Chase has some of the best travel rewards cards available. That is partly for its partnerships with strong loyalty programs but also for its Ultimate Rewards program, which ranks, in my opinion, as the most valuable loyalty currency out there.

Ultimate Rewards earns this respect in two ways: First, points are easy to transfer and use with many high value loyalty programs like United, Hyatt, Southwest Airlines, Marriott, and British Airways’ Avios. Second, it is remarkably easy to accumulate Ultimate Rewards points and even combine them from multiple accounts, making high-cost redemptions easier to obtain. I’ve also before that various cards that earn Ultimate Rewards often make more sense than brand-specific cards like the MileagePlus Explorer or the Southwest Airlines Rapid Rewards cards.

Here are the five steps I use to earn the most Ultimate Rewards points. Since this is a currency that can only be earned with a credit card, not by flying or staying at hotels, you will need to apply for at least one of these cards if you haven’t already.

(1) Get the Chase Sapphire Preferred® Card

This credit card earns 2 points for every dollar spent on any kind of travel, including flights, hotels, rentals — even parking meters. You also earn 2 points per dollar on restaurants. Those two categories cover a good chunk of my annual spend, and I like that I don’t have to worry about one card for airlines or another for hotels.

You also get a bonus 7% dividend, so make that 2.14 points per dollar on travel and restaurants and 1.07 points per dollar on everything else. This is why I think the earnings rate is superior to the Explorer or Rapid Rewards cards, since they earn only 2 miles/points and only with their respective brands. You can always transfer Ultimate Rewards points to these programs instantly.

Customer service is amazing, and I think all these benefits are well worth the $95 annual fee. Fortunately, the current offer waives the fee for the first year and also provides 40,000 bonus points after spending $3,000 in the first 3 months.

(2) Get the Chase Freedom® Visa

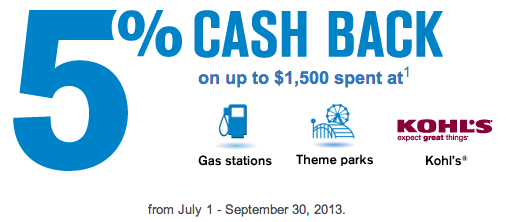

You have to wait at least a couple months between applications with Chase, but I think this is a good one to add to the rotation for three reasons. First, it has no annual fee, so it you can keep it for life and build a strong credit history. Second, it also earns Ultimate Rewards points, which are credited to the same account balance as your Sapphire Preferred. Third, there are quarterly promotions that allow you to earn up to 24,000 bonus points per year.

Chase just opened registration for the most recent bonus period, from July 1 to September 30, 2013. You’ll get 5 points per dollar instead of the usual 1 point per dollar on up to $1,500 in purchases at gas stations, theme parks, and Kohl’s. Past bonus categories have included grocery stores, theaters, and Amazon.com. These are things that don’t normally earn a bonus using the Sapphire Preferred (above) or Ink Bold/Ink Plus (below).

The current sign-up bonus for this card is 10,000 Ultimate Rewards points after spending $500 in the first 3 months. This is usually advertised as $100 because customers who only carry the Freedom card can only redeem their points for cash. Carrying both the Sapphire Preferred and the Freedom cards allows you to use points for more valuable travel redemptions.

(3) Get the Chase Ink Bold® Business Card and Ink Plus® Business Card

I combined these two because the cards are very similar, yet you are allowed to apply for both and get two bonuses. Ink Bold is a charge card, and Ink Plus is a credit card. You can usually apply for the other version at a later date with a plausible excuse. For example, I have an Ink Bold but plan to apply for the Ink Plus in order to get the added flexibility to pay off balances over time. And while generally you may not apply for two consumer or two business cards at once, you are allowed to apply for one consumer card and one business card on the same day.

The catch here is that not everyone has a small business. Fortunately, those who do have one don’t need to be very formal to qualify. When operating as a sole proprietorship, I have applied for multiple business cards by using the name of my business along and my Social Security Number. It’s common that you have to call the bank to answer some questions about your business and its income, but just tell the truth. I didn’t have much income on my first application, so they made me transfer some of my available credit from a consumer card to the new business card.

Once you have an Ink Bold or Ink Plus, you can earn 5 points per dollar at office supply stores, cellular phone service, landline, Internet, and cable TV (up to $50,000 per year or 250,000 points). You also earn 2 points per dollar at gas stations and hotels (up to $50,000 per year or 100,000 points). I’ve found Office Depot is an excellent source for a variety of gift cards I can use at other retailers.

Chase is offering 50,000 points when you open a new Ink Bold or Ink Plus card account and spend $5,000 in the first 3 months. There is a $95 annual fee, but the fee is waived for the first year.

(4) Shop at the Ultimate Rewards Mall

When you log into your Ultimate Rewards account online, you’ll have the option to use their links to shop at various merchants. I’ve found this to be a very easy way to earn extra points for things I would buy anyway. You also don’t have to use a Chase credit card to make the purchase — you just need an Ultimate Rewards-associated card in order to have access to the portal.

This creates some great opportunities to double dip on your purchases. For example, I can buy $200 Nordstrom gift cards at Office Depot with no activate fee and earn 5 points per dollar. I can then use those gift cards to make a purchase from Nordstrom.com through the Ultimate Rewards mall and earn another 6 points per dollar. That’s 11 points per dollar, and since I value my points at 2 cents each, it’s like getting a 22% discount! Use evreward.com to search by retailer to compare the offers from Ultimate Rewards to other shopping portals.

(5) Combine Points with Your Spouse

Finally, just as Ultimate Rewards points are easy to transfer to other loyalty programs almost instantly, you can also transfer points between yourself and a spouse. In the past people were transferring points to all manner of people, but some accounts got shut down — mine was among them (I still have an Ink Bold and Freedom, but I am now an authorized user on Megan’s Sapphire Preferred).

Buried in the fine print was a rule that only spouses could transfer points even if it was loosely enforced in the past. Maybe I’ll try transferring Megan’s remaining points to my account after we’re married. Though I don’t want anyone to get their accounts shut down like mine was, this transfer opportunity remains extremely valuable.

For example, I have Premier 1K status with United and Diamond status with Hyatt. It is far better for me to book airline and hotel awards than for Megan to do the same because my elite benefits and privileges (like upgrades and free changes) will apply. So she transferred her points to me, and then I booked the award. It will also let us pool points to get more expensive awards.

Conclusion

Now that know how many opportunities exist, I hope you’ll realize the tremendous value of a program like Ultimate Rewards. I’ve earned over 500,000 points in the past two years without trying very hard, and others have done much better. We used them to book trips to visit family as well as our own honeymoon.