Today I’m grabbing the “third rail” of the points and miles game.

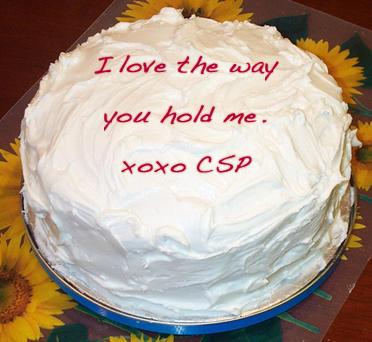

For several years now, the Conventional Wisdom has been that the Chase Sapphire Preferred is the best general-purpose travel credit card out there. It’s got a 40,000-point signup bonus! It’s got two sweet category multipliers! It’s got triple dining points on the first Friday of every month! It’ll even bake you a cake on Valentine’s Day!

But as often happens with Conventional Wisdom, what may have been true in the past isn’t necessarily the case today. The CSP is undoubtedly a decent rewards credit card, but is it the best choice for an everyday card? Is it the first card folks should get when starting to collect loyalty points? Does it deserve the massive amount of attention it gets?

Seriously, is the Chase Sapphire Preferred still all that?

Ultimate Rewards transfer partners ain’t what they used to be.

Once upon a time, the best use of Ultimate Rewards points from the Sapphire Preferred was to transfer them to United to redeem for awesome premium cabin redemptions on United’s partners such as Lufthansa and Swiss Air.

But that was before February 1, 2014. Judgment Day.

Nowadays those premium redemptions are only available at absurd prices, such as 110,000 miles one way to Europe. To put that in perspective, you’d have to spend one hundred and ten thousand dollars in non-bonused categories on the CSP to earn that many points! Can you imagine?

OK, I suppose you could focus all your spend on the first Friday of the month when (don’t know if you’ve heard about this) you can get 3x points on dining. In that case you’d only need to spend $35,000 at restaurants. Hey, if you spread that out over 12 months, it’s less than $3,000 every First Friday! Who isn’t up for taking their significant other out for a nice $3,000 dinner once a month?

That’s not all. Southwest has a mystery devaluation on the way that’s so terrible they won’t even tell us what it is. But even before this upcoming devaluation, transferring UR points to Southwest wasn’t a terrific redemption anyway. You’d get well below 2 cents per point in value using UR points that way. A 2% cashback or Arrival+ card would be better.

That leaves Hyatt, which is still somewhat valuable if you’re a Hyatt fan and can use their limited footprint in your travels, and also British Airways and Singapore Air, both of whom are partners with multiple flexible points programs. That means you can use a credit card other than the Sapphire Preferred and get a lot more bang for your buck in those programs than just one extra point for travel and dining. Speaking of which…

Travel and dining bonuses are sooooo yesterday.

Category bonuses have just exploded. There are more cards than ever offering some combination of extra points in either fixed or rotating categories. From office supplies to grocery stores to gas stations and with multipliers reaching 3x, 4x, 5x, and even 6x, there are a lot of exciting options out there.

The Sapphire Preferred? It has 2x points on travel. And dining. And, uh… well, that’s it.

There are 20 different credit cards that offer at least 2x on dining. The US Bank Cash+ card offers fast food as a 5% cashback category, while the Amex SimplyCash business card has restaurants as one of its 3% category options. Not to mention that both the Discover It and the Chase Freedom routinely have restaurants as one of their 5x quarterly categories. Even the basic (non-plus) version of the Barclay Arrival card gives 2x Arrival points at restaurants, and that’s without absolutely no annual fee.

What about travel? You could get 2x UR points from the CSP, or you could get 3x on the Citi Prestige (and soon the Citi Premier as well). Or 3x for airlines on the Amex Premier Rewards Gold. Or yet again, 2x Arrival points on the no-fee version of the Arrival card.

And as I’ve discussed in the past (see “The Best Use For Citi ThankYou Points Isn’t the Transfer Partners“), when you pair a Citi Prestige with any other ThankYou card (or just on its own) you can redeem at 1.33 cents per ThankYou point directly for any airfare and 1.6 cents per point on American and US Airways. With travel as a 3x category, that means you’re effectively getting almost 5% in guaranteed value on every single travel purchase with a ThankYou card.

With all those options, it’s hard to see how the Sapphire Preferred is the best card for bonus categories anymore.

The other CSP perks are now standard, not industry-leading.

In all fairness, this one is partly a case of Chase being a victim of its own success. When the Sapphire Preferred first showed up on the scene, “no foreign transaction fees” was a relatively new concept. But eventually other banks saw how popular it was to not screw their customers out of an additional fee. They jumped on board and now it’s pretty easy to find a card without foreign transaction fees.

Chase was also one of the earlier banks to start embedding EMV chips in their cards for better security against fraud. But now you can find a variety of credit cards with an EMV chip, usually with the same lesser chip and signature technology as the Sapphire Preferred. Chase is scheduled to roll out chip and PIN technology to most of their cards sometime this year, but for now, the CSP is still using signatures. And to quote Walmart’s senior vice president Mike Cook, “signature is worthless as a form of authentication.” (Don’t worry, I’m sure he’s relying on Walmart’s top notch cashiers to catch any suspicious characters trying to commit credit card fraud.)

Even the generosity of the Sapphire Preferred’s travel category is no longer an exclusive perk. For a long time, the CSP was the only card that included bookings at online travel agencies in their travel category, along with rental cars, taxis, and even tolls. But just a few days from now starting on April 19th, the Citi ThankYou Premier will offer 3x points for travel purchases, which will include all of those same types of transactions plus gas stations. Yes, gas stations.

The Devil’s Advocate says get a Sapphire Preferred. Just don’t use it.

The Chase Sapphire Preferred still has a pretty good signup bonus of 40,000 points for spending $4,000 in the first 3 months. You can also add an extra 5,000 points for adding an authorized user, who does not need to ever use the card and might not even need to be human in nature.

Having a CSP is also the only way you can transfer UR points to Chase’s travel partners if you don’t have a business and therefore don’t have a Chase Ink card. Though if you are eligible for a business card, there’s even less reason to hang onto a Sapphire Preferred. I’d personally keep an Ink card over a CSP because the Ink cards are more likely to have retention bonuses and that Ink 5x office supply category comes in handy a lot more often than you’d think.

But even if an Ink card isn’t in the cards for you, the Sapphire Preferred still shouldn’t be the main card in your wallet. There are too many other great options out there nowadays. Pick one of those as your everyday spend card. And until Chase gives us more reasons to use it, store the Sapphire Preferred in the drawer.

Even if it tries to send you chocolates on your birthday.

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him @dvlsadvcate on Twitter or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Guess What, Wyndham? I’m Having More Fun Now That We’re Done.

- Yawn… Someone Wake Me If Daily Getaways Ever Gets Good

- Another Mistake Fare? Quick, Upend Your Life!

Find the entire collection of Devil’s Advocate posts here.