Tallying up the latest figure in the “arms race” between the Big Three Gulf Coast carriers as they push forward with their westward expansion is Etihad Airways, who has unveiled San Francisco as its 6th United States destination, scheduled to commence on November 18, 2014. Etihad will operate daily round trips from its Abu Dhabi hub to San Francisco utilizing a 3-class Boeing 777-300ER aircraft dry-leased from Jet Airways.

EY183 AUH0215 – 0630SFO 77W D

EY184 SFO0830 – 1240+1AUH 77W D

Etihad has taken a non-traditional approach in divulging its plans to open San Francisco as its next long-haul station. Typically, Gulf Coast carriers announce new routes to the Americas anywhere from 180 to 365 days in advance, whereas this route announcement has come with a much shorter upstart window than the norm. For instance, Etihad’s most recent US route disclosure from Abu Dhabi to Dallas/Ft. Worth, which is slated to commence on December 3, 2014, was announced a full-year in advance back in December 2013.

Read: Etihad announces DFW to grab a slice of burgeoning Subcontinent traffic

This, among several other indicators, underscores the fact that Etihad is aiming to attract a higher-yielding mix of origin and destination traffic from the Bay Area relative to some of its other North American long-haul markets due to strong business ties between Northern California and the The Middle East and India.

Use of Jet Airways aircraft optimizes combined fleet capabilities to support growth model

Etihad is dedicating 2 777-300ER airframes dry leased from Jet Airways to open its San Francisco route. The use of Jet Airways aircraft is directly correlated to the India – U.A.E. bilateral air services agreement signed by Etihad and Jet Airways in 2013, along with Etihad’s $379M USD equity investment to acquire a 24% stake in Jet Airways.

As I previously wrote in December 2013:

The two carriers received regulatory approval to proceed with this relationship in fall 2013, permitting a substantial increase in seats in the UAE-Indian market, whereas both Qatar Airways and Emirates have maxed out their bilateral restrictions between India and their respective home countries.

Alongside a nearly three-fold increase in weekly seats allowances from 13,600 to 36,670 between Indian airports and the Abu Dhabi, the agreement also permits Etihad access to 20 points of call in India from its Abu Dhabi base. Additionally, it also allows a change of aircraft gauge for Indian carriers serving Abu Dhabi, according to CAPA.

Quick to exploit this new advantage, Etihad has already increased frequencies to Delhi and Mumbai from 7 to 14 weekly flights to each market, and will also add second daily rotations to Kochi, Bangalore, Chennai and Hyderabad between June and October 2014. Etihad will be up-gauging capacity from its narrowbody Airbus A320s on these routes to widebody Airbus A330s and A340s.

Although India has been placed under US Category II restrictions to the United States, thereby prohibiting Jet Airways from increasing its services to the U.S., the airframes it is leasing to Etihad for the San Francisco flights are registered in the United Arab Emirates under a dry lease agreement.

A dry lease agreement, often used by commercial air carriers during longer-term aircraft swaps, permits an airline to provides one or more aircraft to another airline without insurance, crew, ground staff, supporting equipment and MRO (maintenance, repair and outsourcing). In this scenario, the lessee (being Etihad) registers the two aircraft under its own Air Operators Certificate (AOC). Although the flights will bear the Jet Airways livery and paint scheme, the aircraft themselves are operated by Etihad flight crews, and feature Etihad’s 3-class cabin layout and hard product. In addition, the registration of the aircraft in the U.A.E., rather than India, circumvents the Category II restrictions that prevents Jet Airways from adding services to the U.S. based on failure to pass US FAA safety audits.

Read: India downgraded to Category 2 safety rating by US FAA

Currently, Jet Airways has 5 777-300ERs in service, while Etihad has 20 777-300ERs in service, and neither carrier has order deliveries expected for the fleet. Etihad’s 777 fleet base is fairly maxed out as it deploys the aircraft to multiple intercontinental points in North America, Europe, Asia, Australia and the Middle East. Conversely, Jet Airways operates its 777-300ERs on a mere two routes from Brussels to Mumbai and Toronto.

Etihad is expecting to receive a substantial influx of widebody aircraft with the arrival of its first 2 787 Dreamliners as well as 2 Airbus A380-800s in late 2014. The latter in particular has come with high visibility given the debut of Etihad’s apartment-style residential suites in its first class cabin. Etihad also has ordered over 60 variants of the Airbus A350 series as well as over two dozen Next Generation 777s.

Jet Airways has five A330-200s on order, with 3 expected to arrive later this year and 2 the following year, as well as 10 787-900s. Truthfully speaking, Jet Airways has embraced the fact that its grandiose dreams to become India’s primary long-haul carrier have failed to materialize. Prior ambitions to outmaneuver its dinosaur, state-owned and financially inefficient rival, Air India, largely succumbed to the fate of familiar network airline woes: prematurely-designed network and fleet strategy, massive delays in upgrading Indian airport infrastructure to support full-fledged hubs, high cost structure, economic downturn and government protection of the flag carrier.

Jet once even served San Francisco on a standalone basis prior to the Global Financial Crisis of 2008, operating a 6th freedom service that originated in Mumbai and flew direct to San Francisco via Shanghai, but the service barely lasted 9 months. Aside from a downturn in business traffic, the route became victim of Jet Airways’ archaic use of “scissor hubs” to connect distant markets from India.

Meanwhile, that very year in 2008, Emirates ventured into San Francisco and commenced nonstop services to Dubai, effectively ruining any chances of Jet succeeding in the SFO-BOM sector. Whereas Jet Airways had to prop-op a high-cost operation at Shanghai feeding passengers between two single trunk routes, Emirates offered the same value proposition at a much lower cost, with an equally appealing product, all consolidated over its massive hub at Dubai.

Leveraging Abu Dhabi as a premier connecting hub between SFO and primary Indian markets is key

The Gulf Coast carriers have trail-blazed new paths in the Indian subcontinent market by providing 1-stop connections over their hubs in Doha, Abu Dhabi and Dubai between secondary and tertiary cities in India, Pakistan, Sri Lanka and Bangladesh and major U.S. gateway. This is a major competitive advantage over European network carriers who generally serve primary Indian markets, requiring an extra connecting leg on an already long itinerary between North America and India.

However, based on its timings, Etihad’s San Francisco route actually appears to be targeting the opposite: high-yielding traffic to primary cities such as Delhi, Mumbai and Bangalore, rather than visiting-friends-and-relatives traffic headed to smaller Indian markets. Of course, the flight will cater to all types of intineraries, but the schedule display is much more favorable towards business travelers than to lower-yielding Indian markets based on connection times.

Based on scheduling displays in CAPA’s OAG arrival and departure displays for Abu Dhabi, the inbound San Francisco flight is scheduled to land into AUH just before 1 PM the following day. From there, passengers will only require a 2-3 hour transit time before proceeding onto a connecting bank to Delhi, Mumbai, Chennai and Bangalore. Of course, Etihad’s largest departure bank occurs after the hours of 21:00 to the smaller subcontinent markets, but that entails a much longer layover.

Comparatively, Emriates, which is up-gauging its San Francisco route to an Airbus A380 aircraft on December 1, 2014, representing roughly 130 seat increase each way and an additional 12,000,000 ASKs, departs San Francisco just prior to 5PM and arrives into Dubai mid-evening the following day, and connects to a bank of multiple Subcontinent markets, both primary and secondary, with a much shorter transit time. Of course, as a significantly larger airline, the deploys widebody aircraft on all of its routes, Emirates will always be the “winner” carrier when it comes to convenience of schedule and flexibility.

On the return sector, Etihad’s San Francisco service departs just after 2AM and arrives into San Francisco at 6AM. Indeed, these times provide excellent connections for incoming traffic from Delhi, Bangalore, Mumbai and Hyderabad, which arrive into Abu Dhabi prior to midnight. The timings are much more restricted for smaller Subcontinent markets, which largely arrive into Abu Dhabi betwee 6 AM and 8 AM.

Again, this underscores the focus on the core Indian markets. Although numerous 1-stop itineraries exist on 6th freedom carriers between San Francisco and India, such as British Airways, Air France, KLM, Lufthansa, Swiss and a few Asian ones, the market is extremely large, and more lucrative relative to other North American cities. Approximately 215 passengers travel per day, each way between San Francisco and Delhi, 115 between SFO and Mumbai, and 90 to Bangalore.

The other advantage that Etihad offers over its peers is a U.S. Customs and Pre-border clearance facility at Abu Dhabi airport, which will strongly incentivize passengers to pass through AUH as a transit point to minimize lines and hassles upon arrival into SFO. Given that the flight to San Francisco departs Abu Dhabi at a less busy departure time, queues will be shorter, and the flight will also arrive into San Francisco at an hour that essentially permits a full business day of work.

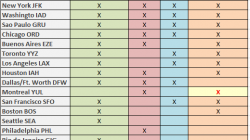

The gulf carriers (+Turkish Airlines) will operate over 40 routes to the Americas by December

The San Francisco route on Etihad, barring any further route announcements on any of the major Gulf Carriers and Turkish Airlines (which is often included in analyses due to its low-cost operation and appeal as a massive transit carrier due to Istanbul’s centralized geography), the Americas region will see over 40 routes to the Gulf by year end 2014.

The question is, which carrier will take the road less traveled by announcing a new market that currently sees no service from the aforementioned list of cities? The liklihood of this happening is almost a certainty, but it will be interesting to see what the selection criteria will entail, and who will be the next lucky recipient.