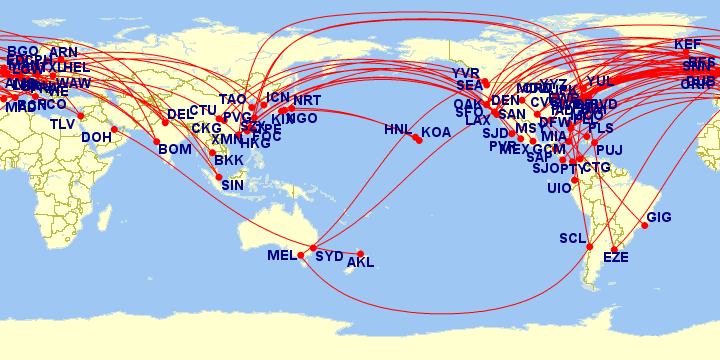

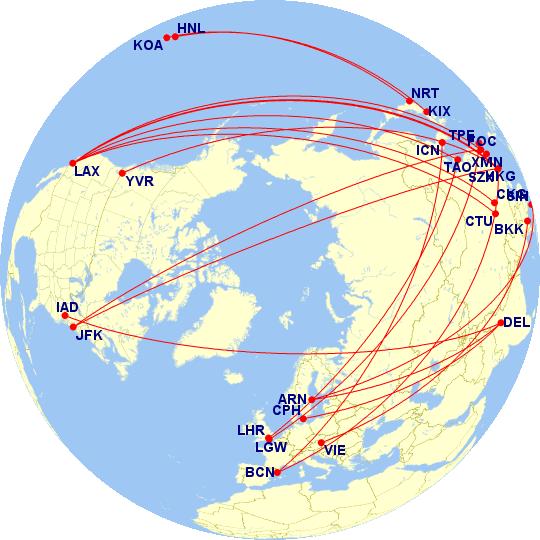

This past year, global airlines launched over 510,000 nautical miles of new international routes all over the world, bringing far-flung destinations even closer together and linking smaller cities with larger ones for the first time ever. The average flight for the dataset collected measured over 4,700 miles in length, taken from a sample set of the weekly news publications from Routes Online. e

The Airbus A350 and Boeing 787 were instrumental in allowing this to happen, but even narrow-body aircraft such as the 737-MAX also played a small, but important role, particularly in cases like linking the Northeastern U.S. and Canada with parts of Western Europe. The MAX and the Airbus A321 NEO will continue to play a huge role in route development in 2018, along with the Bombardier CSeries, the 777-X, the 787-10 and the Airbus A350-1000.

Perhaps the most noteworthy changes this year were increases in long-haul, low-cost carrier flying, notably Southeast Asian carriers coming to the U.S., as well as secondary Chinese carriers expanding in the U.S., Canada, and Europe. There was much less growth from the Gulf carriers as opposed to prior years, especially in the United States. In fact, Emirates cut capacity to the U.S. by nearly 20% earlier this year as a result of the laptop ban.

These were some of the most noteworthy route developments in the following regions of the world:

North America

It was another record year of growth for Montreal-based Air Canada, who experienced double-digit capacity growth on transborder routes between its hubs at Toronto, Montreal, and Vancouver to the U.S., and added a series of new links on its mainline and Rouge subsidiaries in 2017. Salient adds on Air Canada mainline included Toronto to Mumbai, Vancouver to Melbourne, and Montreal to Shanghai, and on Rouge from Toronto to Berlin and from Vancouver to Nagoya. Next year, Montreal will receive its third link to Asia with new Air Canada service to Tokyo Narita, complementing existing service to Shanghai on Air Canada and Beijing on Air China, which continues onto Havana from Montreal.

South of the U.S. border, AeroMexico wasted no time kicking off the year by announcing new service from its Mexico City hub to Seoul Incheon, making the South Korean capital its 3rd Asian market, in addition to Shanghai and Tokyo Narita. Mexico City was also popular among Asian carriers as All Nippon Airways launched nonstop service from Tokyo Narita to Mexico City, competing head-to-head with AeroMexico, and also utilizing a 787. Furthermore, China Southern Airlines launched a tag-on service from its existing Guangzhou-Vancouver route to Mexico City, which operates 3 times weekly, also on a 787-8. The Vancouver-Mexico City routing does not have fifth freedom rights, however, which means that only passengers traveling between Guangzhou and Mexico City can take this flight.

Mexico was also a big market for Southwest Airlines, which added several links to resort cities like Cabo San Lucas and Puerto Vallarta from Oakland, Sacramento, and San Jose. However, Southwest also announced that it would not be utilizing slots at Mexico City airport to operate flights to Los Angeles and Fort Lauderdale as planned, and instead intends to focus all of its Mexico City services via its Houston Hobby gateway hub. However, Southwest is still heavily committed to its #CaliforniaStrong initiative, as it now offers service to six California cities from Cabo San Lucas (Oakland, Sacramento, San Diego, Los Angeles, San Jose, and Orange County), three from Puerto Vallarta (OAK, LAX, SAN) and one from Cancun (LAX). It also plans to add more routes to Cancun from cities like Pittsburgh and Raleigh/Durham next year.

Back on the home front, Southwest inaugurated service to Cincinnati in June but also terminated service to Akron/Canton and Dayton that same month. Additionally, Southwest swapped out two of its Cuban markets (Varadero and Santa Clara) with Grand Cayman and Providenciales, Turks and Caicos. Cuba was also a bust for Alaska Airlines, who launched nonstop service from LAX to Havana in January 2017 on a 737-900ER and recently announced plans to terminate its single daily flight to Cuba in January 2018.

Speaking of Alaska, they are the chief reason why Southwest is going gang-busters in California. Alaska, which has acquired Virgin America, has added a salvo of mid-con and trans-con routes from its West Coast bases at Los Angeles, San Diego, San Francisco, San Jose, and Portland to several large and medium-sized cities on the East Coast, Upper Midwest and Great Plains. Examples include Newark to San Jose and San Diego, Philadelphia to San Francisco, Portland to Detroit, and Dallas Love Field to Seattle. Alaska is also watching closely as Southwest gears up to launch Hawaii service in 2018/2019, though specific details have yet to be announced.

On the topic of Hawaii, JetBlue has not announced any plans to serve Hawaii, but in the meantime is happy to codeshare with Hawaiian Airlines. JetBlue’s MINT product continues to expand successfully on its transcontinental routes, though the carrier probably wishes it could fix its network deficiencies on the West Coast. Hope for building a customs facilities at Long Beach fell through, while Southwest, who holds slots at LGB, continues to apply pressure. Things are a bit brighter for JetBlue’s on its East Coast strongholds as its wildly successful Boston Logan hub continues to grow and feed a large volume of partner carriers at BOS. JetBlue plans to become more in cahoots with TAP Air Portugal and Azul Linhas Aereas, as JetBlue founder David Neeleman watches his empire of airlines with Portuguese origin continue to blossom. JetBlue had a much-hyped return to Atlanta this year with new routes to Boston, New York JFK, Orlando, and Fort Lauderdale, essentially igniting a low-cost carrier bloodbath with Southwest, Frontier, and Spirit and obviously pissing off the 800lb gorilla in Atlanta, Delta Air Lines.

Delta had a busy summer with the official signing of the new joint venture with Korean Air, the relaunch of nonstop Atlanta-Seoul service, and new service from New York JFK to Berlin, Lisbon, and Glasgow, as well as Boston to Dublin and Portland to London Heathrow. Next summer, it intends to launch service to Lagos and Ponta Delgada from JFK, as well as from LAX to Amsterdam and Paris CDG. Indianapolis will also receive its first European link to Paris on Delta, and Orlando will also be connected to Amsterdam Schiphol.

Delta’s joint venture with Air France-KLM also afforded Minneapolis/St. Paul to become the recipient of an additional 3-weekly service to Amsterdam, which was intended to be summer-seasonal and instead has extended to year-round service. Meanwhile, Delta and Air France-KLM officially announced plans to include Virgin Atlantic in their highly-lucrative transatlantic joint venture agreement. Virgin launched 787-9 service from London Heathrow to Seattle over the summer (though it dropped service to Detroit) and also launched new secondary market service from Manchester to Boston and San Francisco.

San Francisco continues to be a blockbuster hub for United Airlines, which is not only adding new transpacific service from SFO but also transatlantic flights. Summer of 2017 saw new service from SFO to Munich, while Summer 2018 will see new seasonal service to Zurich. It will also add Papeete, Tahiti in 2018, though it is suspending two secondary Chinese routes to Xi’an and Hangzhou. However, these losses are Singapore’s gain, which received a second nonstop link to the U.S. via United Airlines from Los Angeles. United’s ultra-long-haul plans will also include Houston next year when it launches nonstop service to Sydney from IAH.

Though not ultra-long-haul, Denver will see European service restored on United when it launches service to London Heathrow next summer. And, though United once previously flew it, Denver-Panama City service returned this year thanks to Copa Airlines. Another noteworthy Latin American reinstatement for United was the return of Newark – Buenos Aires, which was last flown in 2013. Back to Copa, the Star Alliance carrier continues to hold down its U.S. bastion cities, although United appears to have more interest in deepening its partnership with Synergy Group’s Avianca Holdings. Its Brazilian subsidiary, Avianca Brazil, launched its first North American routes this year from Sao Paulo to Miami and New York JFK.

Brazil is still not where it needs to be pre-2015 levels for airlines like American to reinstate service to secondary markets, but it is giving Dallas/Ft. Worth – Rio de Janeiro a second attempt briefly during the high summer season. American also added Miami-Cartagena service this winter as well. It was also a landmark year for transatlantic and transpacific growth at American, with the launches of DFW-Amsterdam and Rome, Los Angeles-Beijing, and Chicago O’Hare-Barcelona. It will add service from Chicago to Venice and DFW to Reykjavik next summer.

Latin America and the Middle East

American is still hopeful that its joint venture application with LATAM Airlines will be approved in early 2018, which would be a huge boost after several years of delays. In the meantime, LATAM continues to grow north-south pairs such as an Orlando-Santiago link on 787-8/9s. Next year, it will also add seasonal service from Sao Paulo to Las Vegas on its Brazilian subsidiary. LATAM also commenced service from Santigo to Melbourne, growing Chile’s roster of transoceanic services to Pacific destinations to three, as LATAM already flies to Sydney via Auckland, and Qantas operates nonstop service from Santiago to Sydney.

LATAM also has a joint venture agreement with International Airlines Group, the parent company of British Airways, Iberia, Vueling, LEVEL and Aer Lingus. One of IAG’s highly anticipated route launches this year was from London Heathrow to Santiago on its 787-9, which purportedly has been a very successful route launch. Also highly anticipated was TAME Ecuador’s foray into the United States, which commenced nonstop service to New York JFK utilizing Airbus A330-200s earlier this year.

Emirates has still kept plans to launch Panama City on the shelf, but Qatar Airways has plans to launch Rio de Janeiro and Santiago sometime in 2018. Etihad, meanwhile, pulled out of Latin America altogether when it canceled Sao Paulo service in March.

Emirates may not have been growth-crazy in the U.S. this year, but it was indeed still controversy-friendly: it launched fifth-freedom service from Newark to Athens earlier this year, spurring Delta to unleash a short video illustrating the effects that the “Big Three” of the Middle East carriers have on U.S. jobs. Okay, then…

Qatar Airways launched the world’s longest flight from Auckland, New Zealand to Doha, Qatar, measuring 9,032 nautical miles. However, it is not the world’s longest flight by block time, which is a distinction that goes to United’s newly-launched Los Angeles-Singapore route at 17 hours and 55 minutes. Qatar holds a 10% stake in LATAM, which also plans to fly to Israel next year (Sao Paulo-Tel Aviv) which was once a route that El Al Israel flew, and dropped, in 2011.

Speaking of El Al, it was a big year for the Israeli flag carrier, which re-launched service to Miami after a 9-year hiatus since serving South Florida, one of the largest unserved U.S.-Israel city pairs. El Al last served Miami in 2008 utilizing a 767-200 but dropped the route due to high fuel costs and the high operating costs of the 767. Since Israel had Category II restrictions for a period thereafter, which prevents them from changing aircraft on existing U.S. routes or adding codeshares, El Al was unable to serve Miami again until it passed certain safety audits by IASA and the FAA. Now that this milestone has been achieved, El Al is not only serving Miami, Boston, Los Angeles, Newark, and New York JFK but also is deploying its brand new 787-9s to the U.S.

Europe

The 787 continues to work wonders for British Airways, which re-launched service to New Orleans earlier this year using 787-8s. It will also return to Nashville in 2018, also utilizing the 787. Its older-generation 777s are also being put to use to fly leisure routes out of London Gatwick, such as LGW-Oakland and Fort Lauderdale. Furthermore, IAG’s new LEVEL subsidiary launched routes from Barcelona to Los Angeles, Oakland, Buenos Aires, and Punta Cana this summer.

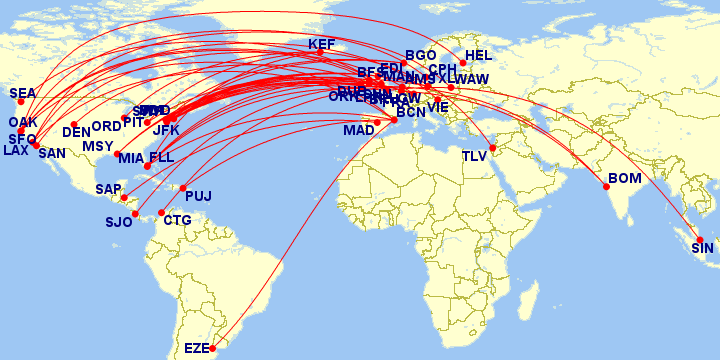

On the topic of long-haul, low-cost, there was massive growth on the transatlantic side with Norwegian launching Copenhagen to Oakland, Barcelona to Oakland, Los Angeles, Newark, and Fort Lauderdale, London Gatwick to Singapore, Seattle and Denver, Rome to Newark and Los Angeles, all on either 787-8s or 787-9s. The 737-MAXs were used to launch Bergen to Providence and Newburgh/Stewart, Belfast to Providence and Newburgh/Stewart, Cork to Providence, Dublin to Providence, Edinburgh to Hartford, Newburgh/Stewart, and Providence, and Shannon to Newburgh/Stewart and Providence.

Norwegian’s 2018 lineup is similarly exhausting, with plans to launch Paris to Newark, Denver, Boston, and Oakland, London Gatwick to Buenos Aires, Austin, and Chicago, Rome to Oakland, Madrid to New York JFK and Los Angeles, Milan to Los Angeles, and Amsterdam to New York JFK. It remains to be seen whether Norwegian will be able to generate enough cash flows through the slower winter period to address its rising debt levels and unending lawsuits.

Still on the low-cost thread: Thomas Cook launched Manchester-San Francisco, while Icelandair added Philadelphia and Tampa in 2017 and will add Dallas/Ft. Worth and Cleveland in 2018. And that’s not all: WOW Air will also add DFW and CLE next year, along with Cincinnati, Detroit, and St. Louis. In 2017, WOW added Pittsburgh, Chicago O’Hare, Miami, and Tel Aviv.

Back on Continental Europe, Condor added service from Frankfurt to San Diego, New Orleans, and Pittsburgh, while Eurowings launched service from Cologne to Seattle. Air Berlin launched service from Berlin to Los Angeles and San Francisco, although these were terminated in October 2017, in line with the fall of Air Berlin. To back-fill some of Air Berlin’s voided capacity, Lufthansa added Airbus A330-300 service from Tegel to New York JFK and Miami.

Los Angeles was a hot market this year for secondary European carriers, as it received new service on Austrian Airlines to Vienna and LOT Polish Airlines to Warsaw. LOT also commenced 1x weekly service from Chicago O’Hare to Krakow, Poland, a route it last served in 2009/2010 and will commence service from Chicago and New York JFK to Budapest, Hungary in 2018. Back on the West Coast, San Francisco was happy to receive a second look from Finnair, with nonstop summer-seasonal service to Helsinki. Finnair also serves Miami, which received attention from Aer Lingus this year with new service from Miami to Dublin. The Irish carrier will also launch Philadelphia and Seattle in 2018.

KLM reiterated its commitment to Latin America this year with new service to San Jose, Costa Rica as well as Cartagena, Colombia. Also noteworthy was Air Europa’s new route from Madrid to San Pedro Sula, which has become Honduras’ first nonstop link to Europe. KLM also returned to Mumbai, a route that was once served on its joint venture partner Delta, and canceled in 2015 allegedly, “due to the Gulf carriers.” KLM, along with Air France and Delta, also has an enhanced cooperation with Jet Airways, which launched service from Bangalore to Amsterdam and Chennai to Paris this year, as part of the agreement.

Jet Airways previously operated its European hub at Brussels before moving it to Amsterdam in 2016, so Brussels Airlines added a new link to Mumbai this year from BRU this year, utilizing an Airbus A330-200. It was also a big year for Jet’s largest competitor Air India, which began service from Delhi to Stockholm, Copenhagen, and Washington Dulles, as well as from Newark to London Heathrow. The jury is still out on the anticipated routes from New Delhi to Los Angeles, Dallas/Ft. Worth, and Houston, which was anticipated for late 2017/early 2018.

Asia-Pacific

Fifth-freedom rights have been instrumental in allowing Asian low-cost carriers like AirAsia X and Scoot to come to the U.S. This year, both of them launched service to Honolulu, using an Airbus A330-300 and 787-9, respectively, originating in Kuala Lumpur and Singapore with stopovers in Osaka Kansai in each direction.

Secondary Chinese carriers were aggressive this year: Hainan Airlines launched service from Chengdu and Chongqing to both New York JFK and Los Angeles, and from Las Vegas to Beijing. Xiamen Airlines launched New York-Fuzhou and Los Angeles to Qingdao and Xiamen. Hong Kong Airlines launched or announced Los Angeles, New York JFK, and Vancouver to Hong Kong, and Beijing Capital Airlines launched Qingdao to London Heathrow.

Air China, the principal mainland Chinese carrier, wasn’t going to sit back and watch all this happen. It also fired off its own salvo of secondary Chinese routes such as LAX to Shenzhen and Shanghai. Cathay Pacific launched Barcelona and plans to serve Dublin next year. China Airlines returned to London with service to London Gatwick, utilizing Airbus A350s. Korean Air’s Barcelona station became nonstop, Singapore started nonstop service to Stockholm using an Airbus A350, and Thai resumed service to Vienna using a 777-300ER.

Japan Airlines resumed service to Kona using a 767-300ER from Tokyo Narita, a route it had dropped in 2010 as part of its bankruptcy restructuring. It also launched service to Melbourne, Australia. And finally, Virgin Australia is (trying) to make a comeback in the U.S., with recently re-launched service from Melbourne to Los Angeles using a 777-300ER, although it will go against both United and Qantas’ 787-9 service to LAX, and Qantas’ anticipated San Francisco – Melbourne service in 2018.

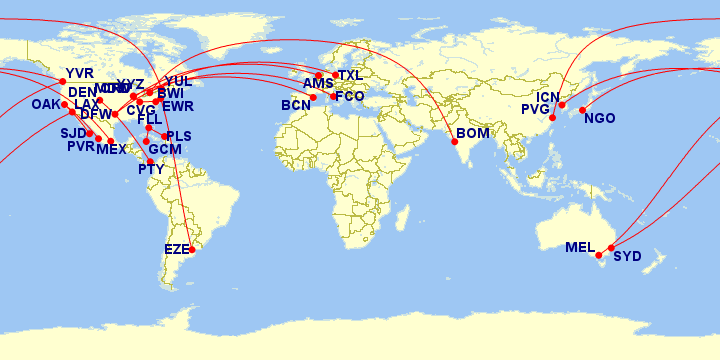

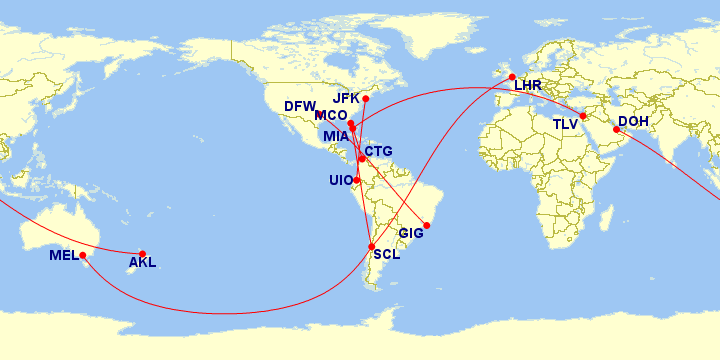

Maps generated by the Great Circle Mapper – copyright © Karl L. Swartz.