While on vacation I wrote two credit card reviews, including one arguing against the United Airlines credit cards and another arguing in favor of the Hyatt credit card. I mentioned a general pattern in that it’s much easier to make a favorable argument for a hotel credit card given their often lower annual fees, free nights, and automatic elite status when compared to airline credit cards that may offer benefits you’ll use sparingly.

But there is one airline credit card I think makes sense for many people, and that’s the Alaska Airlines Visa Signature®.

I have only two reasons. First, get the card it provides some easy miles, often with no minimum spend (depending on the offer). Second, keep the card because the annual companion fare is often more valuable than the annual fee. Buy almost an Alaska Airlines ticket in economy class for yourself and a companion can travel on the same route for $99 plus taxes and fees. This companion fare is treated just like a regular fare, meaning it can be upgraded and will earn miles. Just about any trip that costs more than $200 will be well worth paying the $75 annual fee. I once saved nearly $1,000.

One of the best features of the companion fare is that it comes as a discount code anyone can use. The cardholder does not need to be one of the passengers. But the person booked as the primary passenger does need to be present. I was fortunate that when booking flights to my bachelor party in Las Vegas last year I had kept myself as the primary passenger since my companion wasn’t able to make it at the last minute.

Does Everyone Need a Companion Fare?

The only reason not to keep this card would be if you really don’t fly Alaska Airlines. And that happens. I have a couple friends who are moving to Pennsylvania and don’t have family on the West Coast. They’re unlikely to use the companion fare, or at least they’re not willing to commit to the card in order to keep it.

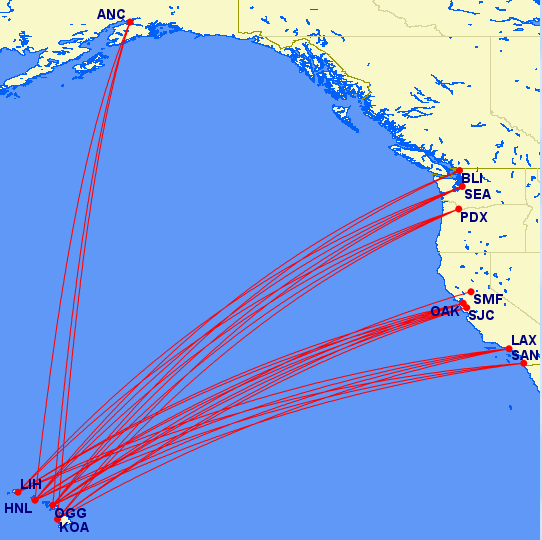

However, Alaska and its partners fly to more places than you might think. It’s especially valuable for just about anyone living west of the Rockies and could be considered the Jet Blue of the west. It’s now expanding in Salt Lake City in response to Delta’s expansion here in Seattle and adding ever more nonstop routes from Portland and Seattle to East Coast airports. You could visit the Emerald City, the City of Roses, or connect onwards to Alaska or Hawaii. (At one point they were expanding so quickly to Hawaii that some thought it might even begin competing in the inter-island market, and it remains one of the best ways to redeem Avios to Hawaii.)

Why Is this Card So Popular?

I commented in the past that this card has an almost fanatical devotion among residents in the Pacific Northwest, but I don’t think it’s about the miles. The average consumer is not a miles and points addict and almost certainly has never heard of manufactured spend. Even some frequent flyers may not really understand why they use a particular card. Capital One has slick, successful marketing campaigns but always looks pretty awful to me when I examine the benefits.

One idea why my neighbors like the card is that Alaska Airlines is a local company, and we like local stuff. It’s why Alaska serves Sun Liquor spirits, and makes a big deal about delivering Copper River salmon from Alaska. Another idea is that Alaska is a friendly company. They’ve got great customer service, and if people are flying with them anyway they might want to use their card.

But my preferred idea is that the companion fare is a very salient benefit. Not everyone maximizes this benefit to the same degree, and some probably never knew that it used to be valid for first class tickets. But when the time comes to redeem it, that companion fare means a couple hundred dollars all at once. Earning and redeeming miles at some future date, assuming there is award space and the program hasn’t been devalued, is much more difficult to value. I actually prefer to earn Avios points if I want to book an award on Alaska Airlines, though Alaska’s miles are pretty good for partners like Cathay Pacific.

In my opinion, the Alaska Airlines credit card doesn’t offer travelers much beyond the companion fare, but that’s good enough for me and worth paying the annual fee even if I stick it in a sock drawer.

The earning power isn’t particularly special. Though you’ll earn 3 miles per dollar on Alaska purchases — which is better than many airline cards that earn only 2 miles — it gets only 1 mile per dollar on everything else. United will give you 1.5 miles on all purchases with its Club card or 10,000 bonus miles after spending $25,000 with its Explorer card. British Airways will give you 1.25 miles on all purchases or 2.5 miles for its own flights.

The benefits are almost nonexistent. Aside from the 3X miles and the companion fare, the only other thing Bank of America advertises is that there’s no cap on the miles you can earn — a feature of nearly every travel credit card in the U.S. You won’t get free checked bags, priority check-in, or a fast track to elite status.

Even the sign-up bonus tends to be mediocre. The standard offer is 25,000 miles, though it requires no minimum spend. Sometimes it will go up to 40,000 or 50,000 miles, but many other airline cards regularly offer 30,000 to 50,000 miles, so Alaska is near the bottom of the pack. Currently the best offer I could find was for 25,000 miles upon approval, found on the AlaskaAir.com home page. I heard about a $100 statement credit but didn’t find an active like that advertises it.

But one valuable caveat is that Bank of America is one of the loosest banks when it comes to repeat applications. You can apply for this card over and over to get a new bonus. You can apply without closing your existing card. And Bank of America doesn’t try to keep it a secret. I’ve met a banker, who when I told him I already had this card, asked me if I wanted another one.

Who Shouldn’t Get this Card?

The downside of Bank of America’s lax application policies is that they’ll do just about anything to get you approved, even if it means approving you for a card other than the one you applied for. To get the card mentioned above, which is a Visa Signature product, you need to have excellent credit (typically above 740-760) and sufficient income in order to get approved for a credit line of at least $5,000. Without that, you’ll be automatically downgraded to one of two lesser cards — Platinum Plus or plain ol’ Preferred — with a smaller bonus. The Platinum Plus card gets just 5,000 miles and a $50 annual discount, but no companion fare. The Preferred card gets just 3,000 miles and no discount.

If you don’t already have great credit, my opinion is you shouldn’t be applying for travel credit cards with annual fees and higher interest rates. Get a no-fee card and spend a few years fixing whatever problems got you in this mess. Those who do have great credit, enjoy the benefits of the Alaska Airlines Visa Signature card.