Yesterday I outlined my Spring App-O-Rama. I mentioned I applied for two Chase cards, but on the other hand Chase can also be very picky about rejecting people who file new applications too often. Sometimes their applications will also ask if they’ve previously rejected your application in the last six months, a potential deal-breaker. Deciding how often you can apply is a very important question since Chase has some of the best credit card offers out there as well as some of the best customer service.

A lot of people will tell you to file a new application with Chase every six months. In my experience, I’ve been cutting the time between applications down by a month with each new card. I got the United Mileage Plus Select Visa back in 2010 followed by the Continental OnePass MasterCard in early 2011, six months later. Then I got the Hyatt Visa five months after that. The Chase Sapphire Preferred was next after four months. And just last night I applied for the United Club Visa after only three months since my last application. It was also my first instant approval from Chase! So go figure. Apparently if you want an instant approval, you need to apply every three months. (Please note the sarcasm.)

Of course, I try to maintain a good banking relationship with them. I actually use all of my cards and pay the annual fees. The benefits are worth it. I get a $60 credit on the United Select card since I’m 1K, and the remaining $35 is worth getting 3X miles on purchases instead of 2X with the current Explorer card. The $75 fee for the Hyatt Visa is worth the free night each year. And the Ultimate Rewards card is valuable just for the easily transferrable points. Other cards like the Priority Club Rewards Visa also offer a free night or similar offsetting retention bonus that you don’t even have to ask for.

The only card I’ve canceled with Chase is the Continental OnePass Plus card, now rebranded as the Explorer card. It just isn’t a useful card. I don’t care about free bags or Priority Access as an existing elite. I don’t care about upgrades on award trips since I don’t fly award tickets myself. The 2X miles on purchases is inferior to what I already have with the Select card. The only thing that would be worthwhile is primary car rental insurance, but I have a low deductible and rarely rent a car anyway. I explained these failings when I canceled it in February.

I’m still waiting to hear about the Ink Bold Visa application, which I filed just before the United Club application. In general the rule is that you can apply for one personal card at a time from Chase, but you can double down by also applying for a business card on the same day. It doesn’t surprise me that they probably will want me to call up their reconsideration line since I have a new business (this blog) operating as a sole proprietorship under my Social Security number instead of an EIN. But I don’t expect any real problems, and I have well over $40K in available credit lines at Chase that I can cut or redistribute. I’m using less than 5% of that each month, but maintaining a high line of credit gives you leverage to negotiate.

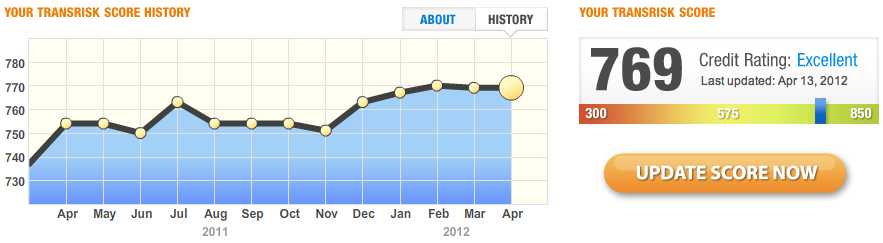

Maintaining a Good Credit Score

As the Frugal Travel Guy likes to say, your credit is your most important asset. Always pay attention to your credit score and how your decisions affect it. Are you applying for a house in the next two years? Maybe you should lay off the applications, or at least cut it down to one every six months. Are you going to be carrying a balance? Rewards cards are a bad idea as they usually have higher interest rates.

In my case, I only spend what I can afford, and I always pay off the balance in full each month. Responsible card applications can actually raise your score by increasing the number of accounts and decreasing the ratio of debt to credit even though it may decrease the average account age. I use CreditKarma.com and CreditSesame.com to give me estimates of my credit scores for free.

A low score is a big reason why your application might be rejected, but even a high-score guy like me has had trouble now and then if I don’t pay attention to recent account openings or closures or unusually large balances that I haven’t yet paid off. In fact, opening a savings or checking account can sometimes create a pull that will temporarily decrease your score. Like all things, plan carefully.