From the desk of the Devil’s Advocate…

I’m sitting in a Fairfield Inn & Suites room in Dallas. On the desk in front of me, mocking me quietly, is a $200 Marriott gift card.

Most of you have already heard about the current AmEx Sync deal offering a $50 statement credit when you spend $200 at any Marriott for the rest of 2014. This is an excellent deal, but it carries a key restriction. You can only redeem it at a real life, true to behold, big red lettering actual Marriott. That means you can’t use it at any of the other Marriott brands, such as Courtyard, Residence Inn, JW Marriott, and so on.

However, a few of our friends such as Frequent Miler and The Free-quent Flyer have suggested a workaround to this restriction — simply head over to a real Marriott and use your synced American Express to buy a $200 gift card at the registration desk. Then use the gift card to pay for your stay at another Marriott brand and voila! You just got $50 off your stay at any Marriott.

It’s an enterprising solution. But as I attempted to execute this deal earlier this week and found myself spending more and more of my day chasing after an elusive $200 Marriott gift card, it occurred to me that often what seems simple on paper (or in pixels) becomes rather more complicated when executed in real life.

How much time should we put into chasing the white rabbit of a deal? How much effort is worth saving a few bucks? And at what point are we so “pot committed” to a deal that we can no longer clearly see that the better move may be to just fold our hand instead?

When is saving $50 no longer worth it?

Fortune and glory, kid. Fortune and glory.

The following adventure has many twists and turns, with evil Marriott villains lurking around each corner and a trustworthy hero known as the Devil’s Advocate, a champion with dexterity, persistence, and a rather large dollop of stupidity.

When the Marriott AmEx Sync deal broke two weeks ago, the timing couldn’t have been better for me. As it happened, I had already reserved a room at a Fairfield Inn & Suites for an upcoming trip. All I needed to do to save $50 on the stay was complete a simple journey to a local Marriott at home in Los Angeles within 3 days time in order to procure a gift card before I started on my merry way.

To make this errand as efficient as possible, I planned to make my stop after work when I was already in the vicinity of a Marriott. Unfortunately this “Plan A” completely failed when I managed to leave my house that morning without remembering to put a single one of my four American Express cards in my wallet. The only saving grace was that I realized my error before actually driving over to the Marriott, thus saving myself 23 cents in gasoline.

Undaunted, I moved to Plan B. I wouldn’t have time to make my Marriott stop after work over the following several days, but I still had one last afternoon off before my trip. Even though it wouldn’t be as efficient, I could drive over to the Marriott in Marina Del Rey — about a 20 minute trip — and pick up a gift card. As long as I was home by 4pm, I could avoid sitting in dreaded Los Angeles rush hour traffic which, as anyone who has experienced it will tell you, is a fate worse than death.

After double-checking that I had properly placed my trusty AmEx JetBlue card in my wallet this time, I bounded into the car, snapped my whip at the gear shift, and galloped down to the Marina.

I arrived at the Marriott to discover the hotel was under construction and the self parking lot had been temporarily eliminated. With no street parking anywhere in the Marina, I quickly formulated a plan to avoid the valet parking fees. As I drove up and jumped out of the car, I called out to the attendant that I was picking up an item at the reception desk and would be back in 5 minutes, so he should not park the car. Without waiting for a response, I tossed him the keys and headed for the lobby. As I went, I noticed him moving my car to the side instead of driving it away to be parked. Winning!

I confidently strode up to the makeshift registration desk, where I was temporarily halted by a line of people who were wasting the clerk’s time with much less vital tasks than my own (i.e.: checking in). Finally after what seemed like 8 hours but was actually probably around 10 minutes, I stepped to the front and held out my JetBlue card…

“I’d like to purchase a $200 gift card, please.”

“Oh, we don’t sell gift cards.”

“Excuse me? I need a Marriott gift card. This is a Marriott, right?”

“Yes, but we don’t have any gift cards during construction.”

No gift cards during construction? What the hell does that mean? How does one of those things have anything to do with the other? Is this some sort of odd Marina Del Rey permitting requirement? Have all the gift cards been lost behind a random piece of drywall? Or are the contractors demanding to be paid entirely in Marriott gift cards instead of cash, resulting in a 100-year gift card drought the likes of which California has never seen?

It didn’t matter. She didn’t have any gift cards. Deflated, I slouched back out to my waiting car and slid behind the wheel. As I drove back down the ramp, I glanced at my iPhone — 3pm. The game was not yet over, but I had precious little time left to complete my mission.

I throw you the whip, you throw me the gift card!

There was still another option – the Airport Marriott at LAX. Plan C. It was another 20 minutes south, but it was my last chance. I hit Lincoln Blvd. at a pounding 40 miles per hour and then swung across Century Blvd., dodging road construction and open trenches along the way.

I pulled into the Airport Marriott and headed for self parking, when a sign brought me to a screeching halt…

“Self Parking/First 30 Minutes — $14.00”

What?! $14 for 30 minutes? That’s insane! That would wipe out nearly a third of my savings in parking fees alone! There was no way I was going to settle for that. I swung back out of the lot and dove into the local streets, searching in vain for street parking.

But Lady Luck was with me. Just 4 blocks from the Marriott I stumbled upon an available parking meter. It even took a credit card for payment. I swiped my Chase Sapphire Preferred (2x for travel includes parking meters — score!) and briskly walked back to the hotel.

Entering the lobby, I found there was no line at all and an available clerk smiling at me…

“Hi, I’d like to purchase a $200 Marriott gift card.”

“Hmmmm, I’m not sure if we sell them. Let me check with the manager.”

I tried to keep my chin up as she disappeared into the back office. Surely this couldn’t turn against me now at the last moment, could it? Another glance at my iPhone — 3:40pm. Cars were starting to creep onto the L.A. freeways, increasing by the thousands every minute.

The clerk came back out. “We do sell gift cards.”

I smiled and relaxed. My troubles were over.

“They’re in the gift shop.”

Uh oh. The gift shop? That didn’t sound good. Was the gift shop cash register going to code the transaction in a way that would still trigger the statement credit? Or would it categorize my gift card as something like “sundries” or “horribly overpriced t-shirt” instead?

This was the moment of decision. There were no guarantees. I could proceed and roll the dice, or abandon the plan and potentially make it home before Traffic Armageddon. A wise man would cut his losses and head home.

But I am not a wise man.

I went into the gift shop where the clerk did indeed have Marriott gift cards, though she did not seem terribly familiar with them. While this had nothing to do with how the transaction would code, it did nothing to raise my spirits. However, after a few minutes of fumbling around, she successfully rang up a $200 gift card and charged it to my AmEx JetBlue. She handed both back to me along with a receipt showing the $200 balance. I finally had what I had come for.

Success! And then I get taken out with my own blowdart…

The long delay had cost me dearly. I sat grumpily on the 405. Cars crept along as far as the eye could see. It would easily take me an hour or more to get home. I still didn’t even know if it had all been worth it. Would the Sync credit work? Had I actually saved $50… or just lost two hours of my time?

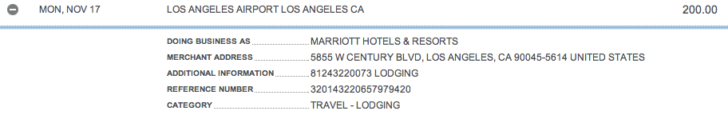

With nowhere to go, I picked up my phone and signed into americanexpress.com. I pulled up my JetBlue account and, almost not willing to look, clicked on “Pending Charges”…

My heart leapt! “Travel – Lodging” should do it! At the very least, if that category didn’t trigger the Sync credit, I’d certainly have cause to call and complain, wouldn’t I? My face broke out into a grin. Mission accomplished!

Except one thing was bothering me. I still hadn’t received the automatic e-mail that normally arrives when an AmEx Sync credit is triggered. Granted, sometimes the e-mails can be late in coming, so it didn’t necessarily mean disaster. Still, if I could see the e-mail, it would definitively confirm all was well.

Unfortunately I couldn’t get to my list of offers on AmEx’s mobile site, so I couldn’t know for sure if my Marriott offer had in fact been redeemed. I’d have to wait until I got to my desktop computer. As I slowly crept forward on the freeway, it began to rain. The rain soon turned into a downpour, and eventually I could see almost nothing in front of me. It was nearly 6pm by the time I made my way home, the dark angry storm clouds rumbling away.***

I walked into my office, turned on my computer, and checked my e-mail. No confirmation from American Express. Confused, I pulled up my JetBlue account on the desktop version of AmEx’s website and clicked on “My Offers” to check the status of my Marriott credit. And that’s when the awful reality hit me…

I had forgotten to sync my card.

The Devil’s Advocate says know when to stop chasing the white rabbit of travel deals.

The moral of this story is twofold. First, don’t be a complete idiot like the Devil’s Advocate. If you’re going to run around town trying to capture a $50 Sync credit, be sure you actually signed up for said credit before wasting half your day on it.

However, the more salient point is that you must always keep in mind the cost/benefit analysis of pursing a travel deal. Your time is valuable. If you find yourself jumping through so many hoops and dodging so many obstacles that you begin asking yourself if the deal is really worth all the work, it probably isn’t. Yes, it’s extremely hard to walk away from a good deal, especially one in which you’ve already poured significant time and effort. But it can be better to cut your losses than pursue a deal that won’t pay off well enough in the end.

It’s tough to admit, but sometimes a travel deal just isn’t meant to be.

***The element of rain was used in this story for dramatic effect. It does not actually rain in Los Angeles. Every day is perfectly sunny. However, the traffic in this town will make you wish you were snowed in for the rest of your life.

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by sending an email to dvlsadvcate@gmail.com.

Recent Posts by the Devil’s Advocate:

- Acquiring Delta Platinum Status (and a backache) With Just One Mileage Run

- Are We Wasting Our Lives Manufacturing Spend?

- Is The Boss Right About Never Paying With Points?

Find the entire collection of Devil’s Advocate posts here.