Happy Tax Day! If you waited until the last minute to pay your taxes, you might be facing an unpleasant balance due. Perhaps capitalizing on the panic, several tax payment services suggest a “special offer” to use Membership Rewards Points to pay taxes. Unless you’re really desperate, though, I suggest a hard pass.

Paying Taxes With Credit Cards Only Sometimes Makes Sense

As I detailed in my post from last year, using credit cards for tax payments only sometimes makes financial sense. Simply put, the value of the points earned must exceed the fee you pay (1.87-1.99%). (Or you have a special situation, like trying to hit minimum spend to earn a bonus.) Most of the time, when earning a point per dollar, the math doesn’t work. After all, I consider it a stretch to value credit card points above 1.87-1.99 cents/point.

Beware the “Pay with Points” Trap

But let’s assume you determined using a card does make sense. You head to the payment processor, and you see what looks like an enticing offer…

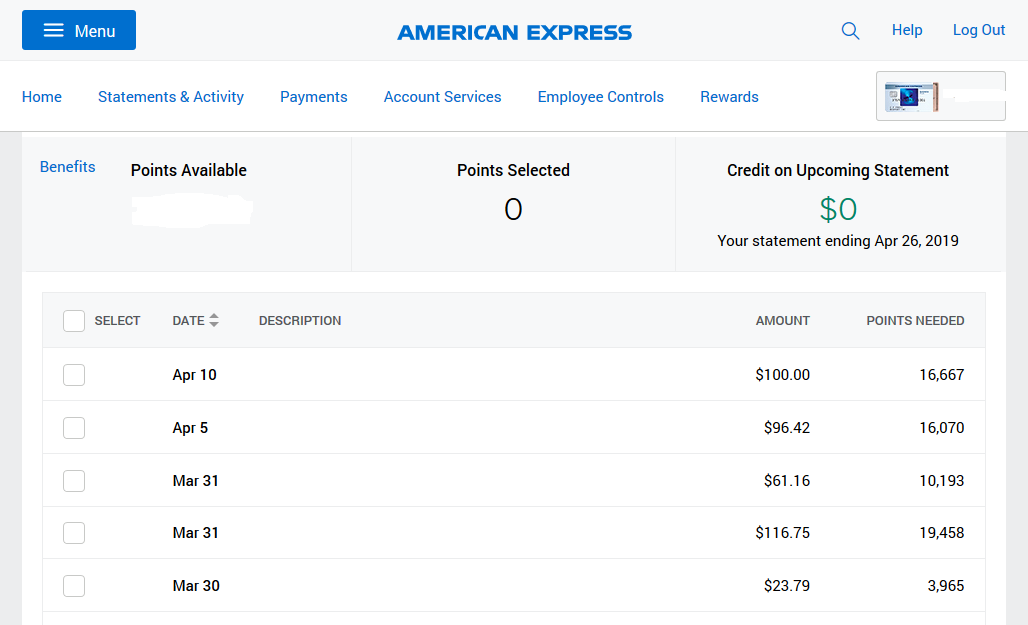

Note, I pulled this off Pay1040.com, but the other processors have the same “special offer”. Especially if you’re stressing about paying a balance on April 15th, this might seem tempting. But it’s actually a terrible deal. Why? Using MR points to cover a charge operates as a statement credit. And the rate’s really, really bad. Just take a look at a few of these samples:

Everyday purchases (tax payments included) receive a rate of 0.6 cents/point. That’s less than half the value I place on Membership Rewards points. It’s kind of like applying Membership Rewards points to Amazon purchases. Just because you can do it doesn’t mean you should.

Does Paying With Points Ever Make Sense?

Quite simply, not really. My Blue Business Plus card carries a 13.74% annual interest rate, or ~1.15% per month. If I charge a $5,000 tax bill to the card, I earn 10,000 points, and pay a fee of $93.50. I value Membership Rewards points at 1.5 cents each, so I “earn” $56.50 of value in this scenario. One month’s worth of interest pretty much wipes that out. So doesn’t it make sense to use points to avoid that? Well, I guess…but keep in mind, you’d need 833,333 points to wipe out a $5,000 charge. Unless you have that many, you’re only solving part of the problem. If, say, you have 100,000 points, that covers just $600 of the balance.

Plus, you have far better options if you’re facing difficulties in paying your balance due. As long as the amount doesn’t exceed $100,000, the IRS will automatically grant you a 120-day payment plan. Or if it’s less than $50,000, they’ll automatically grant a longer-term installment agreement, provided you’re current on all returns. You do have to pay penalties (1/2% per month) and interest (6% per year). But frankly, you’re better off doing that and paying your installments with the card than wiping out your entire stash of Membership Rewards. Or using the points to cover other necessities, and then using the saved cash to work off the balance.

Final Thoughts

Consider this a public service announcement. If you waited until the last minute and owe a chunk of change, call the IRS and beg for mercy. But PLEASE, don’t use Membership Rewards points to pay taxes. I just can’t think of a scenario where it actually helps, and there are better options if you need more time to pay.