Mexican low cost carrier (LCC) Interjet will add a new nonstop flight between Miami and Cancun next April according to the always indispensable OAG changes thread from enilria over at airliners.net. The new route will operate four times per week (Monday, Wednesday, Friday, and Sunday) using the Airbus A320ceo. The flight schedule for the new route is as follows:

| Flight # | Routing | Dep | Arr | Days |

| 4O 860 | CUN – MIA | 9:45 | 12:25 | 1357 |

| 4O 861 | MIA – CUN | 13:25 | 14:15 | 1357 |

The timing of the route is interesting, as April is the tail end of the peak season for Cancun (winter) with spring breakers (both rowdy college students and families with children in school) forming a plurality of the demand. But Interjet’s entrance is welcome regardless, as it will boost competition on an expensive itinerary.

Despite the low fares, the passenger experience on Interjet is actually quite good and the carrier is often considered Mexico’s answer to JetBlue. The 150-seat Airbus A320 that will serve the Miami route has 34 inches of seat pitch, though the carrier’s A320s will eventually be reconfigured into the more dense 162-seat configuration currently on the A320neo. The carrier also has free snacks and drinks, so it isn’t an ultra-low cost carrier (ULCC) like Spirit or Viva Aerobus.

Cancun-Miami also served nonstop by American Airlines, who operates six flights per day using Boeing 737-800 equipment. Spirit Airlines and JetBlue also operate one daily flight apiece from Fort Lauderdale. Despite this capacity, early indications are that Interjet will bring down fares in the market pretty substantially. Looking at fares for late April (April 20 to 26), the US carriers (including Spirit and JetBlue) are all asking for more than $300 round trip (and Miami is actually about $50 cheaper than Fort Lauderdale). Interjet, in contrast has fares at $178 roundtrip, and while these may be introductory fares, passengers will certainly benefit from at least a temporary reprieve.

Interjet continues to grow Cancun with Mexico City growth off the table

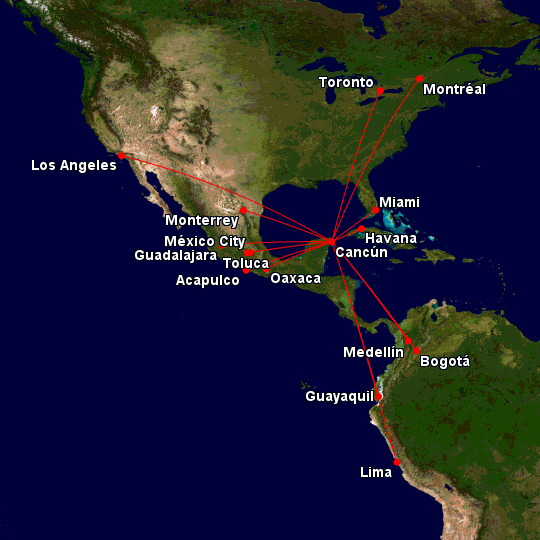

The route is part of a broader pattern of growth for Interjet at Cancun, where they are the largest carrier. Once Miami launches in April, Interjet will offer 209 weekly departures (31 peak-day departures) to 15 destinations. However more than half of that frequency (105 flights) is to Mexico City (Interjet’s homebase and largest hub) with 16 flights per day on weekdays and 12-13 on weekends. Still, Interjet has a substantial medium haul operation at Cancun, with flights to Bogota, Guayaquil, Miami, Lima, Los Angeles, Medellin, Montreal, and Toronto.

However, Interjet eventually plans to grow the Cancun hub to 378 weekly departures (more than 50 per day), so the Miami route is just the start of a broader expansion. Lima, Guayaquil, and Medellin are all new routes launched in 2019, though the airline also ended service from Cancun to New York JFK in June.

The growth at Cancun is certainly driven by the massive boom in tourism demand for Mexico’s largest vacation destination. In the past decade, traffic at Cancun Airport has more than doubled from 11.2 million passengers in 2009 to 25.2 million in 2018, and more than 90% of that traffic is origin and destination (O&D).

However the carrier is also looking to grow Cancun because its primary hub at Mexico City International Airport is nearly saturated. Interjet operates more than 100 flights per day at Mexico City to 52 destinations, and the hub by itself is bigger than Interjet’s focus cities at Cancun, Monterrey, and Guadalajara combined.

However, the airport is also out of capacity and development of a new Mexico City airport has been taken off the table by the efforts of Mexico’s leftist president Andrés Manuel López Obrador. So with limited prospects for growth, Interjet will have to turn to Monterrey and Guadalajara (each about two thirds the size of Cancun), but especially to Cancun. Miami is likely the first of multiple additional US destinations that will be announced in the next few years.

Podcast about Mexican aviation

If you’d like to learn more about the Mexican aviation market (particularly low cost carriers), Episode 39 of my aviation podcast has a deep dive into the market and an interview with the CEO of Volaris, a rival of Interjet in Mexico.

Maps generated by the Great Circle Mapper – copyright © Karl L. Swartz