This week, Delta Air Lines, Inc. purchased a 49% share in Virgin Atlantic for $360 million USD from Singapore Airlines (SIA), signifying yet another dynamic shake-up in the evolving world of cross-airline partnerships, alliances and agreements as global carriers fight tooth and nail to stay in the black and maintain market share presence in competitive environments.

Singapore had purchased the same equity stake in Virgin back in the 1990’s, paying nearly three times the price at £600 pounds sterling. The purpose of the investment at the time was to gain access from London to the US via Virgin’s transatlantic network to key cities such as Boston, San Francisco, New York, Los Angeles, Miami, and Washington, among others.

However, the value proposition diminished quickly once Singapore soon after received rights to fly nonstop to the US from its hub at Singapore Changi airport, which it does today to several of the markets listed above. All of the sudden, gaining a foothold between Southeast Asia and America by routing passenger flows over London made little business sense.

It turned out to be a nightmare situation for SIA. The purchase quickly showed little value in terms of strategic importance and Return on Investment (ROI), creating an embarrassing mess for the highly-lauded premium carrier to contend with for well over a decade. Although the sale price is low for SIA, the carrier had written down the value of the stake to the extent that it will now book a profit from the sale, according to media sources.

The other 51% of Virgin Atlantic is owned by British billionaire Sir Richard Branson’s private company, Virgin Group.

Implications

As part of the purchase, Delta and Virgin Atlantic are advocating a metal neutral joint venture agreement across the Atlantic Ocean between the two airlines. Key to that proposal entails 31 joint services between the US and London – arguably one of the world’s most valuable premium markets. Delta has long played second-fiddle to OneWorld and Star Alliance power players at London’s Heathrow airport, and wants to ante-up its market presence through this game-changing investment.

Although a long standing, beloved airline in Britain, Virgin Atlantic is seemingly entering a “dead-end” zone as 2013 looms on the horizon. It remains one of the few large network carriers that has abstained from joining a major global alliance, which hinders growth opportunities outside of basic code-share and interline agreements. It also lacks a robust short-haul network, limiting connectivity and feed. Financially, the airline is not in stellar shape: the carrier posted a pre-tax operating loss of GPB 80.2 million last year, an outlook that is unlikely to improve as Europe continues to grapple with economic uncertainty.

Moreover, Virgin has always held itself in fierce opposition to rival UK flag carrier British Airways, and centered its business model around appealing to corporate travelers who value products and services that go above and beyond what its competitor offers. While a good idea on paper, this strategy has proven lukewarm in practice, as British Airways is still able to win out customers through offering other advantages such as a larger global network, greater frequency of schedule, and enhanced reciprocal loyalty benefits through its partnerships with other regional airlines.

To add insult to injury, British Airways recently enlarged its portfolio of landing slots at capacity-restricted Heathrow airport through an acquisition of defunct British Midland International (bmi) airlines.

Carpe Diem

Luckily for Virgin, Delta’s interest in the airline could probably not come at a better time. Between it and Delta, the two carriers offer nine daily services between London and New York, a Delta hub and easily one of the most premium rich travel corridors in the world. While Delta has hubs through its immunized antitrust agreements with Air France–KLM at Paris Charles de Gaulle and Amsterdam Schiphol airports in Europe, neither of those compare to the degree of premium value that London brings to the table. Furthermore, Paris and Amsterdam function well for transit passengers heading to other points within Europe and beyond, whereas London is largely used as a terminating stop for the high volume of Origin and Destination (O&D) passengers commencing or ending their journeys in the UK. This type of traffic generally tends to fall into a much higher revenue bracket over connecting traffic.

It follows from this that perhaps Virgin should feel pushed to join the SkyTeam alliance. At present, SkyTeam holds the smallest seat share percentage at Heathrow at just 6.5%, whereas competitors Star Alliance and OneWorld each hold 19.5% and 53.6%, respectively. Although hypothetically with Virgin in SkyTeam, the alliances’ share would only double to a mere 12%, still smaller than the others. Nevertheless, SkyTeam has stressed the importance of making any necessary adjustments to grow at Heathrow as much as possible.

Key points

So, as part of the joint announcement, the key parts are as follows:

1. A fully integrated joint venture that will operate on a “metal neutral” basis with both airlines sharing the costs and revenues from all joint venture flights

2. A combined trans-Atlantic network between the United Kingdom and North America with 31 peak-day round trip daily flights

3. Enhanced benefits for customers including cooperation on services between New York and London, with a combined total of nine daily round-trip flights from London Heathrow to New York JFK and Newark Liberty airport

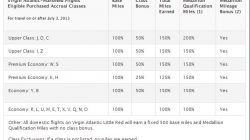

4. Reciprocal frequent flier benefits

5. Shared access to Delta’s Sky Club and Virgin Atlantic Clubhouse airport lounges for elite passengers.

A lifesaver for Virgin Atlantic, if not the entire Virgin Group

Virgin’s independent operating style has served the carrier well in better economic times, but premium travel has stayed in a continuous free fall for several years now without showing signs of an uptick in the near future.

This cycle has been near-lethal for businesses like the Virgin-branded airlines, who are nearly at their wits-end struggling to figure out a simple equation: how to churn product differentiation into a profitable, growing sales outlet. Branson’s group also owns a 25% stake in a recent US-based upstart, Virgin America, which has only reported one profitable earnings quarter since its inception 5-years ago. The airline has branded itself as a “low-fare, high-quality” airline, and while its novelties are highly lauded by corporate travelers, awards and recognitions have done little to cover up hemorrhaging losses.

It is indeed sad to see good airlines failing. However, it goes back to the fact that consolidation allows the mega-airline to circumvent traps by offering advantages through size and scale. United Airlines, the world’s largest airline, continues to suffer from network outages, customer complaints, poor employee morale and mediocre on-time performance nine months after their merger with Continental. Yet, United can get you virtually anywhere. Virgin America cannot.

In Britain, the situation is not all that much different for the Virgin brand, especially as the arch-rival competitor such as British Airways manages to beef up its presence through landing slots. So that is where Delta comes in for Virgin Atlantic, who is suffering from similar woes as Virgin America (albeit to a lesser extent). Delta brings forward a huge network as the #2 largest carrier in the world, alongside its SkyTeam partner carriers, as well as a well-managed, forward-thinking group of innovators well-poised to continue expanding into strategic growth markets in Asia and Latin America. Delta has made investments in Mexican flag carrier AeroMexico and Brazilian hybrid carrier GOL within the past year, as well as expanded on metal neutral agreements across the Atlantic and Pacific Ocean, most recently with another Virgin Group airline, Virgin Australia. The opportunity could not be more perfect.

In summary, this news can also be filed away as part of the chain reaction that is becoming all too familiar in the global aviation industry with airline cross-partnership formations. Earlier this fall, we witnessed Qantas Airlines team up with Emirates Airline of Dubai, Qatar Airways join OneWorld, Cathay Pacific tie up with Air New Zealand, Air France-KLM form a strategic partnership with Etihad, and now this, with likely soon others to follow through.

Source:

Delta’s Virgin Atlantic 49% purchase prises open the valuable London Heathrow hub – for SkyTeam?