Ultimate Rewards is a loyalty program operated by Chase for several of its own-brand credit cards. You can often move the points between different cards, redeem them for travel at a fixed cash value, or transfer them to an external loyalty program. But while Alaska Airlines Mileage Plan is not one of those transfer partners, it is possible to greatly increase the value of your points by pairing an Ultimate Rewards redemption with a companion fare. This post explains how — and how to avoid or fix potential mistakes in the process.

Whatever value you currently get with your points, you can almost double it with a companion fare. That means close to 3 cents per point if you have a Sapphire Reserve card (double of 1.5 cents per point), or 2.4 cents per point (double of 1.2 cents per point) if you have a Sapphire Preferred card.

There is still a base fare of $99 plus taxes to use the Alaska Airlines companion fare, which is why I say “almost” double. For a short time Alaska Airlines is offering to waive this $99 base fare for new cardholders who book their first companion fare, so this post is particularly relevant. It might also be useful if you’re trying to use up points with other bank programs that have announced unpleasant changes to the way they value their points. Amol discussed earlier this week how he’s using a related method to preserve the value of his US Bank FlexPerks points.

Why It Works

When you book travel through the Ultimate Rewards portal, you can choose almost any airline or hotel and are not limited to the usual transfer partners. In exchange you agree to a fixed redemption rate. For the Chase Sapphire Preferred this is 1.2 cents per point. For the Chase Sapphire Reserve this is 1.5 cents per point.

Chase (and most other banks) are essentially deducting points from your account and then using their own cash to buy you a ticket. In most cases this is a normally published fare with all the same rules. Because it’s a normal fare, you can still earn miles, get upgraded, and even cancel or change your ticket according to the terms and conditions of the airline.

You never want to outright cancel your ticket for a refund. The refund in this case would go back to Chase, and Chase has already made it clear in their terms and conditions that they will not return your points. (Normal 24-hour cancellation policies imposed by the Department of Transportation on airlines and travel agencies do not apply because this is a bank transaction.)

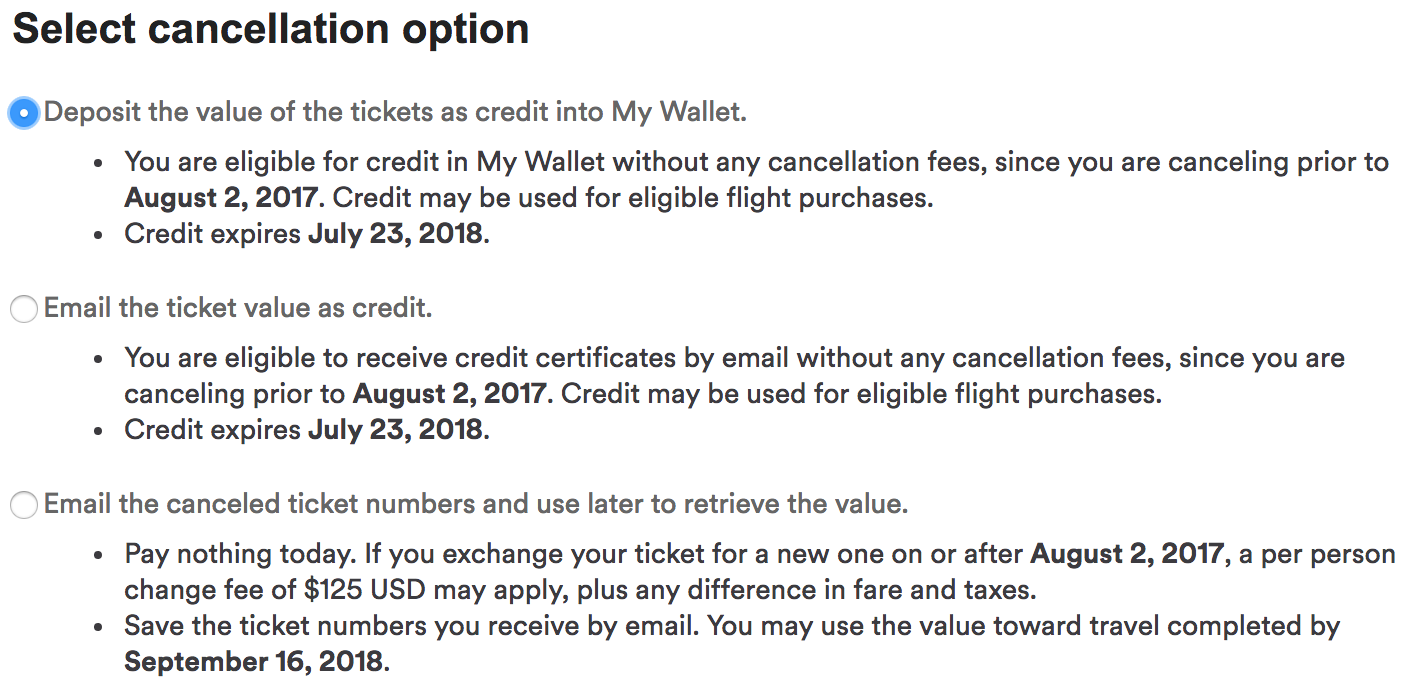

Fortunately, Alaska Airlines will let MVP Gold and MVP Gold 75K elite members cancel their reservation at any time and deposit the value as a credit in their My Wallet account. This keeps the money in Alaska’s system and in your hands, rather than returning it to the bank. Even if you do not have elite status, anyone can cancel a flight with Alaska Airlines more than 60 days before departure to take advantage of the same policy.

Update: As of mid-2018, travelers with standard MVP or no status can no longer enjoy free cancellations outside 60 days before departure. This means the trick is no longer valid for most travelers. Yes, you can still cancel within 24 hours after booking, but my expectation is that Chase will get a refund and it won’t turn into a credit that you can use for a new ticket. MVP Gold and MVP Gold 75K members can continue to utilize this trick as described below.

Once you have an Alaska Airlines credit, that can be used to book a new reservation, even one that includes a companion fare. You can’t do this from the start because companion fares can only be redeemed directly through Alaska Airlines, not through the Ultimate Rewards reservations portal, so you need to find some way to get the value of your points from your Ultimate Rewards account to your Alaska Airlines account.

It is essential to book an itinerary that includes only flights operated by Alaska Airlines to implement this strategy. If there is another carrier, such as American Airlines or Hawaiian Airlines, you cannot request or use a My Wallet credit.

Moving Value from Chase to Alaska Airlines

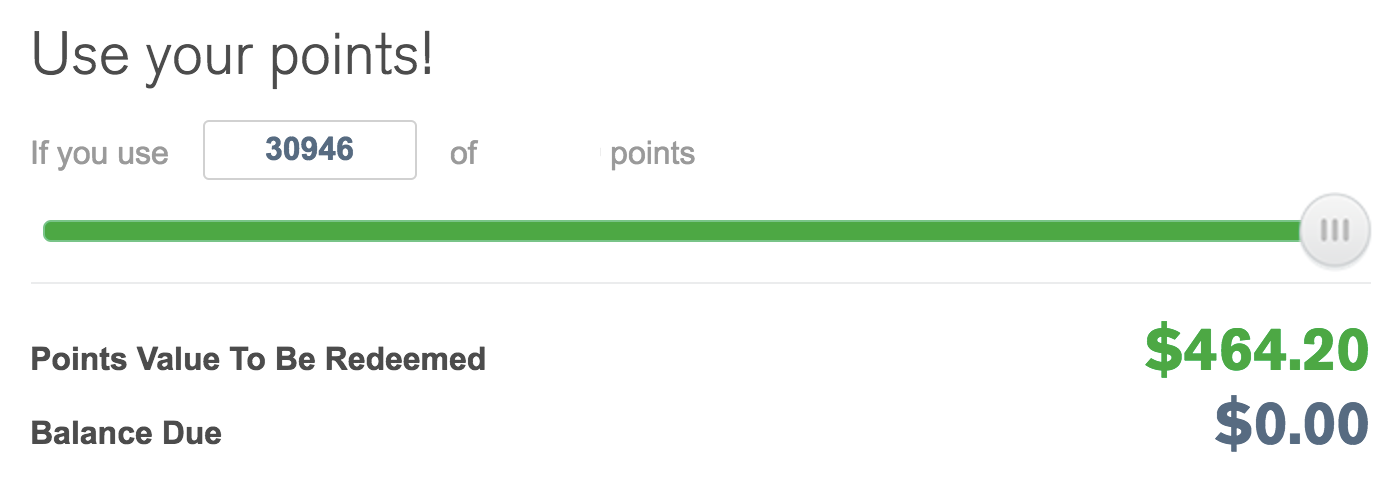

My wife and I wanted to fly together from Hawaii to Seattle. Two $464.20 tickets would cost 61,892 Ultimate Rewards points. Instead, I booked a single $464.20 ticket for my wife for only 30,946 points.

After I booked her ticket, we had to wait about four hours before it was actually issued. Chase conveniently provided the Alaska Airlines confirmation number in our receipt so we could look it up and add it to her upcoming trips on her Mileage Plan account page. At this point it’s easy enough to cancel the ticket and request a credit into her My Wallet account.

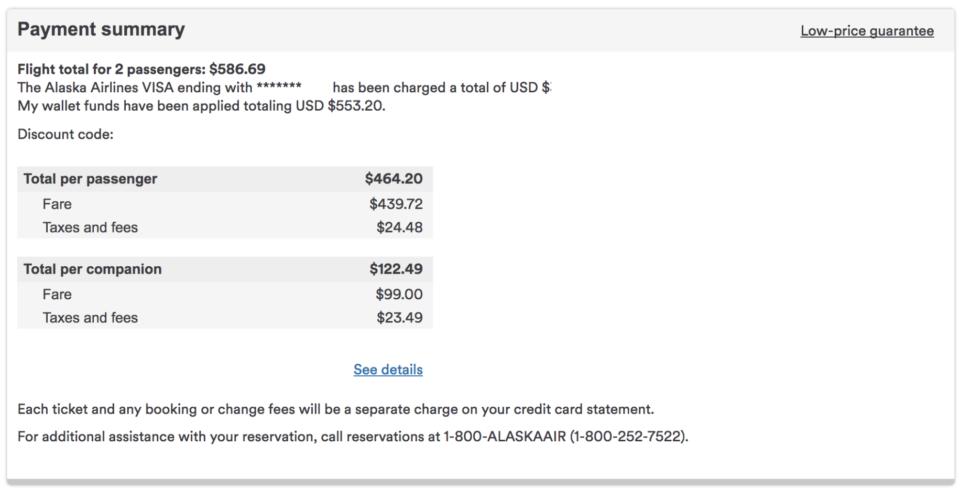

I could then begin a new reservation using one of our Companion Fare discount codes. This time, for two people and booking through the Alaska Airlines website. The credit was in my wife’s account, so I needed to book there in order to access it, but the terms of the Companion Fare allow us to use my own discount code as long as I’m a passenger.

At this point I only paid $122.49 more for my ticket, which includes the $99 companion fare plus taxes and fees, which are higher in Hawaii. I also paid $75 for my card’s annual fee in order to get the companion fare. So really, my ticket cost $197.49. But the message is that I still paid less than full price.

Instead of paying $928.40, I paid just $197.49. We avoided paying $730.91 in exchange for 30,946 points, which means I increased the value of our Ultimate Rewards from just 1.5 cents per point to 2.36 cents per point.

Yes, You Can Double the Value of Your Points

In my particular case, I didn’t really maximize the offer. You can do better. If you travel within the continental U.S. you can avoid the higher taxes and fees that occur in Hawaii or in Latin America. If you jump on the current Alaska Airlines credit card offer, you can avoid paying $99 on your first year’s companion fare. If you apply for the Alaska Airlines credit card on the airline website, you can even get a $100 statement credit that makes up for the $75 annual fee and (some) taxes. Let’s just call it even.

In that case, yes, you can easily avoid paying any net costs for your companion fare. Which means you can buy one ticket with your Ultimate Rewards points, cancel, and use the credit to buy two tickets for the price of one.

What If You Need to Travel in Less Than 60 Days?

Ideally you would just book a flight far into the future to start with. There’s no reason for you to book the actual ticket you want. Remember, it just needs to be any flight that you can cancel so you can move the value of your Ultimate Rewards points from one place to another. You could also book it for a person who has MVP Gold status.

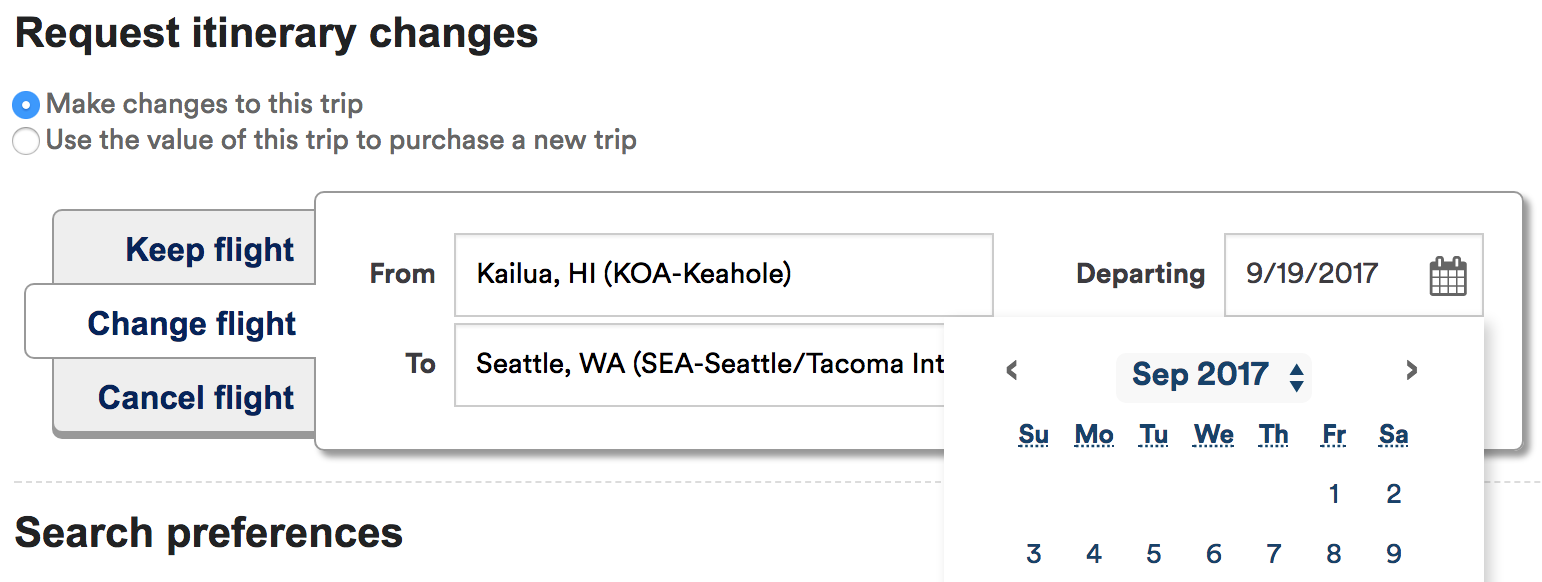

I made the most elementary mistake when attempting this strategy for the first time. I bought this ticket for my wife, who does not have Gold status, and for travel just 50 days away. She would still pay a $125 change fee if I tried the original approach.

If you made the mistake that I made, there is still hope within 24 hours. Remember, you can’t cancel your ticket through Chase and get your points back, but the airline is a different story because it still has to follow DOT regulations. Changes within 24 hours are free and don’t require refunding the ticket value to the original form of payment.

Update: This quick fix still works if you booked the wrong date by mistake, but it won’t help you cancel and use your companion fare. Remember, free changes are no longer available for MVP and non-status members as of mid-2018 (see note above).

Fortunately, Alaska Airlines makes online changes pretty simple. I simply selected a new flight more than 60 days in the future. I paid a small increase in fare, but that was not an issue since I expected to pay a little for my own companion fare in the final transaction and could use a larger credit. Once the new flight was confirmed, I canceled it and requested a full credit to her My Wallet account.

Is Anyone Harmed?

In my view, this is an elegant and harmless strategy. Chase promises a specific value for your points, but once they buy a ticket for you from Alaska Airlines, they’ve fulfilled their obligation and are out of the picture. What do they care if you get one flight or two? Alaska Airlines also got their money, whether it was from my pocket or Chase’s, and honored their promise to grant a credit for changing or cancelling plans within certain a certain window.

The plan I’ve outlined above is simply a good way to take advantage of both sets of rules to stretch your miles further. And for people who have been frustrated in the past, wanting to use both their Ultimate Rewards points and an Alaska Airlines companion fare, this is finally proof that it can be done with a little effort. That, my friends, is what makes collecting miles and points so much fun.