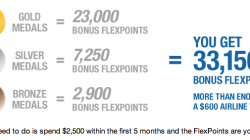

Last summer, US Bank offered a much higher sign-up bonus for its FlexPerks Travel Rewards credit card tied to the number of medals the United States won at the summer Olympics. FlexPerks points, like some other bank points, can be redeemed at a fixed value toward almost any flight, allowing you to still earn miles and upgrades. The promotion then was worth $600, but I showed how to spend just a little more to turn it into an $800 offer.

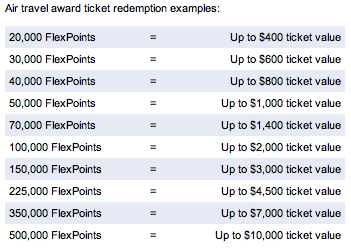

You can get up to 2 cents in value for every point, but the challenge is that awards are priced in tiers. The lowest award is 20,000 FlexPoints and allows you to buy a ticket worth up to $400. That means you leave money on the table if your ticket would normally cost less.

If your ticket costs more, you need to buy up to a more expensive award. The next tier is 30,000 FlexPoints for a ticket worth up to $600. See the rest of the table below:

The current FlexPerks sign-up bonus is for 17,500 points after spending $2,500 within 5 months. That’s only $500 a month, and at a rate of one FlexPoint per dollar is a total of 20,000 FlexPoints – enough for a $400 award.

I still stand by much of what I wrote at that time, so I encourage you to go back and read that post. FlexPoints are potentially the most valuable points currency available for booking tickets that still earn miles.

Even the Wells Fargo Rewards points I complained about last month were worth only 1.75 cents each. ThankYou points are worth only 1.33 cents. Ultimate Rewards points are worth 1.2 cents. Membership Rewards points are worth 1 cent (1.2 cents if earned with an American Express Business Platinum Card). Getting 2 cents for every FlexPoint is a great deal if you can find the right flight.

A bonus perk is that whenever you use your FlexPoints to book a ticket, you’ll also get a $25 credit for fees like checked baggage and in-flight purchases. I already get free checked baggage, so that’s a lot of drinks! More likely, I would try buying a small gift card from the same airline and see if the amount gets credited (much as you can do with the American Express Platinum Card).

Charity Is Rewarding

One more thing you should know is that the US Bank FlexPerks card has a fairly simple earning structure: one FlexPoint per dollar up to $120,000 per year, and one FlexPoint per two dollars after that. But for every dollar spent on a charity, you get three FlexPoints! Amol confirmed this back at the time of the Olympics promotion.

An easy way to give money to charity is through Kiva microloans, and there is a very active Kiva community you can learn more about on MilePoint. The great thing about Kiva is that you can deposit money with a credit card and then, once the loan is repaid, you can withdraw the funds in cash.

It’s one of the more interesting ways to create “manufactured spend” that shows up on a credit card statement without really spending any money. Kiva has a repayment rate of over 98%, and you help improve people’s lives in the process.

Conclusion

FlexPoints have their faults. I dislike the tiered redemption program, and it seems unfortunate that they slow the earnings rate past a certain point. But you’re unlikely to ever reach $120,000 a year in total charges, and I think most of us who take some care to search for the right flights can find a way to maximize the value of those FlexPoints.

If you are able to float just a couple thousand dollars, you could use your card to make a loan through Kiva and earn three FlexPoints per dollar. You’ll have to pay off the card for loan #1, but once the loan is repaid you can use your card again for loan #2, and pay your credit card bill with the repaid funds from the first loan.

Loaning $10,000 a month would earn you 360,000 FlexPoints each year for a potential value of up to $7,200. You’ll probably have to start out smaller, but I hope you see the potential. Assuming a 98% repayment rate on your Kiva loans, you would really only lose $2,400 in a year to get that $7,200 in travel, and you might not lose any money at all if you get lucky with good loans.

You wouldn’t actually need to front $120,000 all at once either. This is all “manufactured spend” where you make an initial charge, withdraw the funds, and then use them to make another charge. But it’s a clever way to rack of a lot of free flights. Book tickets that earn miles in your favorite loyalty program, and you can earn even more free travel!

Links

There are both personal and business version of the FlexPerks Travel Rewards card. The personal card has an introductory annual fee of $0 and $49 each year after that. The business card has an introductory annual fee of $0 and $55 each year after that, but it can be waived if you spend $24,000 each year. If you are eligible for a business card, this might be the better offer.