New benefits will be coming soon to the Citi Prestige card, according to a report by The Points Guy. This card has gone through a roller coaster of sorts after several key benefits were removed (among them American Admirals Club lounge access and a higher redemption rate of 1.65 cents per point for American Airlines flights). However, it’s always maintained some love from people who continue to use it’s fourth night free benefit on hotel stay booked through Citi’s agents.

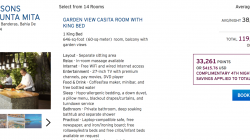

That appears to be the biggest change coming on July 23. Instead of forcing you to call in for help booking a fourth night free stay, you’ll be able to manage the entire process online. New processes also mean that you’ll receive the fourth night discount immediately on your hotel folio rather than as a statement credit at a later date.

This change isn’t actually as good as it seems on the surface. While more convenient for people who like to book travel on their own — or at least review their options — the card delivered a lot of hidden value precisely because the discount was awarded as a statement credit. There are a variety of hotels that offer their own free night benefit, so you could potentially double dip and get a discount once from the hotel and again from Citi.

There is also currently the opportunity to get reimbursed for work travel at a different rate than you ultimately play; your hotel folio might have the full amount, but the fourth night free is credited directly to your statement. (Without passing judgement on the ethics of such a situation, the point is there are plenty of people who HAVE taken advantage of this loophole.)

It appears that in the future the credit will be applied directly by the hotel, at the time of check-out, so there will be no opportunity to double dip or get reimbursed for more than you ultimately paid. By booking through what is essentially a travel portal, it also seems less likely that you’ll be able to earn points with a hotel loyalty program, though this remains to be tested.

As you can see, a lot is still unknown about how this will play out in practice.

Other so-called improvements to the card are not very meaningful:

A metal card, because apparently looks matter. I honestly find metal cards more hassle than they’re worth, and no one has ever complimented me because of one.

You’ll be able to redeem your ThankYou Rewards points directly for a cash statement credit at a rate of 1 cent per point. This is hardly competitive with the Chase Sapphire Reserve, which allows you to redeem points for 1.5 cents per point when you book travel through the Ultimate Rewards portal. There are also a variety of cards with 2% cash back rewards.

And finally, there will be a new, higher sign-up offers of 75,000 ThankYou Rewards points when you spend $7,500 in the first three months. While that’s a good offer, it’s temporary and not actually a benefit change. Credit cards revise their sign-up offers all the time. Considering past offers from competing cards like the Chase Sapphire Reserve (100,000 points at launch) and the American Express Platinum Card (routinely 100,000 points), this is simply par for the course.

None of these are reasons to change my attitude toward the card, and my wife already canceled hers last month when we realized we never used it. Admittedly, your travel circumstances may be different. I know others who have made good use of the fourth night free benefit and saved thousands of dollars every year. But that wasn’t our experience.