Summer is here and you know what that means? That’s right, higher gasoline prices. Every summer, the oil refineries switch to their summer blend blah blah blah. I’m not smart enough to understand what that all means but what I do know is that my gas expenses goes through the roof around this time of year.

But other than buying an electric car or hybrid vehicle, there really is no way around it. It’s a necessary evil and we all need it to get to work and live our lives. So what are we to do? How do we beat the big oil companies at this game (and earn some miles and points along the way)?

The answer is actually pretty simple. By buying gas gift cards, of course.

Let me explain.

First off, did you know that gas stations advertise two different prices? No, you didn’t? Well, don’t feel too bad because the majority of people don’t either. The sad part is that most people don’t realize they have been paying the higher of the two prices all this time. Take a look at the picture at the top of this post.

I took that picture today at a gas station near my house. This is the typical sign that most people see when pulling into a gas station. If you’re just driving down the road and need gas, most people would expect to pay $4.13/gallon (for regular 87 octane). Well, you would be wrong if you’re like 99% of Americans who use a credit/debit card to pay for their gas purchases.

Now, let’s take a look at a smaller sign at the same gas station that no one sees.

You see that? There are actually two different prices. The price in bigger font is for the cash price i.e. pay with dollar bills. Whereas if you want to use a credit card, it’s usually about 10 cents higher. In this case, it’s 8 cents higher than the cash price. Sneaky huh?

So here’s the “hack.” When you pay for gas using a gas gift card, you will ALWAYS be charged the cash price and not the credit/debit card price. That’s it. You don’t have to go inside, use a special code or do anything differently. Just swipe your gas gift card like any other gift card and you will automatically be charged the lower price.

Just by using this one trick, you will start saving about 10 cents per gallon every time you fill up your gas tank. Assuming you fill up your car once a week (15 gallons at $4.10/gallon), that’s a savings of $78.00 a year. That doesn’t sound like much but trust me. It will add up.

Now where you buy your gas gift card matters also. Most of you have a credit card that earns bonus points or miles when used at gas stations right? Double points at gas stations or something like that? Well, stop using your credit/debit card at the pump! Just trust me on this. If you must, go inside and pay with your credit/debit card. Or better yet, go inside and buy a gas gift card. They sell them right at the counters. Then go outside and use the gas gift card or heck, just give it to the clerk immediately after he activates it for you to pay for your gas. That will give you the double points and the discounted “cash” price on gas.

But the better hack to getting more miles and points is to get (or use) a credit card that earns you bonus points at office supplies stores, grocery stores or pharmacies, etc. Those category bonus points are usually higher than gas bonus points. And you know what they sell at office supplies stores, grocery stores and pharmacies? That’s right, gas gift cards.

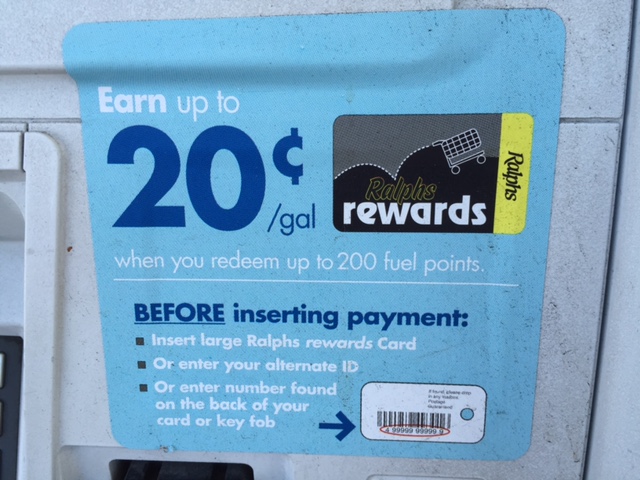

Let’s take this one more step. Depending on where you live, there might be an Albertsons, Kroger, Ralph’s or similar grocery store in your area. All of these grocery stores have partnered up with gasoline stations to give you “crossover rewards” for shopping at the grocery store and redeeming your points at the partner gas station. For example, my grocery store, Ralphs (part of the Kroger family chain of grocery stores), partners with Shell Gas. By being a “Ralph’s Rewards” member (free to join), I earn 100 fuel points for every $100 in groceries I buy.

I can then redeem those points for cheaper gas at Shell. For every 100 points I redeem, I get 10 cents off per gallon of gas. For 200 points, I get 20 cents off per gallon of gas. Your points accrue monthly and you can only redeem up to 200 points per fill up, up to 35 gallons. And the best part, they have year round promotions where you can earn an additional 200 to 400 points for every $100 you spend on gift cards (any gift cards, not just for gas). Those are in addition to the normal fuel points you earn just from grocery shopping. I’ve been doing this trick for about a year now and I haven’t paid “full price” for gas since.

I know I just threw a lot of math at you. Let me break it down.

Take me for example, I shop at Ralphs grocery store, fill up at Shell Gas, and use an American Express EveryDay Preferred credit card. And for the record, I am just using myself as an example. I am not endorsing these companies in any way nor do I have any affiliate links or relationships with them to benefit from.

So, if I were to just use my Amex card the lazy way at the pump every time I needed to fill up, I would:

Step 1: Drive to the gas station and use my credit card at the pump. For $100 worth of gas, I would get 2 x points at gas stations, earning me 200 Amex Membership Rewards points. Total. That’s it.

That’s not great and I can do much better by buying a gas gift card.

Step 1: I’ll go to Ralphs and buy a $100 gas gift card for Shell Gas. For my same $100 purchase, I will earn 4.5 x points at grocery stores which nets me 450 Amex Membership Rewards points. I will also earn 200 fuel points for my $100 gift card purchase.

Step 2: Go to Shell and enter in my Ralphs Rewards number. I then use the Shell Gas gift card I just purchased. Now, I will save 8 cents per gallon (for using the gift card and getting the cash price) AND an additional 20 cents off per gallon for using my 200 Ralphs Reward points.

For one extra step, I will earn 250 extra Amex points AND pay 28 cents less per gallon of gas. If you filled up every two weeks, that would be a net gain of 6500 Amex Membership Rewards points and $219 a year.

But if I haven’t convinced you yet, let me add one more point.

Using gas gift cards can save you from being a victim of credit card fraud.

If you guys haven’t heard, credit cards are getting skimmed left and right throughout the country. Credit card skimming is when a crook obtains your credit card number and makes fraudulent purchases on your credit card without having to steal your actual credit card.

Because people are still in possession of their credit cards, oftentimes they don’t realize that their credit card numbers have been compromised. Crooks go out and make thousands of dollars worth of purchases and you get stuck with the bill. Of course you can get the charges reversed from the credit card companies but it’s still a hassle having to cancel your card, get a new credit card and update all of your auto-payments.

Now take a guess on where the majority of credit card compromises occur. That’s right, gas stations. So how do you protect yourself? Use gas gift cards instead. That way, if anything does get compromised, it’s just a simple gift card and not your actual credit card number. It’s a win-win situation all around. Not only will you earn more points by using a gas gift card, you will also save more money at the pump and protect yourself from potential fraud.

I hope this information helps. Let me know if you guys have any questions or comments.