Reuters published an article this morning that describes how some people maximize the value of their points and miles thanks to online communities and tools, quoting a few prominent BoardingArea bloggers along the way. While I think the article provides a lot of good advice, there are always limits in summaries intended for the general public. I thought I would throw in my own two cents.

Quantity, variety, and planning are the Big Three

The author points out most people are probably like her:

I get points randomly and waste them on trips that have so many inconvenient stopovers and surcharges, I don’t save anything.

This is why most friends and family I speak to have no interest in the miles and points game. They just don’t see the point. If they got a cash back card, they could take that 1-2% in cash and use it for whatever they wanted. If they go for miles, then they may or may not get a similar benefit. I go for miles because I can easily turn a point into 2 cents or much more; the cash back would be a loser for me. Practice helps. but so does having quantity, variety, and planning.

Quantity and variety in my points and miles balances lets me choose the best one for the job. Ultimate Rewards points from Chase let me transfer to lots of different programs instantly whenever I need them. ThankYou points from Citi let me redeem for a cash credit toward any flight without worrying about award space. Avios points are particularly useful on short domestic flights operated by several of their U.S. partners. I am currently accumulating US Airways miles not because I fly like to fly US Airways but because I know they offer some of the cheapest awards for off-peak travel in business class.

If you think about the type of travel you want, start planning for how you can best meet that need. You don’t need UR points if you don’t want to fly with their partners. If you plan to shop around for the best price, ThankYou points might work better. But since UR points can do the same thing, just at a lower value (UR = 1.2 cents/point, TY = 1.33 cents/point) you still need to go back and figure out how quickly you’ll earn points. If your spending patterns earn UR points twice as fast as TY points because of certain bonus categories, that lower-value point is still a larger rebate for each dollar spent with a credit card.

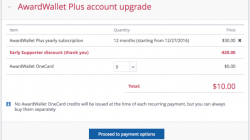

I keep track of all these miles and points using AwardWallet, but there are lots of other helpful tools. Read my review of AwardWallet here.

The best use of miles and points isn’t always obvious

When I first heard of Avios points I thought, “Stupid. When am I going to fly British Airways? Who wants to pay their ridiculous fuel surcharges on international awards?” I don’t care if it’s only $600 for a business class flight to Europe. I refuse to pay the surcharge on principle.

But Avios are AMAZING for redeeming on domestic partners. Depending on the distance, you could pay as little as 9,000 points for a domestic, nonstop flight on American or Alaska. Flights to Hawaii from the West Coast are only 25,000 points in coach, less than the 35,000 points/miles many airlines charge through their own programs. There’s recently been buzz about the cheap price of first class award seats on Alaska Airlines through their partner Icelandair for only 35,000 30,000 miles anywhere Alaska flies! And many airline miles, like those from Hawaiian Airlines or Virgin Atlantic, may be more valuable when converted to Hilton HHonors points at a 1:2 ratio than when used for their original purpose.

So don’t assume you have to use miles and points the way they’re advertised. And even if you’re still going to use airline miles for flying, you don’t have to use them on the same airline that markets them. I got two tickets on Singapore Airlines to Singapore and Hong Kong in first class for only 260,000 United miles plus $126 (total) in taxes. When business class was only available for one short segment, I told the agent, “I don’t care if it’s business as long as I stay on a Singapore-operated plane. It’s still better than United first.”

Quibbles with the article

I have no idea why Capital One Venture Rewards is presented as a “perennial favorite.” Lots of cards, including the Chase Sapphire Preferred and Citi ThankYou Premier, offer the ability to redeem points for a cash credit toward travel. They also have larger sign-up bonuses, and applying for the Citi and Chase cards only puts one hard pull on your credit report. Capital One will pull reports from all three bureaus, making a bigger dent in your credit score. Although it does have the occasional 100,000 point bonus for a short time each year, and that can be sizable, the terms on the latest offer were so restrictive that it didn’t get much publicity. You are better off applying for both the Sapphire and ThankYou cards. Use the bonuses, figure out which one works best for you in the long run, and cancel the other.

The choice for using Ultimate Rewards points is presented as a tradeoff between 2 cents/point for transferring to other partners and 1 cent/point for cash back. You can get 1.2 cents if you redeem for travel through their online portal. You can also get more than 2 cents depending on how you value the partner awards (valuing awards is arbitrary and highly personal). It also suggests Mommy Points likes the Chase Ink Bold card because she earns 5X points at office supply stores but doesn’t reveal the true value of this opportunity: you can buy pre-paid Visa and AmEx gift cards there and redeem them almost anywhere else. I’m sure these were omissions on the part of the author, as they are not the kind of facts Mommy Points would forget!

ExpertFlyer is a good choice for all-purpose award search, but airline sites can be superior if you learn how to use them. Create your own list for which one works best for different options. For example, use American Airlines to search for space on Alaska, Hawaiian, and American all at once. Their site has a pretty good calendar feature. If you need Alaska space in particular (like for Icelandair), use their own site to weed out Hawaiian and American. United has significantly improved their search engine, making it a good choice for almost all Star Alliance partners, but the calendar doesn’t always match reality. Even if it says there is no business class on a particular day, scroll down to view the results because you might see it anyway. For more accuracy but a less user-friendly experience, try ANA.