The Platinum Card® from American Express carries the most expensive annual fee of any card in my wallet. While I can easily justify paying $65 to help me with my elite status with SPG or $75 to get a free Category 1-4 night each year with Hyatt, it’s a lot more difficult to stomach a $450+ annual fee for any Amex Platinum Card.

Difficult, but not impossible. And not all my reasons are the same as many of the other bloggers you may hear from.

I got this card well before I decided to switch my business over to American Airlines, and I’ve never made a habit of flying Delta Air Lines, so recent changes to their lounge access policies that take effect on March 22 and May 1, respectively, aren’t serious issues in my mind.

I admit I had looked forward to getting access to American’s Admirals Clubs this year, but since all my trips start from Seattle, I can still get access to at least one lounge: the Alaska Airlines Board Room, via the included Priority Pass Select membership. Even that isn’t a huge priority of mine because Seattle has a pretty good main terminal. I’m also planning on more nonstop and international travel this year, which means either (1) fewer long layovers or (2) complimentary lounge access due to elite status/premium cabin.

No, the reason I got the card in the first place was for the other benefits. Things like the Global Entry fee credit, the $200 annual airline fee credit, access to reservations through the Fine Hotels & Resorts collection, and a variety of rental car benefits.

Airline Fee Credit — $200 Value

Right off the bat the $200 airline fee credit can usually be applied toward small denomination gift cards (I recommend $50 each) even if they are technically ineligible. Worst case scenario you don’t get the statement credit and you still have $200 to use on an airline you would fly anyway. Other (legitimate) uses of the fee credit I might take advantage of are premium drinks at the airport club’s bar, food in those clubs that offer it, and buy-on-board for the times I’m sitting in coach, usually with Megan.

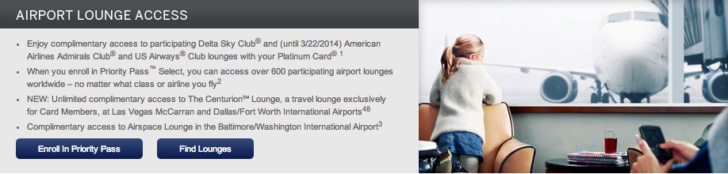

Airport Lounge Access — only $100 Value

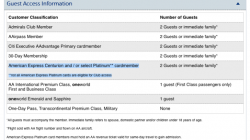

Second, I do use the Alaska Airlines Board Room and other clubs a few times a year. I might use the Centurion Lounges this year if I’m traveling more through DFW, but I haven’t yet had that opportunity. Clearly lounge access with this card has never been a necessity for me, but it is pleasant. I’d place the value of this benefit at only $100 for the entire year. Maybe less.

Rental Car Benefits — $50 Value

Third, I like that the card automatically gets me elite status with Hertz, National, and Avis along with a small discount. The discount isn’t special — you can find discounts all over the place — but the elite status helps with a slightly better car and faster pick-up. In the case of Hertz, it also provides a 4-hour grace period, which has been very helpful in saving me from extra rental charges a couple times. I might value this benefit at $50 since there is money to be saved, but you have to pay up front and I rarely rent a car.

Fine Hotels & Resorts Benefits — $100 Value

Fourth, I have booked a few rooms through Fine Hotels & Resorts and benefited from a complimentary upgrade, free breakfast, and a random credit like $100 at the restaurant or spa. Megan and I most recently took advantage of this during our honeymoon while staying at the St. Regis Bangkok.

The Platinum Card already got me SPG Gold status (call Amex to request it), and the FH&R benefits were the main reason we stayed there instead of the Grand Hyatt down the street where I had Diamond status. It was an even trade: free breakfast either way, and the spa credit made up for the higher rate. But I did enjoy the stay. I think FH&R makes me more amenable to branching out from my usual brands, but I can’t say this is something I use very often. I value it at about $100.

Global Entry — $100 Value (First Year)

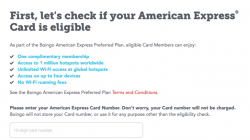

Fifth, the Global Entry credit is a great value if you don’t already have it. I already had Global Entry access as a Premier 1K member with United Airlines, so I used it for my wife’s application. That was another $100 saved — but only for the first year. If you have the consumer version of this card, then you may add up to three additional cardholders for a flat $175 — and they get nearly all the same benefits as you except the $200 airline fee credit. This is one of the cheapest ways to share Global Entry with your friends and family. It is much more expensive to add additional cardholders to a Business Platinum Card, so I don’t recommend that.

Summary

Add it all up and I’d say my American Express Platinum Card offers me about $450 in annual value right now, but in the first year it offered me $550 in value, so I’m coming out even after paying the $450 annual fee. Still, I tried to be conservative in these estimates even as I find myself using them more and more. You may do even better.

Remember that the Platinum Card is primarily a benefits card. I only ever pay for things with it when the Terms & Conditions require it, like when paying for the rental car. Otherwise it only earns 1 Membership Rewards point per dollar. I would rather use other cards for daily purchases, including my Premier Rewards Gold Card or Sapphire Preferred.

Comparing Platinum and Premier Rewards Gold

I don’t discuss the American Express Premier Rewards Gold Card in detail in this post, but contrary to the Platinum Card (a good benefits card), the Premier Rewards Gold offers very good ability to earn Membership Rewards points with less emphasis on benefits.

When I originally applied for these cards, I picked the consumer Premier Rewards Gold Card and the business Platinum Card because both were offering targeted bonuses roughly twice as large as normal. Unfortunately American Express has a rule that it does not award the sign-up bonus to customers who apply for a second consumer or business card that earns Membership Rewards points, so picking different cards is a decent strategy.

But in fact I think it may be more advantageous for some people who apply for both cards to switch it around. Get the consumer Platinum Card because it’s cheaper to add additional cardholders. Get the business Premier Rewards Card (assuming you have a business) for bonus points on flights and computer purchases. If you have a spouse, have him or her get the consumer Premier Rewards Gold card for the grocery bonus. If, like me, you want to switch the type of cards you have, you need to wait at least one year after sign-up. You’ll then receive a pro-rated refund for the annual fees you’ve already paid.

Suggested Links

As always, I greatly appreciate it when you use my links to apply for a credit card, but feel free to chime in through the comments if you know of any links offering a higher bonus.

American Express® Premier Rewards Gold Card

Email me for a referral — 25,000 Membership Rewards points after spending $2,000 in the first three months. No annual fee the first year, and $175 thereafter.

The Platinum Card® from American Express for Mercedes-Benz®

50,000 Membership Rewards points after spending $3,000 in the first three months. Annual fee of $475.