In the wake of Singapore Airlines’ recently-announced new in-flight premium product rollout, which Matthew discusses at length in his post last week, Delta Air Lines has been more vocal about its plans to boost its product and image in the Asia Pacific region, hoping that near-term investments will provide satisfying ROI in the long-run.

Delta is currently the #2 carrier ranked in terms of weekly seat offerings between the US and Asia-Pacific, behind #1 carrier United and #3 carrier Korean Air. Only two other US-based airlines offer nonstop service between the two regions: American Airlines (#7) and Hawaiian Airlines (#8), according to CAPA.

Delta wants to overturn spotty track record in Asia for once and for all

Historically, Delta’s track record in the Asia-Pacific region has produced lukewarm end results, and has largely lacked consistent strategic direction. Tracing back to the 1980’s, Delta relied on MD-11 operations to serve Japan, Korea, Taiwan and Thailand from its then-Portland hub, which was eventually pulled-down in 2001. The high-C/ASM MD-11, combined with the Asian Economic Crisis of 1998, created unfavorable market conditions to maintain these transpacific routes.

In the aftermath, Delta neglected to order a widebody fleet variant that would allow it to re-enter the Asia-Pacific region without payload restrictions, something that it had suffered from with the MD-11. Still, it was timely that Delta partnered with Korean Air in formulating the SkyTeam alliance in 2000, but even with that partnership in place, Delta and Korean have yet to move closer in terms of formulating a joint-venture agreement or deeper relationship on transpacific routes, and that situation remains the same today. This contrasts significantly with rivals American and United, who have both been proactive in forming joint-venture relationships with their Asian alliance partners Japan Airlines (JAL) and All Nippon Airlines (ANA), respectively.

Delta maintained a sole link to Tokyo Narita from its Atlanta hub after dismantling PDX, but experimentations to serve China and Korea nonstop from ATL in the 2000’s were short-lived. Delta also attempted nonstop USA-India routes from its Atlanta and JFK hubs to Mumbai, neither of which turned out to be fruitful. The data points seemed to indicate that none of Delta’s pre-merger hubs were well-positioned to support Asian flights profitably.

The Northwest merger in 2008, however, brought a major panacea to bolstering Delta’s absence in Asia. Northwest’s Asian operations inherited by Delta were heavily Tokyo-centric, but this also allowed Delta to acquire presences in markets such as Singapore, Hong Kong, Manila, Bangkok, Taipei and mainland China, as well as Guam, Hawaii and Saipan via fifth-freedom services.

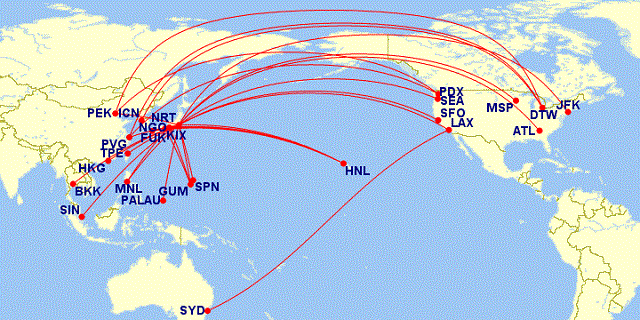

Delta systemwide transpacific network as of July 2013. Note: JV routes not shown, such as Air France operated LAX-Papeete, Tahiti and Virgin Australia-operated LAX-Melbourne and LAX-Brisbane, Australia. (source: Delta.com)

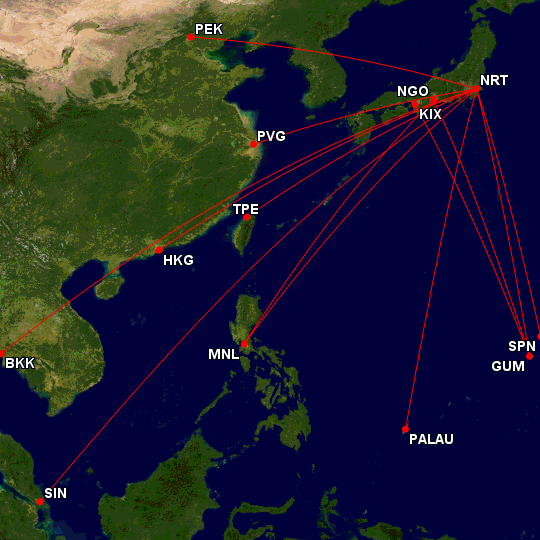

Delta intra-Asia route network as well as “beach island” destinations, inherited from Northwest Airlines merger in 2008 (source: Delta.com)

However, the Northwest Asian route inheritances also contained plenty of baggage as well, particularly pertaining to brand perception. Northwest was generally viewed by travelers as the inferior carrier option compared to its Asian rivals, known for catering to the budget-conscious traveler with a dismal product. According to CAPA, Northwest’s Asia-Pacific yields were often the lowest and dragged down its systemwide average. I was pretty surprised upon making this discovery, as I had always thought that NWA’s Asian network was publicly perceived to be one of its most prized assets.

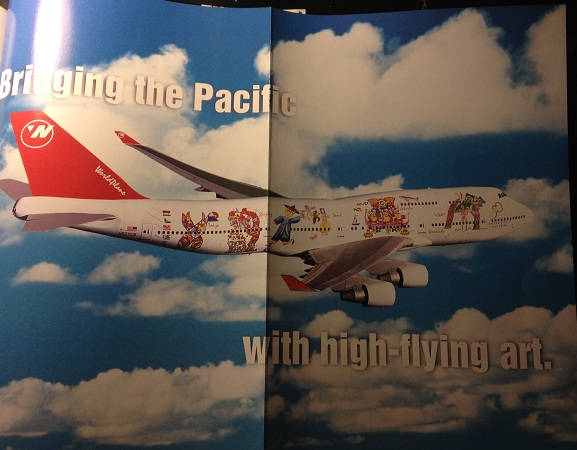

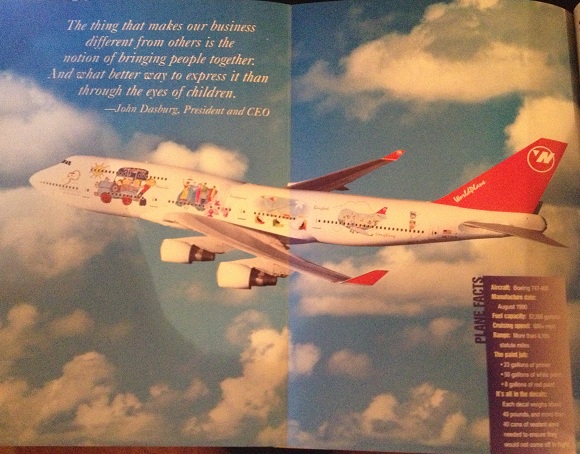

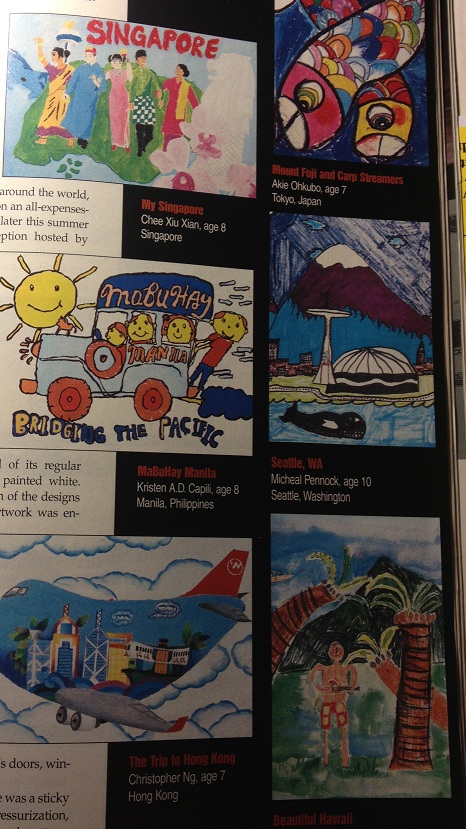

A NWA World Traveler in-flight magazine edition from May 1997 commemorating the carrier’s 50 years of service to Asia.

In that light, once it had acquired Northwest, Delta immediately set to work in improving the brand by upgrading its aging 747-400 cabins and 767-300 cabins used on transpacific flights by installing fully flat-bed seats in its BusinessElite cabins and retrofitting all seats with personal TV-screens. The improvements paid off quickly by helping to push Delta’s transpacific yields up in the late 2000’s post-merger.

However, another added risk-factor of the NWA APAC inheritance was, again, the Japan-centric nature of the hub. 2011 presented a major challenge due to the Japanese earthquake and the depreciation of the Yen. It was also around this time that Delta received coveted slots to operate flights into Tokyo’s Haneda airport – located much closer to Tokyo’s central business district over the more distant Narita airport. Unfortunately, poor departure and arrival times caused load factors and yields on Delta’s Haneda to Detroit and Haneda to LAX flights to plummet so much that these routes were suspended temporarily.

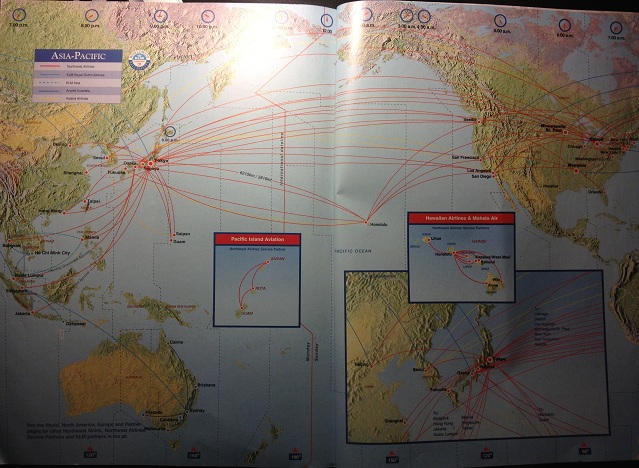

NWA TPAC network from May 1997 shows that the route structure has remained largely consistent throughout the years, with Tokyo Narita serving as the primary “scissors hub” connecting traffic flows between US gateways and major Asian cities. Notably, Delta has restored many routes shown here that were pulled down, such as from Honolulu to Fukuoka and Detroit to Beijing. Others, such as Los Angeles to Osaka and Chicago O’Hare to Tokyo Narita, have been pulled down.

Strategic shift: new focus on product enhancements and Seattle as TPAC gateway

But Delta has since realized that a forward-viewing approach is the remedy needed to bolster its image in Asia. The market has huge potential, as a high-growth region, and Delta has a well-primed hub on the US West Coast in Seattle to link underserved regions and drive up margins, particularly as the transatlantic sector continues to lag in wake of the Eurozone crisis.

Of course, the challenge is luring high-yielding North America – Japan/Asia traffic away from the likes of JAL and ANA, which continue to draw from a very loyal passenger base. However, Delta can tout that its long-haul business class offers 180-degree, lie-flat seats, with all aisle-access universally across its fleet, something the likes of ANA and JAL cannot claim.

The real investments, however, hail from the soft products side. Delta wants to take a “go global, act local” approach to take on cultural sensitivities and increase customer satisfaction in the areas of catering, IFE and cabin crew interaction. For instance, Delta is working with new vendors to incorporate enhanced ingredients in its transpacific meal service, making small, but worthwhile tweaks such as preparing rice onboard tailored towards Japanese tastes. Delta also intends to maximize its local In-Flight Entertainment content to offer more options in Japanese, Chinese, Korean and Hindi.

There is also enormous potential in continuing to leverage Seattle as its dominant springboard for transpacific Asia flights. The scenario is actually quite interesting and a testament to how market conditions can rapidly evolve within a short period of time. After the merger with Northwest culminated, and in wake of the Atlanta to Shanghai and Seoul failures, it was believed that Detroit served as the more viable gateway to Asia, as its geography allowed it to capture a greater flow of connecting traffic drawing from the South, Northeast, Midwest and Central plains versus ATL.

Currently, Delta’s Detroit hub provides the largest number of weekly seats to Asia with roughly 13,000 seats, with nonstop services to Tokyo Narita, Nagoya, Shanghai, Beijing and Seoul Incheon.

However, it is possible that DTW may not hold this distinction for long, and that Seattle may eventually eclipse it as Delta’s #1 US mainland gateway offering the largest number of transpacific weekly seats. Seattle currently holds the #2 position offering roughly 9,000 weekly seats, with nonstop services to Tokyo Narita, Tokyo Haneda (after recently receiving DOT approval to move this route from Detroit), Beijing, Osaka and Shanghai.

The intruiging breakdown of Detroit vs. Seattle to Asia is further intensified by the fact that the Seattle to Asia market is fragmented among several competitors, whereas Delta holds a monopoly on Detroit to Asia. In Seattle, Delta competes against United, Asiana, EVA Air, Korean Air, Hainan Airlines, All Nippon Airways and China Airlines for seats to Japan, China, Korea and Taiwan. Delta is the marketshare leader in the region, but holding a mere 32% of seats, followed next by United at 15.3%.

Still, the growth of Delta’s Asian operations at Seattle seems to indicate that the yields are stronger out of the Pacific Northwest over Michigan. Delta recently exited the nonstop Detroit to Hong Kong market in August 2012, citing high fuel costs of operating this ultra long-haul route on a 777-200LR. However, according to CAPA, Deltas’s VP of Asia Pacific Vinay Dube has hinted that the return of a nonstop route to Hong Kong may be on the near horizon, except this time, it will hail from a different US city, and Seattle seems like a likelier candidate this time around.

While Delta maintains a link from Hong Kong to Tokyo Narita, there is probably greater market potential in linking Hong Kong nonstop back to the US mainland, rather than route over Narita. The same logic could likely be applied to Taiwan in operating a nonstop service to Taipei as well. Markets that are unreachable nonstop from the US due to distance and economic conditions, such as Singapore, Bangkok and Manila, should continue to be linked to Narita.

Although Delta does not consider Seattle to be anything beyond a mere focus city, compared to Detroit, which alternates with Minneapolis/St. Paul to be Delta’s #2/3 hub in the system, Seattle is arguably the most logical choice to pin future growth. It will likely come in small increments, with no more than 1-2 major routes announced each year, but can certainly support staged capacity additions with relative success.

Delta is not interested in serving secondary Chinese cities in the near-term

Moreover, Delta’s strategy for mainland China will differ from that of United’s, the latter of which is opting in the future to deploy newly acquired 787 on new routes to interior China, serving secondary cities such as Shenyang, Dalian, Chongqing etc. from its SFO hub on a less-than-daily basis. The 787 is optimally designed to serve these “thinner” routes profitably, but Delta opted to postpone 787 deliveries ordered by Northwest, prior to the merger. As such, Delta will lack the necessary aircrafts to serve such regions, but instead, Delta prefers to rely on its local SkyTeam partners in China – China Southern and China Eastern – to fill this void instead.

It’s a less-risky strategy that may provide dividends for Delta and SkyTeam, or could later on be viewed as a decision that resulted in missing the boat (a story which will only be told depending on the success of United’s 787 ventures in China, which is still far in an embryonic stage).

Still, this cautious approach is understandable given all of the volatility Delta has experienced in Asia since the 1980’s. Indeed, a much more conservative approach that entails strengthening the existing product, improving brand image and awareness, leveraging SkyTeam partners, and growing the network slowly, may be the better alternative path rather than resorting to the “Delta Darboard” style of the past. This is a colloquial, tongue-in-cheek phrasing often deigned to Delta for its habitual pattern of launching new routes only to pull them down a short while later, reflecting shortsighted strategic network planning behavior.

There will likely continue to be a relatively large gap between Delta and #1 United in the near-term future in terms of US-Pacific seat volume, as United, similar to Delta, has an extensive intra-Asia network, along with a hub at Guam inherited from Continental Micronesia. Moreover, Delta’s west coast gateway at Seattle will always play second fiddle to what United has at San Francisco. However, bigger is not always better, and if the cards are played out right, Delta will continue to ride an upward-trending wave that continues to bring its Asia-Pacific brand into the 21st century.

And, most certainly, Delta and SkyTeam need not fear any competitive threats from American Airlines and OneWorld in the Asia-Pacific region, which should be a temporary relief in the interim.

More images from NWA’s World Traveler May 1997 issue on Northwest’s transpacific services: