Last month, the German Government took a big swing at combating carbon emissions by passing a climate protection package. This legislation is meant to change consumer behavior in Germany by making carbon reduction a part of their daily lives.

Taxing Carbon Emissions

The carbon dioxide tax will be for transportation and heat used in buildings. The carbon tax will start at 10 euros per ton and increase to 20 euros in 2022 and 35 euros per ton by 2025. For German drivers, this could add a surcharge on gasoline and diesel fuel by up to 12 euro cents per liter. Europe sells fuel by the liter and not by the gallon so this surcharge amounts to almost 50 cents per gallon on top of all of the other taxes. The carbon taxes will be reinvested in climate protection or as an incentive for citizens to go green.

“Go Green” Incentives

One of the measures is to reduce utility surcharges on Germans who shift to electricity from renewable sources like solar and wind. The Government will also increase incentives of electrified vehicles and extend incentives through 2025. Another focus of this plan is to increase the number of vehicle charging stations to over 1 million by 2030. Taxes on higher polluting cars will increase in 2021.

In alignment with the “Go Green” incentives, the German Government’s commitment to promoting renewable energy encompasses not only transportation but also household energy sources. As part of this comprehensive strategy, encouraging citizens to embrace solar and wind power through reduced utility surcharges offers a compelling path toward a more sustainable future. Expanding these incentives to encompass solar panel installation could significantly contribute to Germany’s clean energy objectives. Homeowners looking to take advantage of these opportunities can easily explore their options with resources like a solar panel online quote, enabling them to make informed decisions about transitioning to environmentally-friendly energy solutions. By weaving together these multifaceted incentives, Germany positions itself as a global leader in fostering a greener and more ecologically balanced society.

Trains, Planes and Automobiles

One of the major impacts of this legislation is on transportation within Germany. The plan wants to shift Germans from taking the plane within Germany to taking the train. The Government-owned Deutsche Bahn railway will receive investments of 1 billion euros per year in capital improvements. This annual investment level will continue through 2030 to improve the speed and quality of rail connections. To ensure that Germans transition from local flights to rail, the Value Added Tax (VAT) on train tickets will be reduced from 19% to 7%.

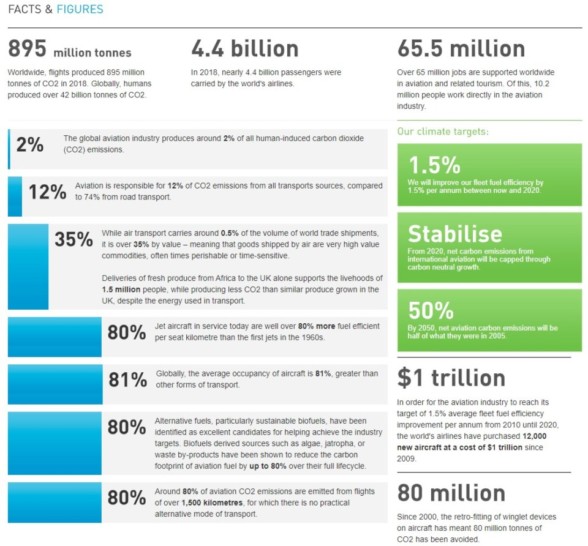

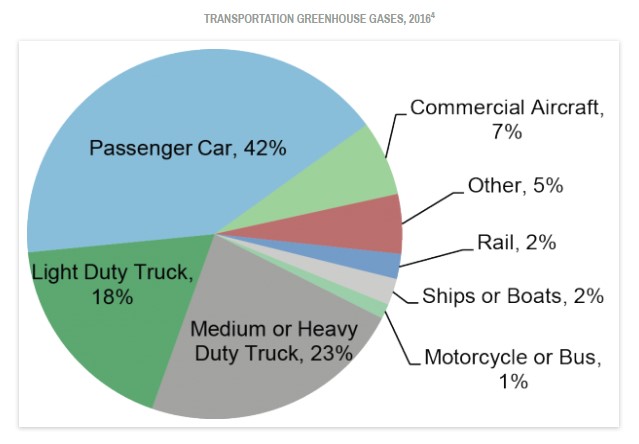

The carbon surcharge for intra-country flights will be increased but that tax rate has yet to be determined. This is most likely the reason for the implementation delay to April, 2020. Here is a breakdown of how aviation contributes to carbon emissions:

Carbon emission levels by mode of transportation:

Image credit: css.umich.edu

Aircraft travel accounts for 7% of all carbon emissions but rail transportation is more efficient by only emitting 2% of the transportation carbon.

Who Contributes Most to Carbon Emissions?

In doing this story, I found there is a highly disproportional emission rate by social-economic groups:

- The wealthiest 10% of the world’s population produces 49% of carbon emissions

- The poorest 50% of the world’s population only contribute to 10% of carbon emissions

The largest contributors by country are:

- China

- United States

- India

- Russian Federation

- Japan

- Germany

What’s Next?

Germany seems to be taking the lead in serious carbon reduction measures. The German legislation will increase taxes for airline travel only within Germany. Germany is only the number six emitter of carbon pollution. Will other larger emitting countries follow suit? What about the top five polluters?