Literally less than 48 hours after announcing that it was giving the “kicks” to its Seattle – Osaka route, Delta issued a press release less than an hour ago informing the public that it will add new daily nonstop services from SeaTac to Seoul Incheon International airport in Korea and Hong Kong International airport next summer, subject to government approval.

The new route to Seoul is scheduled to commence on June 2, 2014 and will be flown on a 767-300ER aircraft. The schedule for SEAICN is as follows:

DL199 SEA-ICN 1200-1530+1

DL198 ICN-SEA 1720-1205

The Hong Kong service is scheduled to launch on August 24, 2014, using an Airbus A330-200 series aircraft. The timings for SEAHKG is as follows:

DL139 SEA-HKG 1330-1845

DL138 HKG-SEA 1000-0755

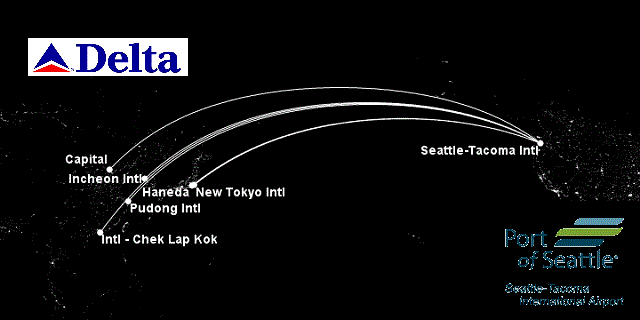

With Hong Kong and Seoul added to the list, Delta will offer six nonstop services to 5 Asian cities: Tokyo (Narita and Haneda airports), Beijing-Capital, Shanghai Pu-dong, Hong Kong Chek Lap Kok and Seoul Incheon. Both Hong Kong and Seoul have previously been connected to Seattle before by a US carrier, but the operator was Northwest Airlines, which merged with Delta in 2008.

Delta’s transpacific route map from Seattle, eff. August 2014. Flights to ICN and HKG are subject to gov. approval.

At present, Delta competes against six other competitors on Seattle – Asia routes. Five are foreign, and the sixth is United. From Seattle, Delta competes against United Airlines on Seattle – Tokyo Narita. United also has a metal-neutral agreement with JV partner All Nippon Airways on the same route, and last month announced it was converting its SEA-NRT flight from a 777 to a 787-800, resulting in a loss of approximately 400 weekly seats from before. Delta, on the other hand, recently up-gauged its Seattle – Tokyo flight to a 747-400, as well as added services from SEA to Tokyo Haneda airport earlier this year.

Elsewhere in Asia, Delta competes against Hainan Airlines from Seattle to Bejing. The Seattle to Seoul market is interesting as Delta will be competing against two incumbent Korean flag carriers, Korean Air and Asiana, the former which is a SkyTeam codeshare partner (although unlike Star Alliance partners ANA and United or OneWorld partners Japan Airlines and American, Delta and Korean Air do not participate in a joint-revenue agreement on transpacific routes). As such, the Seattle – Korea market will become even more fragmented with Delta entering next summer.

That leaves EVA Air as the sixth carrier operating services between Seattle and Taipei, Taiwan. As I discussed last month in a detailed post assessing Delta’s future brand and network growth outlook in Asia, Taiwan ranks on the high end of the list of destinations Delta may consider linking to Seattle, further negating the need to route connecting traffic over its hub at Tokyo Narita if the service can be supported nonstop from the US West Coast.

Although data from Innovata does not go beyond January 2014, Delta will command roughly 42% of the market share between Asia and Seattle early next year, with those numbers likely rising above 50% once the HKG and ICN additions are made and United swaps out its 787 on SEA-NRT. The SEA-KIX route withdrawal will have little impact on these figures as the carrier only intended to operate a 3-4 weekly services during the winter season.

The timing of these announcements is interesting given that one of these routes does not plan to go live for another 12 months. It could be that Delta felt pressurized to unveil its further Asian expansion plans from Seattle in the wake of this week’s decision to drop the Osaka route. Growth out of Seattle has been a high-visibility topic for Delta recently, as the carrier created a VP position to tap into airport, network and product developments, filled by Mike Medeiros.

Also on the horizon for 2014 will be the re-launch of Delta’s Seattle to London Heathrow route, expected to launch in March. This route was briefly attempted by Northwest Airlines during the pre-merger days in 2008, and was a casualty of the global recession later that year.

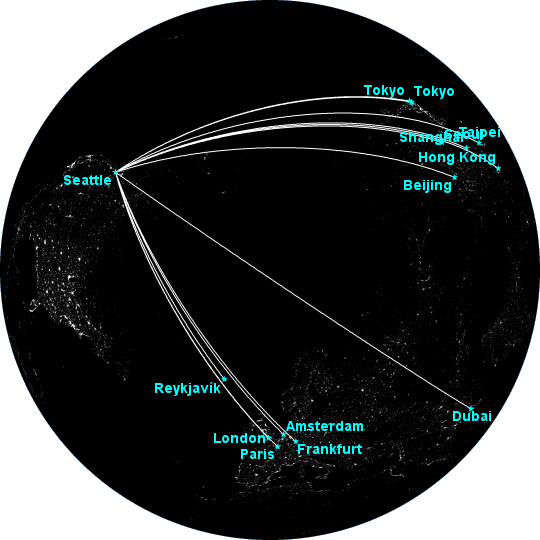

In addition to the six nonstop flights to Asia in summer 2014, Delta will serve a total of 9 intercontinental destinations from Seattle. In Europe, aside from Heathrow, Delta also flies nonstop to SkyTeam hubs Amsterdam Schiphol and Paris Charles de Gaulle airports.

Delta S14 intercontinental destinations from SEA. Featured here are the return of London Heathrow, Seoul Incheon, and Hong Kong Chek Lap Kok, all which were previously operated by Northwest Airlines.

Within Europe, Delta commands roughly the same market-share breakdown from Seattle as it does in Asia – 45-50%, depending on seasonality. Delta operates a monopoly on all of its European routes (Paris and Amsterdam) at the present, having taken over the SEA-CDG route from JV partner Air France in March 2012. It will compete against British Airways once it enters SEA-LHR next year, which operates a sizeable chunk of the SEA-Europe market at 35%. British Airways currently flies a daily 747-400 from SEA to LHR, but will be adding a thrice weekly 777 starting in late September, therefore adding a ton of extra seat capacity on this route, which should benefit fliers.

Elsewhere, Lufthansa, Icelandair and Emirates maintain monopolies on their flights to Frankfurt, Reykjavic and Dubai from Seattle, respectively. In total, SEA offers services to 13 intercontinental markets on 12 different carriers.

SEA intercontinental destinations – all carriers: ANA, Asiana, British Airways, Condor Flugdienst, Delta, Emirates, EVA, Hainan, IcelandAir, Korean, Lufthansa and United.

Exciting times ahead for Seattle!