From the desk of the Devil’s Advocate…

When opening a new credit card, a big selling point is the waived first year annual fee. The banks hope you’ll like the card well enough to hang onto it for the second year and beyond, paying an annual fee over and over again for the privilege of ownership.

Often their gamble proves correct. When the first year fee waiver expires, normal people tend to forget to cancel the card, or they simply shrug and pay the fee because they don’t realize there might be other options. Us wiser folks in the miles and points community make a retention call and attempt to get the annual fee waived for another year. But that doesn’t always do the trick and sometimes we have to decide if it’s worth paying the fee to keep the card.

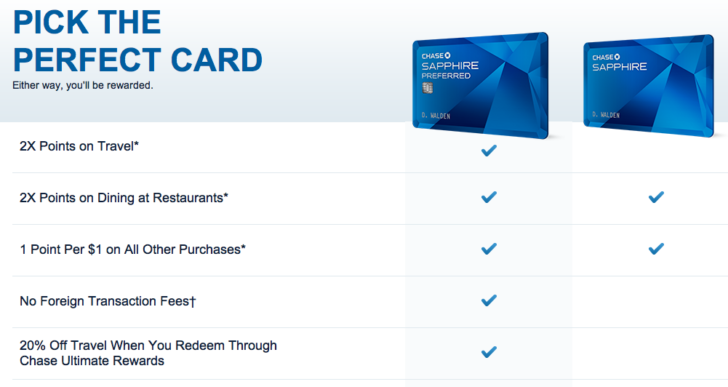

Conventional Wisdomers frequently argue that the Chase Sapphire Preferred is a card worth paying $95 to hang onto. The category bonuses, the argument goes, along with the access to transfer partners make this one card worth its fee.

But if you sit down and do the math, is that true?

What are we getting for our annual $95? How much do we have to spend over a year to make it worth paying? What might we get putting that spend elsewhere? Are the other features of the card truly worth the extra money?

Should we ever be paying an annual fee?

How much spend is needed to offset the fee?

Let’s do some basic math using the Chase Sapphire Preferred as our example since it’s a popular card and most reports indicate it’s rare to be able to get the second year fee waived on it via a retention call (YMMV as always). That means we’ll need to acquire at least $95 in Ultimate Rewards points via spending on the card just to get back to even money.

There’s many ways to value points, but most people value Ultimate Rewards somewhere between 1.5 and 2.2 cents per point. Scott’s most recent Hack My Trip post on the subject last November pegged the value of Ultimate Rewards points at 1.8 cents per point. I think that’s a fair estimate, so we’ll go with that. Also, Scott is my boss, so we’ll go with that.

Using that 1.8 cent per point valuation, without exploiting any bonus categories we’d have to spend roughly $5,277 to earn $95 worth of UR points. Keep in mind that’s just to get back to even — we’re effectively buying those first 5,277 points at the same price we expect to get for them.

Now, some would argue $5,277 isn’t that much to spend in a year. Picking up one $500 gift card at CVS each month and unloading it to Bluebird would do it. No big deal, right?

Except there are fees associated with buying those gift cards. The $500 flavor at CVS is $4.95 per card, so if we did 12 of those a year, we’re adding nearly $60 more to our costs. To offset that $60, we’d need to acquire an additional 3,333 in Ultimate Rewards points. But if we spent an additional $3,333 via gift cards, that’d cost us another $30 in fees, which would also have to be offset. And so on and so on and so on…

We could instead cover that original $5,277 through normal everyday spend, which wouldn’t cost us anything in fees. In that case we’d also likely be able to mix in some bonus spend. Maybe we could even make all of our Sapphire spend solely in the travel and dining bonus categories. That would effectively bring our required spend down to $2,638 for the year. Not too terrible.

Except if we downgraded to a simple Chase Sapphire non-preferred card (or what I like to call the unPreferred Sapphire) we get to keep our 2x dining multiplier, spend that $2,638, and not pay any annual fee at all.

So what we’re really saying is we’d have to spend $2,638 in just the travel bonus category to make it worth paying the annual fee. OK, that’s feasible, if you pay for that much travel in the normal course of a year. Hopefully you’re normally traveling on points and keeping your travel spend to a minimum in the first place. Plus you may already have another card with an equal or better travel category bonus (of which there are several) so you’re sacrificing points in another program just to earn back that annual fee.

In other words, you can do it… but only at the cost of something else.

There’s always the other card features, but…

The Sapphire Preferred has several other valuable benefits… might they be worth at least some portion of the annual fee?

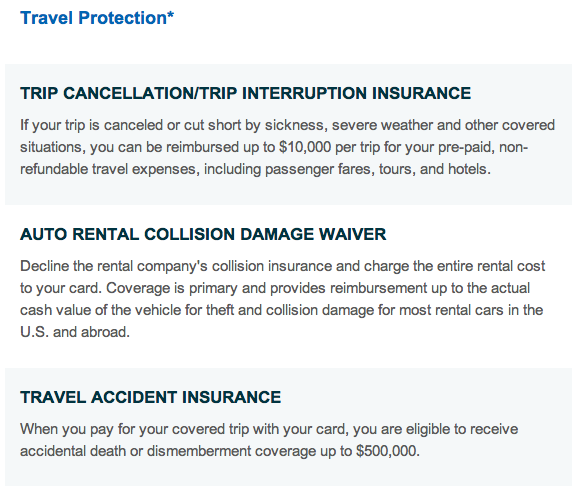

Well, many of those benefits — no foreign transaction fees, rental car insurance, warranty protection — are available on a number of other cards for which the annual fee is either less than $95 or easier to get waived.

But the Chase Sapphire Preferred has one special benefit not available on most other cards. Mainly, it’s a premium Chase card. That’s important because we need a premium card to access Chase’s airline and hotel travel partners. Otherwise if we only have non-premium cards like the aforementioned unPreferred Chase Sapphire or the Chase Freedom, we’ll be limited to redeeming only for cash back or gift cards or various other less rewarding redemptions.

However, there’s three ways to get around this without a Sapphire Preferred…

1. If you have a Chase Ink Bold or Chase Ink Plus, you’d have access to those same transfer partners. Yes, these are business cards, so you’d need to demonstrate some sort of business, even if it’s a new one. But a big advantage of the Ink cards is more category bonuses, including the extremely powerful 5x office supply category. On top of that, retention offers to offset the annual fee on Ink cards are much more common than on the Sapphire Preferred.

2. If you have a spouse or domestic partner, you can transfer Ultimate Rewards points to their account and they can get a Sapphire Preferred with a waived first year annual fee while you don’t have one.

3. As a last resort, if you’re not planning to make a points transfer anytime soon, it might be worth downgrading your Sapphire Preferred to a no-fee Chase card to hang onto your UR points, then down the line applying for a new Sapphire Preferred (or just upgrading back to it again) when you’re ready to make the transfer. Even if you’re not eligible for another bonus offer, at least you’ve put off paying the annual fee until you absolutely needed to pay it.

Another bonus down the line?

Of course, another bonus to closing or downgrading a card instead of paying the annual fee is just that… another bonus. Chase has been toying with the terms and conditions on their cards lately (and not in our favor) so churning the Sapphire Preferred may or may not be possible. But there have been reports that in some cases Chase will allow customers to be eligible for a new bonus offer every 24 months. So instead of paying $95, you can wait it out with one of the above options and then start all over again.

In fact, since each time you get a new Sapphire Preferred you’re already getting the first year annual fee waived, in order to avoid ever paying an annual fee you’d really only have to go every other year without one.

What about your credit report? Wouldn’t having a bunch of credit card accounts being opened and then closed hurt your overall credit score? Not really. Any closed accounts will continue to age on your credit report for 10 years after they’ve been closed. Note that some FAKO credit scores (such as Credit Karma and Credit Sesame) don’t include closed accounts, but the FICO scoring model does and it’s the one that counts.

But if you’re truly bothered by a bunch of closed accounts, then don’t close your Sapphire Preferred — simply convert it. Make it into a Freedom card. Or an unPreferred Sapphire. Hang onto it as a no annual fee card for another year or two until you’re comfortable closing it.

Just don’t feel that you should be paying for the privilege of keeping a card you don’t really need.

The Devil’s Advocate says think very hard about whether you need that second year.

Not all of these solutions would work for everyone, but the point I’m making is that one of these solutions will work for most people, and one is all you need to avoid the annual fee.

I also don’t mean to be picking on the Chase Sapphire Preferred — it just happens to be a card I often see being touted as worth paying for. But the same analysis we did for the Sapphire Preferred holds true for the annual fee calculation on any card in our wallets (or our Apple Pay). Yes, there’s benefits to each and every card. But in the great majority of cases there’s other free options, and you’d have to be giving that card some pretty hefty use in order to justify paying its annual fee.

Personally I have not paid a single annual fee in the last two years unless it was offset by a retention offer or some sort of annual reward (such as the 40,000 Gold Points that are automatically awarded for each renewal year of the Club Carlson cards). Maybe at some point there’ll be a card that I calculate is worth paying for without any sort of enticement. But I haven’t seen it yet.

If you’ve really done the math, most likely you haven’t seen it yet either.

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by sending an email to dvlsadvcate@gmail.com.