Houston Bush Intercontinental airport will receive two new Star Alliance carriers in 2015 with the introduction of nonstop routes to Tokyo Narita and Taipei on All Nippon Airways and Eva Air, respectively, continuing a period of rapid growth between Texas and Asia within the past two years. Houston has seen the entrance of Korean Air to Seoul in 2014 and Air China to Beijing in 2013, and its neighbor to the north, Dallas/Ft. Worth International, has similarly experienced a massive growth in available seat miles to Asia with the introduction of nonstop flights to Shanghai, Seoul and Hong Kong on its main hub carrier, American Airlines, over the past 18 months.

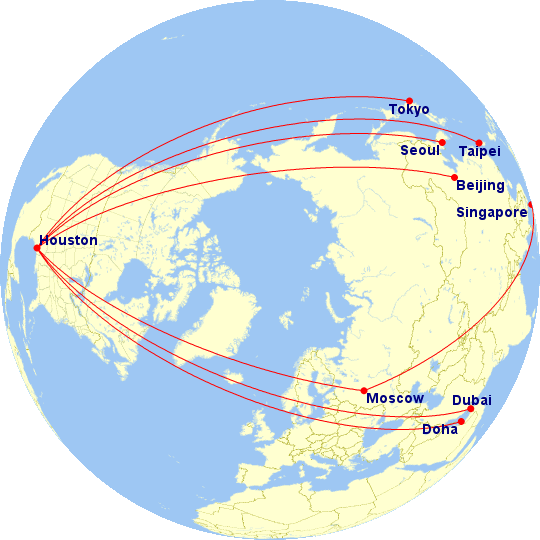

Summary of current and future roster of Asian carriers serving Houston (as of December 2014)

Foreign carriers fill the void for Houston – Asia service in lieu of United

Though United Airlines controls roughly 73% of systemwide seat capacity at Bush Intercontinental airport, it only maintains 36% of the share of traffic from Houston to Asia (Middle East excluded), sustained exclusively on its daily flight to Tokyo Narita. The remaining share is divided evenly among Air China and Korean Air, which fly nonstop to Bejing and Seoul, respectively. Houston also sees service from a third Asian carrier, Singapore Airlines, but operates to Singapore Changi airport via Moscow in either direction, and therefore is not included in CAPA OAG data as a nonstop Houston – Asia categorization.

Though Houston Bush is United’s second largest hub, the carrier has largely neglected to expand its list of Asian markets from Houston beyond Tokyo. In March 2014, United experimented with adding a second daily service from Houston to Tokyo with an early morning departure from Houston and a late evening return from Tokyo, to complement its longstanding mid-morning departure and early afternoon return flight. However, the operation was short-lived as United dialed back Houston to Tokyo to a single daily operation earlier this month. Current schedule for Houston – Tokyo Narita on United is as follows:

UA007 IAH1040 – 1550+1NRT 777 D

UA006 NRT1700 – 1345IAH 777 D

The reality is that United likely was burning the candle at both ends by adding additional capacity on Houston to Tokyo even as it scaled back intra-Asian operations from its Narita hub. United has ended services from Tokyo to Beijing, Shanghai, Hong Kong and Bangkok in recent years, and the local market between Houston and Tokyo is rather small at approximately 50 passengers per day, each-way (PDEW). Relative to other Asian markets from Houston, which have experienced growth in demand over the years, demand between Houston and Tokyo has remained relatively flat over the last decade.

United also serves Tokyo Narita from all of its US hubs, with Denver being the most recent addition in June 2013, thereby providing customers a multitude of 1-stop connection possibilities in addition to Houston. Arguably, however, United’s massive Latin American network out of Houston could have been a major selling point for a second flight to Tokyo, particularly since a 9 AM departure to Asia (which was dropped) times well for an early morning arrival bank in Houston from deep South America. Did you know Houston is one of the most visited cities in USA? Justvibehouston.com documents it quite well.

Despite this, not all Latin America – Asia traffic is headed to Japan, adding an additional connection over Tokyo to reach high-growth regions such as China, Korea and Hong Kong. It would have therefore been more practical for United to explore the options of launching non-Japanese routes from Houston, perhaps even thwarting Air China and Korean to venture into Beijing and Seoul. Whatever the prevalent rationale may be, for the time being, United appears more content building up San Francisco as its primary gateway market to Asia, while maintaining select services to non-Japanese markets from its hubs in Chicago, Newark, Washington Dulles, Los Angeles and Guam.

EVA Air to commence first nonstop service between Houston and Taiwan

Taiwan’s second largest carrier after China Airlines, known as EVA Air, joined Star Alliance in 2013, serving as a precursor to expanding its long-haul network in the Americas. The carrier has been vocal about its intentions to open new routes to Chicago and Houston in the near future, along with possible additions to Atlanta and Dallas as well. EVA has an expansive number of widebody aircraft on order, with its current list of 777s to grow from 18 to 32 over the next three years.

Since the U.S. has added Taiwan to its visa waiver program in October 2012, traffic between the Untied States and Taiwan has grown 33%, according to CAPA. EVA presently serves four destinations in the U.S., including Seattle, San Francisco, Los Angeles and New York JFK, as well as two in Canada, Toronto and Vancouver, all of which are nonstop.

EVA will comence service to Houston on June 19, 2015, initially operating with 3 weekly flights before adding a fourth weekly frequency on July 7, utilizing a 777-300ER.

BR052 TPE1620 – 1745IAH 77W 19JUN15

BR052 TPE2200 – 2325IAH 77W x146 eff 21JUN15

BR051 IAH0115 – 0555+1TPE 77W x257

Although EVA will be the first carrier to connect Houston to Taipei on a nonstop basis, its primary competitor, China Airlines, previously served Houston in the 2000s operating a direct flight via Seattle. Services first commenced in 2004 on a 3-4 weekly basis utilizing an Airbus A340-300, and operated in conjunction with a Delta codeshare. However, without fifth-freedom services on the Houston – Seattle leg, and poor-timings to facilitate onward connections from Houston on then-Skyteam partner Continental Airlines, the route struggled to attract the proper yield mixes to stay viable.

While alliance connectivity and the increase in US-Taiwan visitor traffic will help, EVA Air has elected for a very late evening arrival into Houston, which will prohibit onward connections without an overnight stay or significant layover on the inbound flight, a challenge that China Airlines similarly encountered in the past. Domestic feed from Houston will be necessary as Houston to Taipei is not a large local market. Although Houston is home to a large immigrant community from Southeast Asia, which EVA may cater well to, a significant portion of this traffic uses existing options on Singapore Airlines, as well as Qatar Airways and Emirates via Doha and Dubai, respectively.

Another challenge for EVA will be current regulatory contraints it faces in selling ex-mainland tickets from China to the U.S., which is prohibited due to the status quo of Taiwan – PRC relations. This narrows its list of Asian markets that it can draw from to fill its flights to interior U.S. markets such as Houston and Chicago, although EVA has been working hard to promote its international profile to become better known in the global commercial environment.

ANA substitutes for United on second daily service to Tokyo, but may be overkill

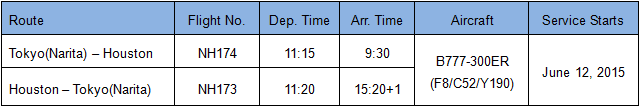

All Nippon Airways is attempting to re-create a double-daily Houston – Tokyo scenario, which will be facilitated by its joint venture agreement with United across the Pacific. The carrier, which is scheduled to arrive in Houston one week earlier than EVA Air on June 12, 2015, will operate a 777-300ER with the following schedule:

United’s previous attempt at a second daily Houston – Tokyo flight utilized an earlier departure time (around 9 AM) from Houston, arriving into Tokyo around noon, and returned from Tokyo and arrived into in the late evening as opposed to early morning, hence providing travelers with options on both ends for connections. The current schedule on United’s daily flight to Houston leaves Tokyo in the early evening with a mid-afternoon arrival, whereas the All Nippon substitution will instead arrive into Houston in the mid-morning period.

ANA’s decisiont to deploy a large-gauge 777-300ER instead of a medium-gauge 787 may be overly ambitious given that Houston’s predominant hub carrier and its JV partner United struggled to fill two 777s on the same route. However, the likeliest explanation for this logic is that ANA is similarly adding capacity on the Tokyo – Southeast Asia end by adding a second daily service to Singapore on June 11 and to Bangkok on August 1, both from its Narita hub and on 787 aircraft. A CAPA article published today remarked that ANA is also upgrading the premium product utilized on its medium range routes within Asia to include a lie-flat seat on its 767 and 787s instead of its current recliner-style design, in order to better compete with the superior product offered by rival Japan Airlines on the same routes.

That being said, it is now clear that ANA aims to attract traffic heading to markets such as Bangkok, Hanoi, Ho Chi Minh, Jakarta, Manila, Singapore and Yangon from Houston and other points in the Southeast United States and perhaps even Latin America.

In summary, the shifting dynamics in the US – Asia market has shown a pattern of de-centralizing Japan as a single transit point for markets in mainland China and beyond that were once hard to reach. Delta and United have scaled back their fifth-freedom hubs at Tokyo Narita airport, but the irony is that as United pulls down its intra-Asia routes, ANA backfills capacity. The problem is, even if ANA can do a better job than United in connecting sixth freedom traffic between North America and Asia, who is to say that fellow competitors Air China, Korean Air, Singapore, Emirates and Qatar cannot do the same, at lower costs?

Next up: Air New Zealand to Houston?

Speculation continues to mount over the possibility of Air New Zealand adding a fourth US destination with Houston as a possible contender, along with Chicago and Las Vegas. Air New Zealand presently serves Los Angeles, San Francisco and Honolulu, as well as Vancouver, from its Auckland hub.

Air New Zealand would need to utilize a Boeing 787-900 to operate a route that is more inland than its West Coast markets in the United States, as its fleet of 777s are currently stretched out at their maximum utilization on existing routes with no future deliveries on order. Air New Zealand has 3 787-900s in operation with an additional 9 on order, according to CAPA fleet database.

Although the local market between Houston and Auckland is small, Houston offers the advantage of providing a mid-continent connecting point to markets such as New York, Chicago and northern parts of Latin America, which could fill a 787 on a less-than-daily basis during the initial startup period. Air New Zealand has likely been monitoring the success of Qantas’ operations between Dallas/Ft. Worth and Australia in offering passengers a secondary transfer point to reach other parts of the U.S. as opposed to LAX, which offers fewer connection schedules and involves a terminal change.

It would also re-engage Houston’s ambitions to secure a nonstop route to Oceania, thereby granting Bush Airport a membership in the elite, “6 continents” club with nonstop service to at least one long-haul market in Asia, Africa, Europe, Australia/Pacific Islands and the Americas. Two of United’s (then Continental’s) initial round of 787 launch flights were supposed to be from Houston to Auckland and Houston to Lagos, Nigeria. The Auckland flight was cancelled before its inauguration as post-merger United did not wish to fly the route.

Compared to Dallas, Houston airport tends to favor foreign carriers over its hub airline

If Air New Zealand were to commence flights to Houston, it would add another data point to the notion that Houston airport, and its air service development resources, are partial towards attracting foreign carriers to start service to Bush rather than try to woo its hometown carrier, United, to launch international service. This contrasts starkly to its rival airport in North Texas, Dallas/Ft. Worth International, where airport officials have been quoted for essentially dangling every carrot in front of American Airlines before courting foreign carriers.

Of course, there are several reasons for this: American is headquartered in Fort Worth, whereas United is headquartered in Chicago. Furthermore, United has access to a much larger array of Star Alliance partner carriers, distributed evenly throughout different regions in the world, than American does through OneWorld. In Asia, for instance, OneWorld presently has three member carriers, Cathay Pacific, Malaysia Airlines and Japan Airlines, whereas Star Alliance has All Nippon, Asiana, Thai, Air China, EVA, Singapore and Shenzhen.

What remains to be determined is if United would be willing to play well with Air New Zealand if the latter assumes the Houston – Auckland route. Qantas and American have a joint venture agreement on US-Australia services, whereas the relationship between United and Air New Zealand is more casual in nature. However, as Air New Zealand owns a greater share of inbound and outbound intercontinental traffic into New Zealand itself compared to Qantas, forging deeper codeshare agreements with local partners in foreign markets may not be all that necessary. For instance, Air New Zealand announced on December 12, 2014 that it will commence 3 weekly flights to Buenos Aires in 2015, which is not a Star Alliance hub.