After five years of leaning out its long-haul network, Aer Lingus is back on the market and ready to expand its global reach after announcing major expansion plans across the Atlantic from Dublin and Shannon last week to the U.S. and Canada.

As part of its new network initiatives, EI plans to resume 5-weekly services to San Francisco from its Dublin hub, commencing on April 2, 2014, and a new daily service from Dublin to Toronto commencing on April 21, 2014.

In addition, Aer Lingus will be adding transatlantic capacity out of its Western Ireland base at Shannon airport by converting its Boston and New York JFK routes to SNN from summer-only to year-round. While EI will once again deploy the Airbus A330-200 on the resumed SFO route, it is toying with a new strategy of operating a transatlantic 757s on the new Toronto route, as well as the 5-weekly SNN-BOS/JFK routes.

Two of the 757s will be wet-leased from ASL Aviation Group’s Irish airline Air Contractors and based at Shannon to operate the JFK and BOS legs, and one will be based at DUB to operate the new route to Toronto. Seating configuration will entail 12 premium seats and 165 main cabin seats. Replacing older Airbus A330s variants traditionally used on the SNN to BOS/JFK routes with 757s will help improve the economics on these routes and enable EI to operate them year-round at a higher frequency.

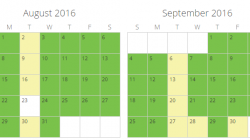

The new 757-operated Boston – Shannon flight will go live on January 20, 2014, and the JFK-Shannon flight will commence on March 30, 2014. Both routes will operate year-round, 5 times weekly (although it appears BOS-SNN will increase to daily in March 2014 for the summer period). Current schedules in Innovata display JFK/BOS-SNN routes operating 3-4 weekly in the off-periods with temporary suspensions common in the winter months between January and March.

The new schedules are as follows, according to airlineroute.net:

Dublin – San Francisco (starts 02APR14)

EI147 DUB1220 – 1520SFO 332 x24

EI146 SFO1720 – 1135+1DUB 332 x24

Dublin – Toronto (starts 21APR14)

EI129 DUB1400 – 1620YYZ 757 D

EI128 YYZ1750 – 0520+1DUB 757 D

Shannon – Boston (eff 20JAN14)

EI135 SNN1330 – 1530BOS 757 x26

EI134 BOS1920 – 0610+1SNN 757 x26

Shannon – New York JFK (eff 30MAR)

EI111 SNN1220 – 1440JFK 757 x26

EI110 JFK1820 – 0600+1SNN 757 x26

With these additions in place, Aer Lingus’ transatlantic network should look like this by April 2014

Aer Lingus has formerly served both the U.S. West Coast and Canada in recent years. While EI is new to Toronto, the carrier previously operated a 2-weekly nonstop flight from Shannon to Montreal back in the late 70’s and early 80s, with the service continuing onto Chicago from YMX.

San Francisco, on the other hand, saw Aer Lingus metal for two years between 2007 and 2009. Service was dropped in October ’09 with the cessation of 4-weekly services to SF. The schedule featured an earlier departure from DUB and an earlier departure from SF on the return.

Aer Lingus fall 2009 schedule to SFO:

EI147 DUB0950 – 1250SFO 332 x246

EI146 SFO1500 – 0915+1DUB 332 x246

The pull-down at SF was part of a broader network rationalization from Aer Lingus in wake of the global economic downturn, as the carrier dramatically reduced its long-haul network from serving 8 long-haul destinations to 4. At its peak in 2007, Aer Lingus operated Airbus A330-200/300 series aircrafts to 7 U.S. destinations and 1 Middle East destination, with Dubai serving as its sole non-U.S. route to the United Arab Emirates.

The Dubai flight became EI’s first long-haul casualty in March 2008 due to escalating oil prices and low-yields, although the termination eventually paved way for Emirates to enter the Dublin-Dubai market soon thereafter, which has been a strong performer since day one. Arguably, Emirates was better suited to serve this route given its powerful connecting hub on the Dubai end, which creates higher traffic volumes. Noticeably, a few short months after introducing a 777-200ER on the Dublin to Dubai route, Emirates quickly upgauged to a much higher-density 777-300ER.

Soon thereafter, EI announced that it was pulling out of LAX after years of continued service. Although no specific reason was cited to blame the route cancellation, likely factors included oil prices, weakening economy, and cannibalization from the newly-opened SFO route the year prior.

It was a downward spiral from there. The following spring, Aer Lingus announced plans to drop its Chicago O’Hare to Shannon nonstop, after 43 years of on/off flying between the two. A few weeks later, Aer Lingus pulled the plug on its San Francisco – Dublin and Washington Dulles – Dublin nonstops.

Load factors appeared to be mixed on the DUB-SFO route prior to termination, with numbers reaching the 90 percentiles in summer months and dropping as low as sub 60 percent during winter periods. Chicago to Shannon was also highly variable, with numbers as low as 30% in March and peaking at 71% in July. Numbers for Washington Dulles were more consistent, albeit marginal, ranging betweeen 60 and 70% throughout the year.

That left a mere six routes to the U.S: Dublin to Boston, Chicago, New York and Orlando, and Shannon to Boston and New York. Aer Lingus also experimented with a Joint-Venture agreement flight with United flying between Washington Dulles and Madrid, but this was eventually pulled down in October 2012, and the picture has remained the same until today. Average load factors on IAD to MAD would suffer in winter months and peak again during the summer, indicating it was, much like other routes to Ireland, unsustainable throughout part of the year.

In June 2013, rumors began circulating for a few weeks concerning the eventual return of a San Francisco – Dublin nonstop link. Initially, speculation commenced concerning the possibility of a United-operated 787 re-opening up the route. However, this seemed dubious considering United’s latest pattern of behavior with regards to terms of 787 route deployment, which appears to be more focused on replacing aircraft on existing international routes (i.e. LAX-PVG, IAH-LHR, etc) rather than opening up new ones, sans for Denver-Tokyo.

Early last week, the Irish Times leaked that Aer Lingus obtained commitments of support from Apple, Google and Facebook for the resumption of SFO-DUB, given that all three companies have significant operations in Ireland, with guarantees of revenue support to sustain the flight. Aer Lingus officially opened up the route for reservations last week, followed shortly after by the more secretive, albeit welcome, announcement to open up the Toronto station.

Moreover, the codeshare agreement between Aer Lingus and United, as well as JetBlue, among others, should help EI with onward feed to US West Coast cities from SFO. Assuming that the help from the Silicon Valley area stays true, the route should perform fairly well this time around.

At Toronto, Aer Lingus is seeking to tap into the large Irish immigrant community in Ontario. The seat density on 757 will provide the right economics to fill this flight relatively easily, and outsourcing the operations will maintain a low-cost structure. Aer Lingus will compete against Air Transat and Air Canada on this route, both of which operate seasonally. Air Canada, however, is transitioning its Toronto – Dublin flight to its new leisure-focused subsidiary, Rouge.

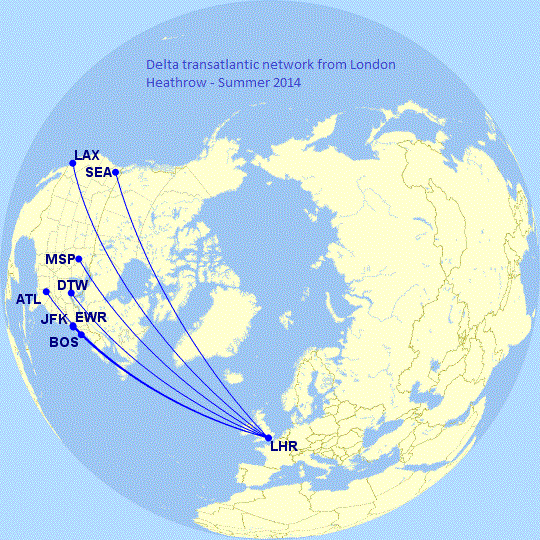

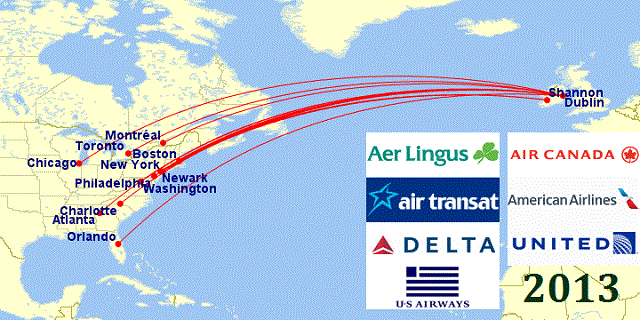

Putting all of this together, next summer, Dublin and Shannon will see a big boost in transatlantic capacity to North America. In total, 7 carriers will operate services to 12 cities. According to CAPA, Dublin airport has experienced double-digit growth in passenger movements between Dublin and North America.

Moreover, Dublin airport tends to capture a significant amount of connecting traffic from the United Kingdom transferring to points in the United States, and having US Customs and Preborder Clearance serves as a major advantage to DUB, as it further seeks to become “an alternative airport to Heathrow.”

The map below displays current North America to Ireland operations for Summer 2013, split among 7 carriers. Note: United’s recently-launched Chicago to Shannon flight not pictured.

If successful, Aer Lingus’ new growth plans in North America will bode a cautiously optimistic outlook for resurgence to its glory days of offering a large number of seats across the Atlantic from Ireland.