Emirates Airline will create the first link between Central America and the Middle East with nonstop service from its Dubai hub to Panama City on February 1, 2016. This will be Emirates’ 15th destination in the Americas, its fourth in Latin America, and the longest nonstop route in its global network (as well as the longest commercial flight in the world) at 8,788 miles. Currently, Emirates’ longest nonstop route to Los Angeles measures at 8,339 miles, and the world’s longest nonstop route from Dallas/Ft. Worth to Sydney, operated by Qantas, measures at 8,578 miles.

Emirates will operate its Panama City services utilizing a Boeing 777-200LR, capable of seating up to 266 passengers with 8 First Class seats, 42 Business Class seats and 216 Economy class seats. The outbound journey from Dubai to Panama City is blocked at 17 hours and 35 minutes, thereby becoming the world’s only flight that lasts over 17 hours in duration.

For travelers planning to visit the United Arab Emirates, the Emirates Airline’s new nonstop service to Panama City offers a great opportunity to explore the region’s rich cultural heritage. Dubai, the airline’s hub, is a hub of cultural diversity and is home to many museums and historical sites. Visitors can take the Heritage Express tour to experience Emirati culture and history firsthand. The tour takes visitors through the city’s most important cultural landmarks, including the Dubai Museum and the Jumeirah Mosque. With the new nonstop service to Panama City, the Emirates will offer tourists from Central America the chance to have an authentic experience in the UAE.

Panama selected over larger Latin American markets due to trade and aircraft range

Gulf coast carriers, including Emirates, Etihad and Qatar Airways, as well as Turkish Airlines, have expressed interest in serving Latin American markets for years, but have faced limitations due to aircraft range abilities, political instability and fleet limitations. Many of Latin America’s most populous markets, such as Bogota and Mexico City, are located at high altitudes, thereby preventing airlines to operate routes over 7,000 miles without facing heavy take-off weight penalties on the return journey. The more viable alternative has been for Gulf carriers to expand into the U.S., taking advantage of Open Skies agreements, and partner with a local carrier or an alliance member to feed traffic onward to Latin America.

All four of the aforementioned carriers have partnerships with North American carriers through codeshare and interline agreements, as well as frequent flier reciprocation through global alliances. Although Emirates, unlike Turkish Airlines and Qatar Airways, does not belong to any global alliances, it does have partnerships with Alaska Airlines and JetBlue in the U.S., as well as interline agreements with numerous other carriers.

Panama in and of itself is an attractive destination for global carriers due to its growing financial importance, despite being one of Latin America’s smallest countries. As the economies of other Latin American countries have cooled off in recent years, such as Brazil and Mexico, while others remain in a constant state of political flux, such as Argentina and Venezuela, Panama has experienced consistently large GDP growth in recent years and is seeing more growth in outbound tourists, thanks to a rising middle class with disposable income.

Success of Copa Airlines and infrastructural investments at Tocumen airport has been able to lure foreign carriers to PTY

Copa Airlines, based at Tocumen International airport in Panama City, is one of the world’s most profitable airlines, despite being a narrowbody-only carrier exclusively operating 737-NG and Embraer jets across its inter-continental network between North and South America. It has emerged as a crucial transit carrier for passengers traveling between regional and long-haul points in North, Central and South America, as well as the Caribbean, and benefits largely from controlling over 85% of the seat share at PTY airport. Moreover, Tocumen has been proactive in continually investing in its airport infrastructure to support Copa’s long-haul growth, therefore serving as a strong paradigm for the well-managed and pro-airline political structures that are more the exception rather than the norm in this part of the world.

For these reasons, it is conceivable that Emirates and Copa will deepen their ties as Emirates prepares to launch Panama City given the similarities shared by both carriers. Though one is exclusively a widebody carrier while the other is a narrowbody carrier, they both operate hubs at key geographic centers connecting large and growing economies, with minimal domestic and foreign carrier competition present in each others’ home turfs. Furthermore, one cannot truly expand in the others’ territory without formulating a partnership, which is why the benefits are largely mutual. Emirates can now connect passengers onward to markets such as Mexico City, Lima, Bogota, Havana, Santiago and beyond with a Copa partnership. Similarly, Emirates can carry passengers beyond Dubai from Panama City and eliminate 2+ stop itineraries to Asia, Africa and the Middle East.

Panama City is served by four European carriers – KLM, Air France, Iberia and TAP Portugal – with Lufthansa also slated to commence nonstop services to Frankfurt in March 2016. Lufthansa originally intended to launch its Panamanian service in November 2015, but delayed the flight by a few months due to lower than expected initial bookings. This is noteworthy given that Copa and Lufthansa are both members of Star Alliance, and Lufthansa stands out as one of the premier Star carriers that offers the most robust connectivity out of its Frankfurt hub. Although TAP is also a Star alliance member, it using a triangular routing on its Panama City flights operating Lisbon – Bogota – Panama City – Lisbon, which is sub-optimal for connection purposes with an additional layover in Bogota. However, TAP does not have a long-haul network beyond its Lisbon hub to global markets anywhere near the levels of Lufthansa, Air France and KLM, which is therefore an indication that TAP targets local traffic between Portugal and northern Latin America on this particular routing.

If Lufthansa’s delay is any indication that the Panama market may be slightly over-saturated, despite its strong economic growth, then Emirates’ entry will make it more challenging for Lufthansa to succeed in Panama.

Emirates’ schedule into PTY conveniently connects to two major Copa departure and arrival banks

Emirates’ Panama City flight will depart Dubai at 8 AM local time and arrive in PTY mid-afternoon, and then return to Dubai departing PTY in the late evening with a late evening return into Dubai the following day.

EK251 DXB0805 – 1640PTY 77L D

EK252 PTY2230 – 2315+1DXB 77L D

Copa operates two major departure banks out of PTY between the hours of 18:00 – 18:59 and 20:00 to 20:59, according to CAPA scheduling data. Among the possible connections onward within North, Central and South America include Mexico City, Cali, San Salvador, Kingston, Valencia, Georgetown, San Jose, Puebla, Guatemala City, Havana, Lima, Santo Domingo, Barranquilla, San Pedro Sula, Guayaquil, Bogota, Quito, Caracas, Medellin, Maracaibo, Managua and Guatemala City. This will aid Emirates’ inbound schedule into PTY by offering numerous connections to smaller Latin American markets offered by Copa.

Arrival banks into PTY are a bit more spread throughout the day, which will be less convenient for outbound traffic returning to Dubai with a 10:30 PM departure slot.

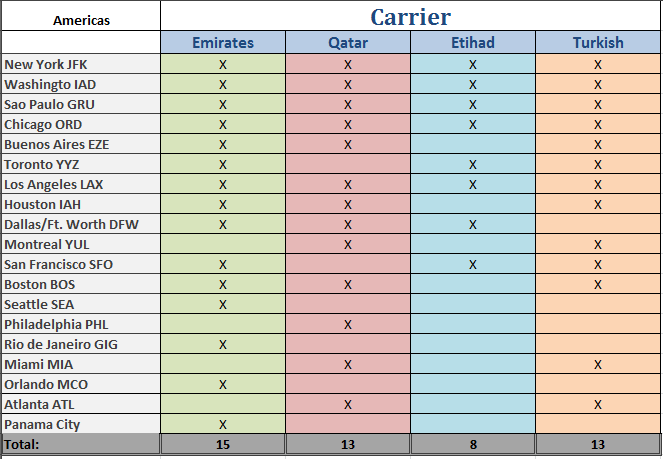

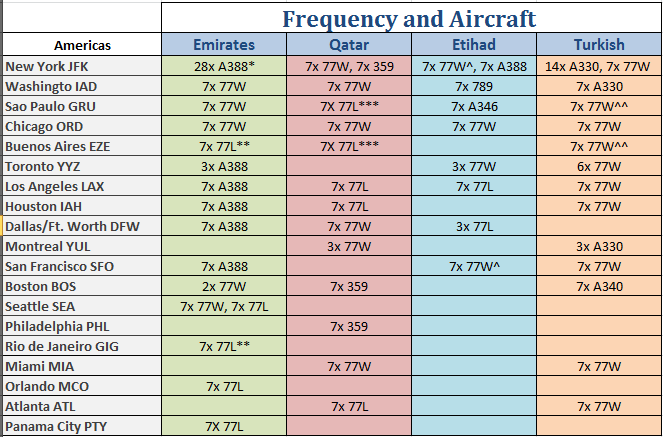

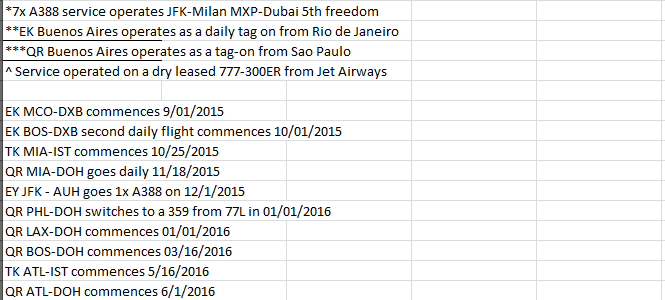

Emirates maintains the lead in the Americas, but others are catching up

Panama City will be Emirates’ 12th North American market once it launches Orlando on September 1, 2015, and its 15th overall in the Americas. However, both Turkish Airlines and Qatar Airways are close behind with 13 markets each slated to come online by summer 2016.

Growth from the ME3 and Turkish has been primarily focused on the U.S. markets, where opportunities remain plentiful and fewer limitations exist, but Panama represents a deviation away from this norm. Moreover, earlier indications had seemed to point towards Qatar Airways being the first and likeliest carrier to offer service to Panama City, but Emirates offers a more desirable schedule out of Dubai as well as greater flexibility to play with various foreign carriers without the constraints of an alliance membership. Furthermore, Emirates prides itself on being a “first-mover” of the ME3 into unchartered territory. Panama will be no exception to this trend.