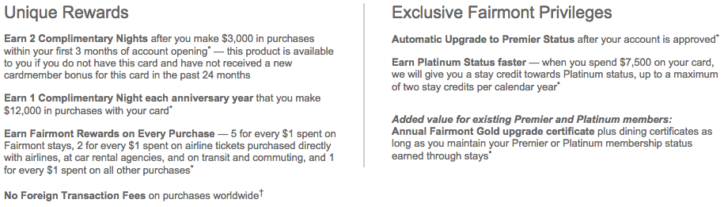

Brendan emailed me this morning to share four new benefits of the Fairmont Visa Signature credit card from Chase. This card isn’t a high priority for most travelers because one of its best benefits is the signup bonus: two free nights the first year, and another free night each additional year when you reach the minimum spend requirements.

Not many people are interested in earning “Fairmont Rewards” with every purchase since the chain has such limited reach. It’s effectively a card that people apply for and put in the sock drawer.

The new benefits don’t really change that strategy, but they do make the card much more attractive in the first place.

- Discounted air travel

- Priority Pass Select membership

- Global entry application fee credit

- Airline incidental fee credit

The last three are all benefits of the American Express Platinum Card, which has a $450 annual fee. Contrast that with the Fairmont credit card, which waives the fee for the first year; it’s only $95 after that.

It’s difficult to tell how much more valuable the card has become without knowing more specifics about these benefits, but I think even a conservative assessment can assign $70+ value to this card each year. Here are my guesses:

Discounted air travel — Little or no value. Perhaps this is access to a 5% discount on preferred partners when you book through their agents.

Priority Pass Select membership — Contrary to popular belief, this doesn’t automatically get you into the lounge for free. I once got this with my Amex Hilton Surpass card, and I still had to pay $27 per person, including myself. The Amex Platinum specifically waives the cost of the first person, and the Citi Prestige waives the first two people.

Global Entry Application fee credit — Some value here. It’s $100 to apply, and the Global Entry membership lasts five years. You may already have Global Entry, in which case you could use this for a friend or family member or to renew your own application.

Airline incidental fee credit — The jackpot. There are so many ways that people have been able to use these “credits” to get gift cards or even cash back on their American Express cards. I don’t know that Chase will be as easy, but it suggests that there are serious limitations in merchants’ ability to properly distinguish an incidental charge. I would expect a credit of $50-100 per year, enough to pay for checked bags on one or two round-trip flights.

I’ll update this post if I learn more, but this could be a potentially very lucrative card for frequent flyers!