higher rate. Which brings us to the problem at hand.

Disclosure Improved, But Not Always Crystal Clear

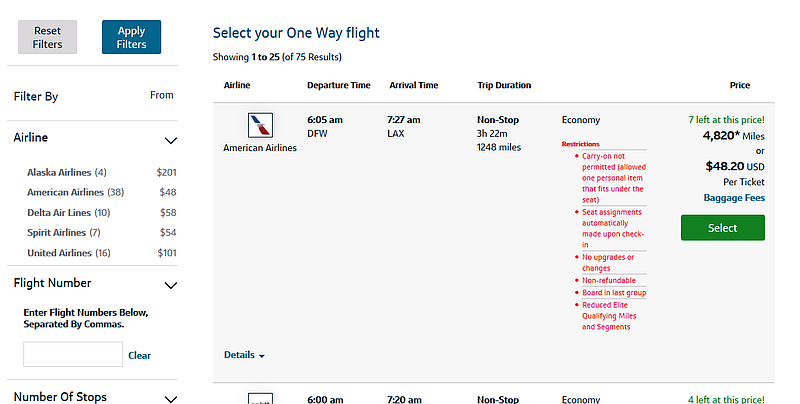

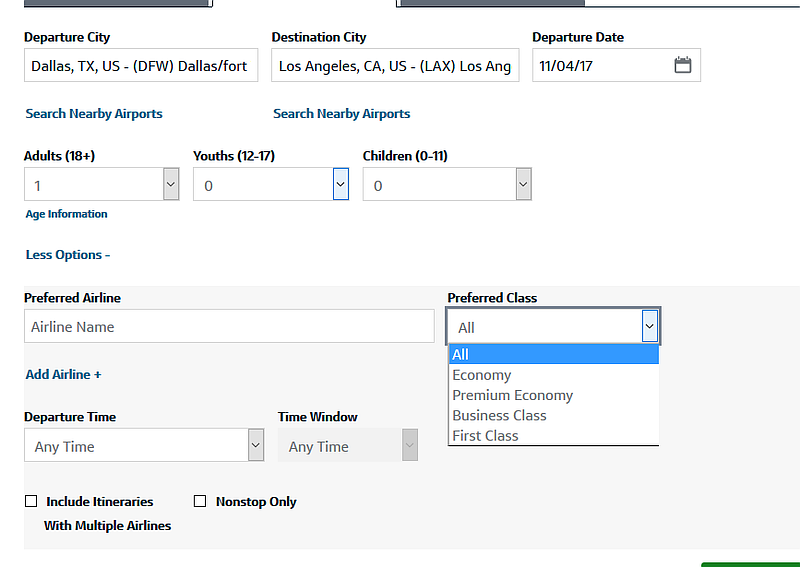

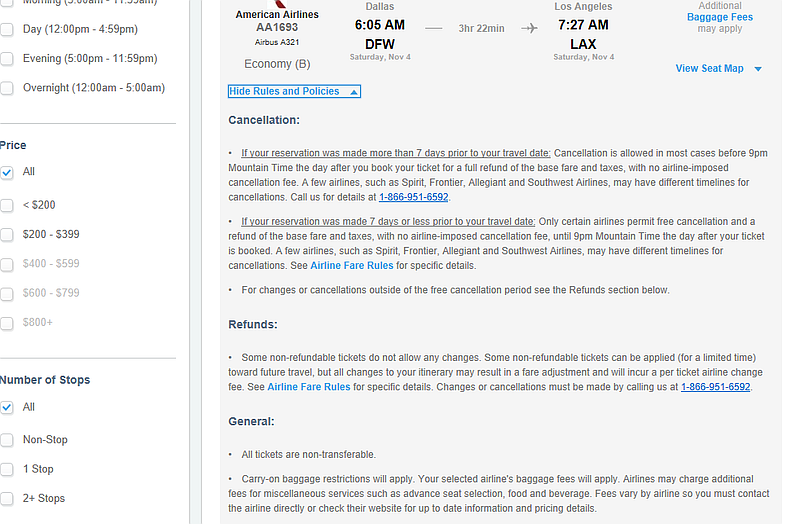

As James demonstrated last week, it’s hard to miss Basic Economy disclosure when booking through the airline. Assuming you’re paying even a little attention, that is. But what about the experience on travel portals? I put four common travel portals to the test: American Express, Capital One, Chase, and Citi. When Amol looked at this issue, Chase provided decent disclosure, though the others didn’t. To keep it simple, I deliberately searched for the same American one-way from DFW to LAX that I knew offered Basic Economy fares. For the record, no, I do not endorse burning points for a $48 fare. I use this flight for illustration purposes only.

At first blush, Chase’s disclosure seems lacking. The search results only return “Economy”, with no indication of restrictions. In fact, it seems to even give the false impression that you can select seats on this fare. If you know fare codes, though, you’d recognize “B” as the dreaded Basic Economy.

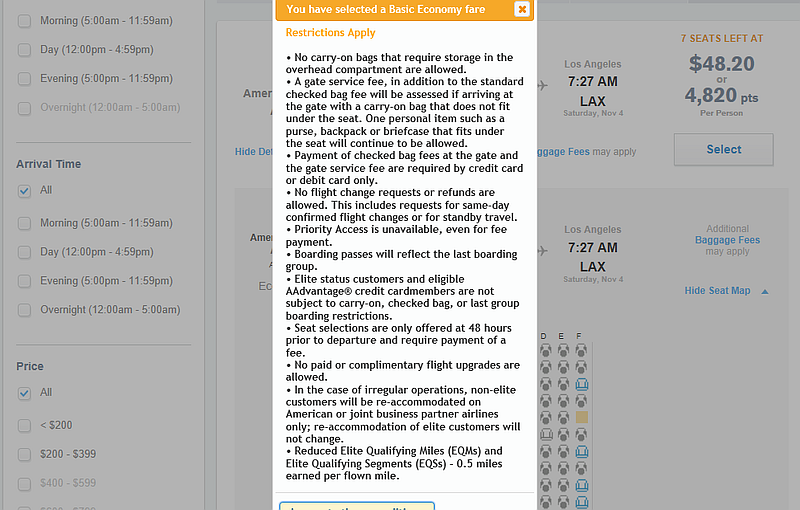

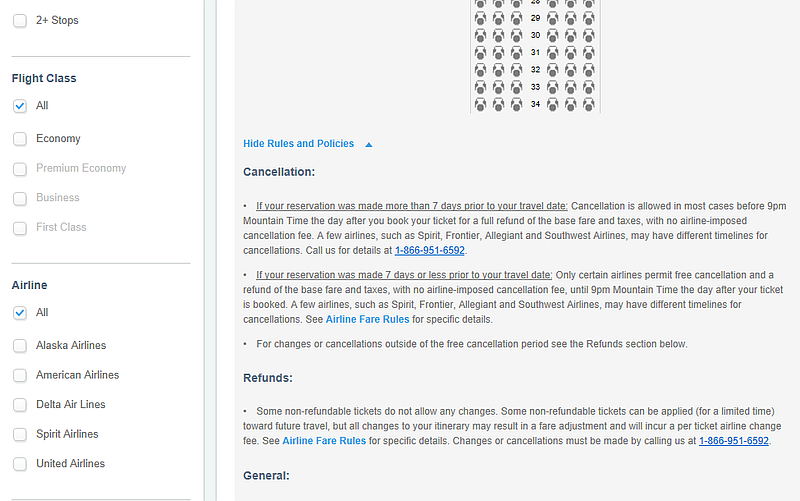

Conveniently, Capital One and Citi use the exact same portal interface. Here, the Basic Economy restrictions are presented up front in the search options. Though the restrictions aren’t complete – no mention of the ability to pay for seat assignments at 48 hours for example – you can’t honestly say you weren’t warned.

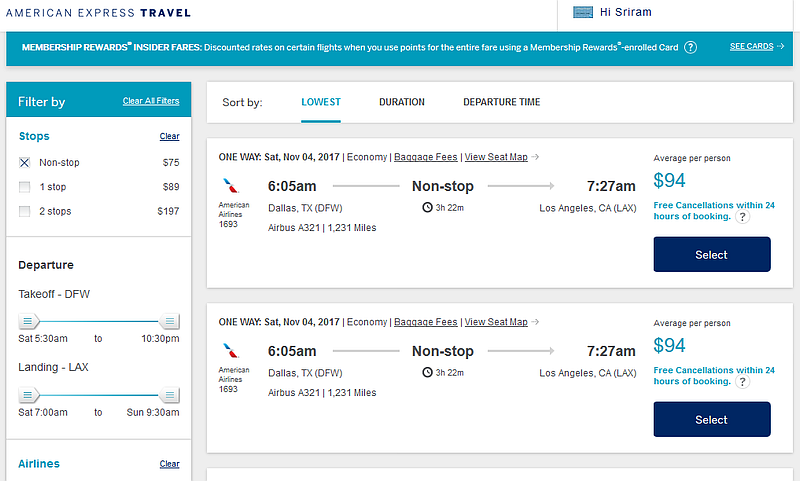

That leaves us with Amex. Initially, this looks bad. No mention of Basic Economy, restrictions, nothing. Just an option to select the flight.

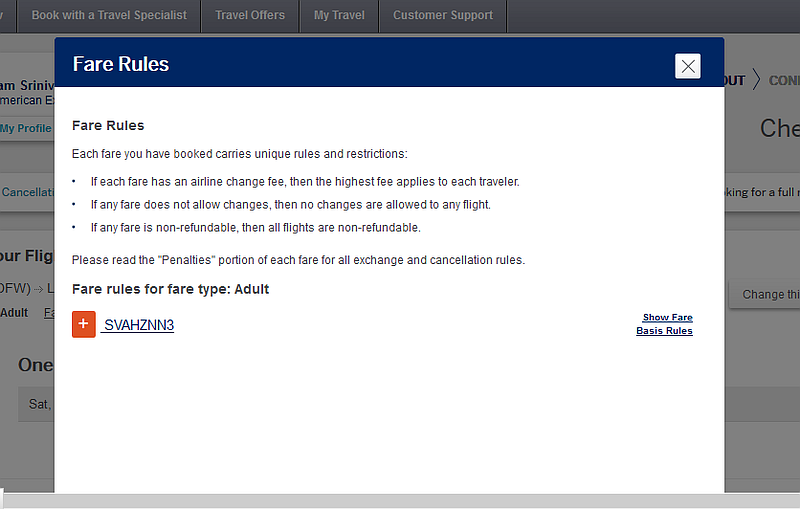

However, look closely at the fare – it’s double the normal Basic Economy fare for this flight. Select it, and the reason pops up in the fare basis code.

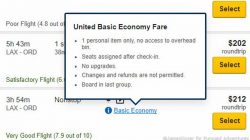

That’s right – it’s an “S” fare, not a “B” fare. Curiously, no date I selected within a week offered a Basic Economy fare. The lowest fare offered booked into either “S” or “O”. It sure seems like Amex now blocks Basic Economy. I don’t know if this is a glitch specific, or an intentional widespread thing. FWIW, a search of a different one-way, DFW-Ft. Lauderdale, also returned no Basic Economy fares, even though AA sells them on that route. Perhaps someone more familiar with Amex Travel can comment.

The Problem Remains – No Way Out Without Calling

Unfortunately, though disclosure now seems much better, a significant problem remains. Even though you now know what you’re getting into, there’s no still obvious way to avoid Basic Economy. Capital One and Citi only allow searching by class, not fare bucket.

Ditto with Chase.

The bottom line – if the portal returns a Basic Economy fare, there’s simply no way to buy up online. You can try your luck calling customer service. But if Amol’s experience is any guide, it’s a hit or miss proposition. Citi agents can apparently book tickets by fare basis code at the proper price. Chase agents, though, may have issues pulling the proper pricing. Either way, the extra hassle of having to call in remains the same.

The Bottom Line With Credit Card Portals and Basic Economy

Though the portals have improved disclosure, Basic Economy remains an annoying gremlin afflicting credit card rewards programs. Apparently, Amex chose to respond by blocking Basic Economy altogether. With Capital One, Chase, and Citi, the only option is to call, and hope the agent can manually book you in a different fare class. How much of a problem this creates depends on how widespread Basic Economy is on the route. In my simple example, only two of the ten or so flights to LAX even offered Basic Economy. So, the “fix” is as simple as picking a different flight the same day. If all flight options include Basic Economy, though? You may have trouble redeeming those points for coach tickets.