Sometimes playing Devil’s Advocate feels like playing Debbie Downer.

There’s been massive excitement about the introduction of the Chase Sapphire Reserve, and normally when the Conventional Wisdom is so overwhelmingly in favor of a new credit card, it’s an opportunity for me to argue that perhaps the card isn’t so great.

But in this case, I really can’t.

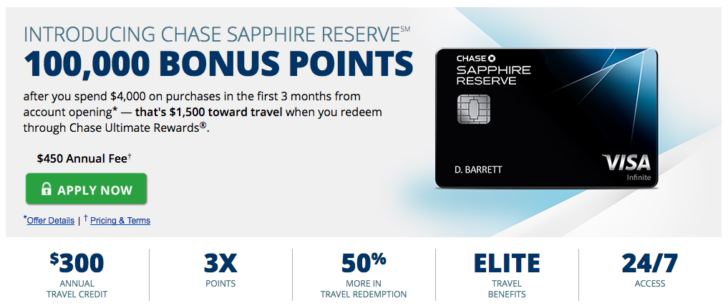

As it stands, you probably cannot beat the value of the Chase Sapphire Reserve, at least for the first year. The 100,000 point bonus along with the guaranteed 1.5 cent per point travel redemption value, plus the $300 travel credit in each calendar year means you’ll get at least $2,100 in value in exchange for the first year’s $450 annual fee. That’s a deal I simply cannot argue against and still maintain any sort of credibility (which, let’s face it, is probably already dangling by a thread to begin with).

But what about the second year? Obviously you won’t get another 100,000 bonus points or more than one $300 travel credit in the second go round, so you can expect to pay at least $150 (the $450 annual fee minus $300 travel credit) for the privilege of keeping the CSR for year #2. So is it worth keeping for that $150?

If that second year started tomorrow, I’d actually say yes, if only because the 1.5 cents per point is so valuable when combined with other Chase cards. The other perks are nice too, but that 0.25 difference between the standard 1.25 cents per point and the CSR’s 1.5 cents per point is a huge benefit. If you redeem just 60,000 Ultimate Rewards points in a year, you’ll have already made back your $150 net annual fee.

However, I suspect that by the time we get to the 2017 renewal date for the tens of thousands of cards issued in the last 10 days, the Chase Sapphire Reserve will look a lot different than it does today.

Yeah, here comes that Debbie Downer part…

That 1.5 cents per point perk is just too good.

Clearly Chase intended to make a big splash with the launch of this card, and they’ve enormously succeeded. When mainstream publications are writing articles about whether you should get the Chase Sapphire Reserve, you know Chase has done its job well.

But beyond the marketing, the real draw of the card are those oversized perks. I’ve already mentioned the 1.5 cents per point that comes with the Chase Sapphire Reserve. If you’ll recall, Citibank currently has a similar benefit on the Citi Prestige – if you have a Prestige and redeem ThankYou points on American Airlines, you get an even better 1.6 cents per point.

If you’ll also recall, Citibank just announced the complete discontinuation of that Citi Prestige benefit by next July.

Clearly it wasn’t sustainable for Citibank, and that was only with American Airlines redemptions. So how can Chase possibly be able to keep 1.5 cents per point going for all travel redemptions?

Most likely they can’t.

On top of that, the Chase Freedom Unlimited currently offers 1.5 points per dollar spent on all purchases. If you don’t have a Chase Sapphire Reserve, those points are only worth 1 cent each, making the Freedom card a basic 1.5% cash back card. That’s profitable for Chase.

But when you combine a Freedom Unlimited with a Chase Sapphire Reserve, each of those 1.5 points per dollar earned on the Freedom Unlimited are also worth 1.5 cents per point when redeemed for travel. That means the combo of those two cards effectively makes the Chase Freedom Unlimited a 2.25% cash back card on all purchases.

As it stands, this means the Freedom Unlimited is the best card on the entire credit card market. And it has no annual fee itself. Again, that is in no way sustainable if Chase intends to continue to make a profit on their credit card portfolio.

What about the rest of the CSR’s benefits?

That $300 travel credit is awfully loose right now. There are reports of everything from subway and bus passes to AirBnB and Zipcars counting as travel. At this rate I might try charging one of my many speeding tickets to the card just to see if Chase will cover it.

While the creditable categories seem to be following the old Chase Sapphire Preferred travel categories at the moment, I won’t be surprised if Chase tightens up some of that down the road.

The 3x travel category is generous, but probably not overly generous. Amex offers 3x on airlines and the Citi Premier has a 3x travel category, so I think that one probably sticks around. On the other hand, no other card gives 3x on dining purchases, so that might be on the chopping block sooner rather than later. Chase could keep the 3x travel and knock dining down to 2x without too much squawking.

Many of the other CSR benefits, such as the Priority Pass lounge membership, the Global Entry fee credit, and access to a collection of luxury hotels aren’t actually much different than the ones found on the Amex Platinum and Citi Prestige. So those might be around for the long haul, but quite frankly, none of them would be a good reason to keep the card anyway.

And since this post is focused on the idea of second year benefits, I’m not even including that 100,000 point signup bonus, which may very well not even last until the end of 2016. That’s entirely a guess, but given the amount of interest in this card, there’s not a ton of reason for Chase to keep it so high for very long. Dropping it to 75,000 bonus points wouldn’t even make a dent in the demand. Even 50,000 points would still bring in plenty of customers.

Oh, and hey, does anyone remember this card?

The Chase Sapphire Preferred was the most (overly?) promoted card on the planet just a little over a month ago. Is anyone even talking about it today? Do you think Chase is getting a ton of applications for the old Preferred card right now?

It’s impossible to believe Chase isn’t cannibalizing some of its own business with the Chase Sapphire Reserve. While the Preferred obviously carries a much more reasonable $95 annual fee, as long as the Reserve has a $300 annual travel credit, it’s really only $55 more than the Preferred. I don’t think there are too many people who would take the lesser card with so many fewer benefits for such a small difference in price.

That $300 travel credit creates a bigger gap between the high-end and mid-level cards than either Citibank ($250 travel credit) or Amex ($200 travel credit) has in their own card lineups. So unless Chase plans to start stripping down the Chase Sapphire Preferred, we can expect the Reserve is going to have to take a hit along the way.

And as long as the Preferred has a 50,000 point signup bonus, Chase is probably stuck with at least a 75,000 point bonus on the Reserve, which means we might very well see the bonus on both cards drop in the future. Citibank just rolled back the Prestige to a 40,000 point bonus, so I would not be shocked to see the Preferred have a 40,000 point bonus and the Reserve a 60,000 point bonus somewhere down the line.

The Devil’s Advocate says grab the Chase Sapphire Reserve while it’s at its best.

We don’t have any credit card affiliate links here at Travel Codex or in this post, so I’ve got no skin in this game. But my advice is this: if you’re interested in the Chase Sapphire Reserve and you’re eligible for it, get it right now. Don’t wait. Go out the front door and get in your car and… hey, okay, let me just wrap up these last few paragraphs before you go, will you?

I’m not saying Chase is going to start cutting benefits tomorrow – obviously it won’t happen that quickly. But I’d guess that if you wait too deep into 2017, you’ll find yourself with less than you’ll get for signing up today. At the very least, I’d expect the 1.5 cents per point guarantee to go away sometime late next year, or perhaps Chase will decouple points earned on other Ultimate Rewards cards from the Chase Sapphire Reserve.

And if you think Chase won’t be willing to cut benefits from this card, just remember the old Chase Freedom 10% annual point bonus for having a checking account, or the per-transaction bonus, or Sapphire Preferred’s First Friday 3x dining category. None of them are still around. When Chase wants to make cuts, they won’t hesitate. So don’t hesitate to get all the perks while you can. Just tell ’em Debbie Downer sent you.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- The Ritz-Carlton Visa Still Ain’t All That

- Even After The Citi Prestige Devaluation, Is It Still Worth Keeping?

- So Which Way Can I Be Wrong About the Hyatt Rebate Promo This Time?

Find the entire collection of Devil’s Advocate posts here.