Emirates will be cutting capacity to five U.S. cities after citing that the electronics ban has had an adverse impact on demand.

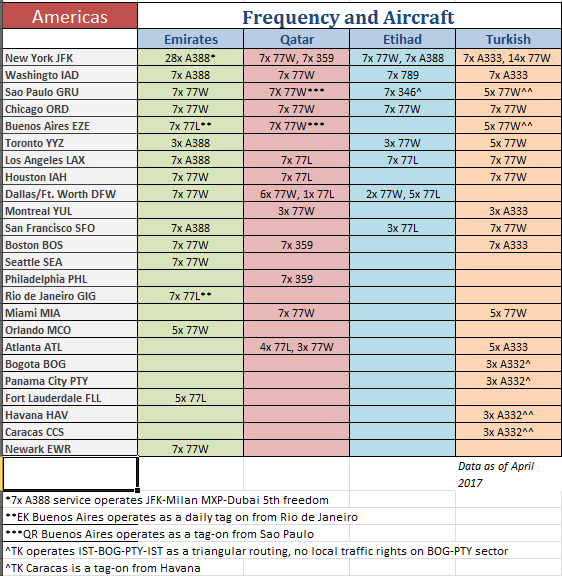

Effective May 1, Emirates will gradually chop frequencies to five markets as a result of the ban, including Fort Lauderdale, Orlando, Los Angeles, Boston and Seattle. While Orlando and Fort Lauderdale’s reductions will amount to less-than-daily services, the cuts to Boston, Seattle and Los Angeles will purely reduce frequencies from twice daily to daily.

The Fort Lauderdale reductions will come into play first, effective May 1, 2017, followed by Orlando on May 23. Orlando and Fort Lauderdale are among Emirates’ newest U.S. markets (with Newark being the absolute newest, with Emirates launching a 5th-freedom service to Athens in March 2017). However, because the Newark route is not included in the scope of the travel ban since it is not a nonstop flight originating in Dubai, it has likely not suffered the same weakness as the other newer markets.

Seattle and Boston will drop from two daily to one daily service on June 1 and June 2, respectively, while Los Angeles will drop from two daily to one daily on July 1. Seattle and Boston are currently operated by 777-300ERs, while Los Angeles is operated on Airbus A380-800s.

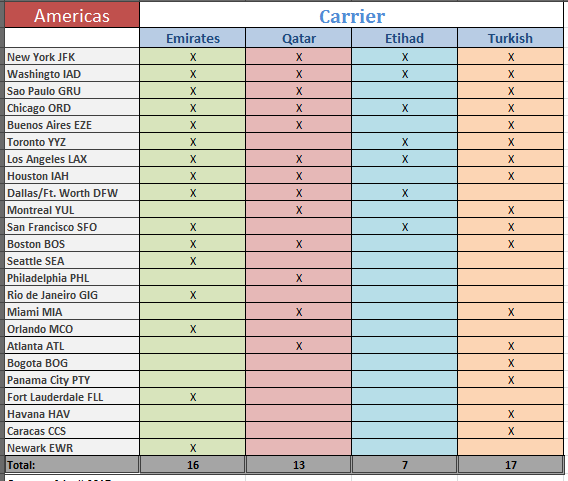

Emirates is the largest carrier to the U.S. that has been impacted by the travel ban, so it is logical that it would be the first to announce reductions in service in wake of weakened demand. The resulting effect that this will have on its schedule will be a drop from 126 weekly frequencies to 101 weekly frequencies to U.S. markets. Overall weekly seat capacity will decline from nearly 53,800 one-way seats to 43,300 one-way seats between April 2017 and July 2017, which amounts to an 18% drop (approximately).

Will Emirates Explore Long-Haul Growth Outside of the U.S.?

Emirates has focused most of its expansion within the ultra-long haul space in the United States over the past few years, and maintained steady capacity to Latin America and Canada. It is unable to add additional frequencies to Canadian airports due to bilateral limitations and Latin America has been weak, particularly in Brazil. Plans to launch Panama City in March 2016 were ultimately canceled prior to launch. However, the Latin American market is recovering and Emirates may be enticed to revisit growth opportunities in the Western Hemisphere aside from the U.S.

Turkish Airlines has expanded into Latin America, adding Bogota, Panama City, Havana and Caracas within the past few years. However, Turkish is aided by geography in that it is capable of flying an Airbus A330-200 without taking a payload hit from its Istanbul hub to the Caribbean and Northern Latin America. Emirates’ smallest fleet type – the 777-200LR – is a high-fuel consuming vessel and presents a significant risk to launching new markets that would constitute ultra long-haul flying.

Emirates is also hindered by the modicum of external partnerships it currently has in Latin America. While it has a reciprocal agreement with Gol, its competitors, namely Qatar and Turkish Airlines, are bolstered by their memberships in the OneWorld and Star Alliances, respectively. Qatar Airways, in particular, has stated ambitions to serve markets as far west as Santiago, Chile, aided by the hub presence of LATAM Chile and its feeder network beyond to Peru, Argentina and so forth.

Lack of Fleet Versatility is a Challenge for Emirates to Address

With the removal of capacity from the United States, Emirates must contend with the hindrances posed by its fleet strategy – in that it only possesses long-haul, widebody aircraft comprised of 777s and Airbus A380s. With the extra frames that will be pulled from the U.S., Emirates must re-deploy this capacity to existing markets or use them to replace older variants within its fleet.

Even still, the inability to lever a smaller aircraft variant, such as a Middle Of Market (MoM) airframe that seats between 150-200 passengers, or even an available 787 or Airbus A350 series, puts Emirates at a competitive disadvantage relative to its peers. Emirates does not have either the 787 nor the A350 in its order pipeline; rather, it has chosen to continue receiving Airbus A380-800s (48 are on order in addition to 94 in service) as well as 777-300ERs. It will, however, be receiving the 777-8 and 777-9 series aircraft, although these deliveries are not expected to begin until 2020.

In summary, Emirates will continue to face short-term challenges in markets where politically-influenced decisions take a hit on passenger bookings. This, combined with the lack of flexibility in fleet arrangements, will only magnify a longer-term issue that Emirates has not been able to address. Emirates is confident that the market will recover and demand will pick up, but it cannot afford to rest on any laurels given the sensitivity surrounding the electronics ban in one of its largest outbound markets. Presumably, with those restrictions in place until the fall of 2017, as well as the unpredictable nature of the current Administration, there are too many outliers to rule out at this point.