I am fortunate to sit on a mountain of points. Between us, Megan and I have about 1.5 million points and miles in over a dozen different programs. I do hold to One Mile at a Time’s policy of never keeping more than enough miles to redeem for a couple of first class international award tickets. The bulk of my high-value points are earmarked for our honeymoon later this year. But still, having so many in the bank can lead me to be overly generous.

Late last year my mother moved from to a small town with limited air service and she needed to fly back and forth to look for a new home. This was an excellent case where domestic awards can provide significant value. A revenue ticket would cost at least $600, but it was a short distance so awards were only 20,000 United miles round-trip.

I earn at least 10,000 miles on every mileage run, so booking these awards for her was a drop in the bucket, just as I’m happy to book awards for Megan’s mother to fly out and help us plan our wedding (a similarly high-cost, low-miles fare). But drops add up, and I can’t afford to pay for all her travel. So after helping her out I explained that we needed to set up some mileage accounts of her own.

Knowing my mother, I would still need to manage them for her. I already manage accounts for Megan, and my brother asked for help, too. So how do I keep it all straight?

Everything’s Better with a Partner

First, it’s no secret that having a spouse or significant other can help you get more value out of travel. I miss Megan when I’m on mileage runs or other trips by myself. But also, she’s able to sign up for the same credit card offers or other promotions, helping our account balances grow faster. If I have a strategy, she can copy it exactly without going through the whole thought process a second time.

1 + 1 = 3

When we go to redeem, we have twice as many bonus points but still only need one hotel room. For flights, I can continue to fly as a revenue passenger and earn elite status while she books awards and flies for free.

But families are a bit tougher. There are a lot more people, they each may live separately and have their own travel habits and financial situations. And good luck trying to get everyone on the same award flight together. It happens but is never easy. There are still a few things you can do to ease the burden.

Tracking Everyone’s Information

I continue to recommend using AwardWallet to track your loyalty program balances. There is a nice feature to create separate accounts for each person and then link them so that they also appear in your own personal account. You may also choose to use MileWise, which works together with AwardWallet. I think it has a slightly cleaner interface and adds the nice feature of assigning cash values to your balances.

Still, you’ll need a spreadsheet, possibly two. The first one is to collect people’s personal information: full names, birthdates, travel preferences, etc. I can’t tell you how many times I’ve booked a flight for the same family member and need to ask my parents for the year they were born. (I’m such a good son I’ve forgotten how old they are!)

The second spreadsheet is to track credit cards. I know which cards I’ve applied for and when the annual fees are due. I can follow Megan’s, too, in my head. But my parents and siblings… *sigh* They are still new to the game. Sometimes I have to remind them that they have to actually use the card before the sign-up bonus will post. No six-card churns for them in the near future.

Still, the bonuses from just two or three cards a year may be all they need for their limited travel needs. Make sure they’re responsible with credit. I usually suggest starting off with something simple: a card with the first year’s annual fee waived, and a bonus that kicks in after the first purchase or only $1,000 in spend. There may be “better” cards out there, but you don’t want to over complicate the situation for a newbie.

Choose cards with well-known, high-value programs instead of niche products. My discussion of Virgin America’s credit card a few days ago may work if you’re on the West Coast, but not for most people. Something like an American Airlines or United Airlines card is ideal. Ultimate Rewards points might work, too, if they’re unsure about committing to a single program.

Consolidate Points and Miles

Whenever possible, try to move the points and miles into one account. It makes it easier to track how many you have, prevent them from expiring, and use them for large redemptions.

I prefer my own account because I’m the one with elite status, so any benefits that carry over on award redemptions help everyone. For example, when I book award tickets for family with my United miles, change fees are waived and my Premier 1K status carries over to provide priority service, free checked baggage, and complimentary domestic upgrades. But I do this strategically. If it’s a cheap award flight with no chance at an upgrade and the dates are pretty fixed, I’ll use miles from someone else’s account.

There are several programs that allow you to pool multiple accounts, which I’ll discuss briefly:

Chase Ultimate Rewards: You can combine points with a spouse or significant other, and you may only transfer points out to another loyalty program in your name. I wrote earlier about how these rules, not previously enforced, tripped me up and led to the cancellation of my Sapphire Preferred card. There is some speculation that the rules are looser for the Ink Bold and Ink Plus if you want to transfer to accounts in someone else’s name.

Citi ThankYou: You can combine ThankYou points earned with a Citi Forward, ThankYou Preferred, or ThankYou Premier card with those of a spouse. The Citi Forward offers some generous category bonuses, while the Citi ThankYou Premier allows you to redeem points at 1.33 cents each toward almost any flight. The ThankYou Premier also lets you earn bonus flight points (essentially double ThankYou points) when you use your card to buy tickets.

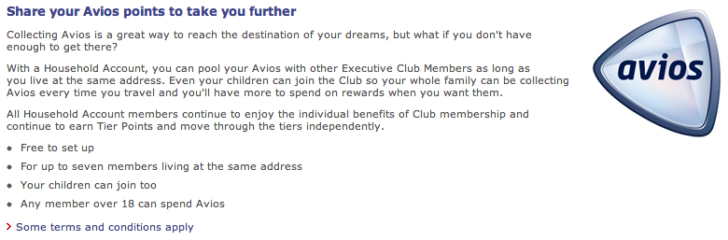

British Airways: Household accounts allow members to pool Avios points between seven people who share the same address, and it happens to have very cheap domestic awards if you’re flying nonstop for short distances.

US Airways: While there is no formal account sharing program, transfer bonuses are common. Since you have to pay for a transfer, you can transfer both ways and effectively keep your own miles while “buying” more. But you need to have some to get started.

Hawaiian Airlines: A “share miles” feature is available only to those who hold a Hawaiian Airlines-branded credit or debit card.

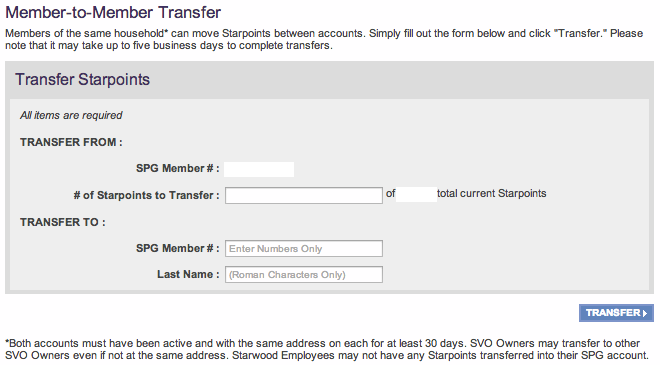

Starwood: Members can transfer points between each other but only if they live at the same address. It is best if this has been established for at least a month before you attempt a transfer, but since Starwood rarely mails me anything, there’s no reason to list people’s real home address.

Marriott: You can transfer points to a spouse but only for the purposes of fulfilling immediate award redemptions and only the number of points necessary for that award. You’ll have to call up and tell them what you want to book, and Marriott will round off the number of points needed to the closest thousand to top off your account.

Other Tips when Booking Travel

Even when all the points and miles are in one place, you may find that you can’t get everyone traveling together. So maybe combining them isn’t necessary until you’ve actually found the availability.

The same rules apply whenever booking travel for a group: compromise. Some people may need to fly separately on different itineraries. If a schedule change occurs, use that to your advantage and ask the agent to move the affected passengers onto the same itinerary as everyone else. (You don’t need to tell them why; you often have a lot of leeway when the airline makes an involuntary change.)

When searching for flights and hotels in the first place, make sure you search for just one seat or just one hotel room. Trying to book multiples may jack up rates or cause an award query to return with no space if you are on a threshold between different availability buckets. Once you find a good price for one person, see if it holds for 2, 3, or more.

Fortunately most hotels have dispensed with blackout dates, but they do still use arbitrary points and hotel “categories.” Make sure you’re getting a good deal before you decide to spend hundreds of thousands of points for a cheap hotel. Furthermore, Starwood’s program is particularly good for families by letting you accumulate elite stay credit for up to three rooms on the same reservation.

Finally, consider fixed-value loyalty programs like those from JetBlue and Southwest Airlines. These programs don’t have blackout dates or other award availability issues and instead just assign a cash value to their points. You draw from the same inventory available to revenue passengers but pay with points instead of cash.