In one of my airline analysis posts a few weeks ago, ‘A Tail of Three LCCs,’ I assessed the competitive positions and strategies of America’s three most high-profile low-cost carriers: Spirit Airlines, Southwest Airlines, and JetBlue Airways. These three companies pursue somewhat divergent business models in terms of the passenger type they attract.

Southwest, which pioneered the low-cost business model back in the 1970’s, has shifted its focus towards attracting higher-yielding passengers as it has experienced a rise in cost base over the years to rival that of its legacy “network” carrier competition. It has also become a later adopter towards chasing ancillary revenue channels and expanding its transborder network, something that it traditionally shied away from in previous years even as newer low-cost carrier entrants were quick to add international services and charge for up-sells.

Meanwhile, Spirit focuses entirely on attracting the low-end, no-frills type of traveler, who would likely travel by rail, bus or car (or not travel at all) to their destination rather than on another airline.

The third low-cost carrier, JetBlue, is positioned somewhere in the middle, as a “hybrid” offering that offers some frills at no additional cost to the traveler, but is capable of doing so thanks to a low-cost structure.

Although not covered in this post, it is important to note here that as recently as last week, Denver-based Frontier Airlines is similarly embracing a “no-frills” business model which will mirror Spirit’s in many ways, but retain some value-added structure into its pricing and distribution strategies that will reflect some of Southwest and JetBlue’s blood. I highly suggest readingRocky’s detailed blog post that describes the attributes of Frontier’s business model transition for more information.

Airline business models are 100% dynamic

Airline industry can sometimes be described as a game of musical chairs. Especially when it comes to network growth strategies (one of my primary topics of interest), the nature of “game-changer” decisions can happen so rapidly, we as consumers (or airline fanatics) barely have any time to think about the business drivers behind the resulting outcomes.

Let’s focus on Spirit first. The Miramar, Florida-based carrier once started off entirely as a “niche” airline that flew leisure routes out of hubs at Fort Lauderdale and Detroit, among a few other smaller focus cities in the continental US. In 2007, the carrier did an about face and altered its identity to become, essentially, the Ryanair of the U.S. by charging travelers for virtually every single add-on item, aside from the base price of the seat, and has recorded strong financial performance ever since.

As I mentioned in ‘A Tail of Three LCCs,’ Spirit’s average base fare in 2012 was 20% lower than it was in 2008, yet its non-ticket revenue has climbed 168% over that same period. The strategy is to entice travelers with low-fares that are entirely unbundled, and it is at the passenger’s discretion to educate themselves about Spirit’s add-on fees prior to travel and succumb to either avoiding them or coughing up for them based on their day-of-departure habits and needs.

Now, returning back to the nature of the game-change, it is my firm belief that had Spirit stuck to its previous model of focusing on leisure routes out of a single Fort Lauderdale gateway, it would have probably folded by this point, or been acquired by another competitor. Instead, Spirit not only allowed the success of its new model to explode its network in the Caribbean, Central American and South American markets, but also gain INCREDIBLE traction in large metropolitan cities in the U.S., between Dallas, Houston, Chicago, Denver, Minneapolis and Atlanta, among others.

As a former Dallas resident who spent 18 years of his youth monitoring the airline market dynamics as they evolved in North Texas, I am beyond stunned by the growth DFW airport has experienced within just TWO years since the advent of Spirit. This year alone, nearly half of Sprit’s 18 new routes will originate and terminate from DFW.

Prior to this, when I moved out of Dallas in 2006, the most dynamic change I had ever seen occur at the airport was Delta’s closure of its DFW hub the year prior, as it was a huge loss-maker for the airline. I remember how much of a blow this dealt to the North Texas economy, and how DFW airport officials were literally imploring airlines with incentive packages to absorb the abandoned capacity. Hardly anybody stepped up to the challenge. AirTran tried to create a mini-hub at DFW, but the 800lb gorilla, American, drove them out with its mega-fortress network. Even Southwest refused to move its operations from Dallas Love Field airport to DFW and take up gate space.

Now, I must say, it is nice to see Terminal E filled up to capacity again thanks to Spirit’s newfound success there 🙂

So what’s happening with Fort Lauderdale?

But is DFW’s gain coming at FLL’s loss for Spirit? Recent trends are showing that Spirit is losing ground to JetBlue in South Florida, with Spirit continually shifting its attention away from Fort Lauderdale, while JetBlue has turned its focus inward to grow South Florida, with intentions to double its existing capacity (as the largest tenant at FLL holding 21% market share) within the next 5 years.

JetBlue nonstop and connecting services from Fort Lauderdale as of May 7, 2013. Image provided courtesy of jetblue.com

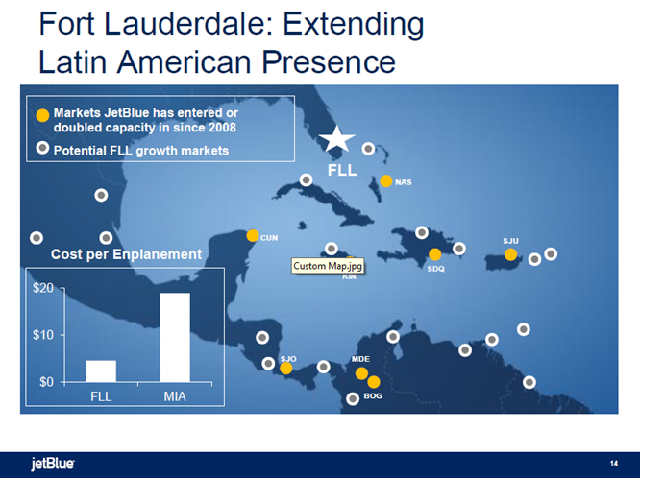

JetBlue grew capacity at FLL by 11.4% in 2012, adding new service to Providence, Bogota, Kingston and announcing plans to launch nonstop flights to Lima, Peru in Nov. 2013.

But it doesn’t end there.

JetBlue CEO David Barger mentioned in an interview with the Florida Sun Sentinel that the carrier owes a “huge thank you” to Broward County administrator and Airport Director Kent George and his team for the $2 billion in infrastructure improvements and terminal upgrades in the pipeline at Fort Lauderdale airport, as well as an $800 million south runway expansion project. Thanks to these investments, JetBlue intends to grow its number of daily round-trips at FLL from 50 to 100 daily, as well as doubling its staff base their from its current headcount of 850 employees and build a maintenance facility at the airport.

Additionally, Barger mentioned in the interview transcript that a new post security connector between Terminals 3 and 4 “will allow customers to more seamlessly move between” the two terminals, “an important component of the infrastructure we’ll need to succeed in the future.”

Assuming these visions are fulfilled, FLL will rank #3 as JetBlue’s largest focus city behind New York JFK and Boston Logan airports.

JetBlue-identified potential expansion cities from Fort Lauderdale, taken from slide 14 of JetBlue’s Analyst Day presentation on March 20, 2013.

So why is Fort Lauderdale so appealing to JetBlue and not so-much-so for Spirit these days? Given the ambitious expansion plans JetBlue has in store for Laudy, does Spirit have something to fear, or can the two co-exist in the same airport without pushing the other carrier out on competing routes?

And, speaking more broadly, does American Airlines have any reason to panic several miles south where it operates a lucrative fortress operation at Miami International Airport, particularly to Latin America, that has minted money since the day the hub was acquired from Eastern over two decades ago?

The fact is, FLL’s operating costs are nearly one-fourth of that of Miami’s, and with 4.4 million Hispanics residing in the South Florida region, there is room for growth. Not only is the demand hailing from short-haul markets within the Caribbean and Central America, but also in the Northern South America region, particularly high-growth markets in Colombia and Peru. JetBlue has achieved rapid market maturity after launching services from Fort Lauderdale to Bogota, Medellin and Cartagena, Colombia, appealing to market demographics with its hybridized product offering and attractive fare bundles.

Moreover, the “sweet spot” that JetBlue can tout is that not only are its fares lower than the entrenched legacy competition offering flights from Miami International to Colombia (such as LAN, American, Avianca, etc) but also that Fort Lauderdale, as an entry point into the U.S., is much less of a hassle than at Miami.

Furthermore, on a 3 hour + flight to Colombia, JetBlue can largely get away with charging a bit more than Spirit while giving passengers peace of mind by not charging them for their first checked bag, carry-on luggage, snacks and drinks and in-flight entertainment.

Therefore, given these noteworthy gains from the Colombia services, JetBlue hopes to extend the same favorable brand attributes to successfully develop the new flight to Peru, and possibly beyond.

Meanwhile, even though JetBlue has toppled spirit as the largest carrier at FLL in terms of seats on offer (holding 19% of capacity share versus JetBlue’s 21%), Spirit still offers more international capacity from Fort Lauderdale, with 35% of its network from FLL serving international destinations compared to JetBlue’s 19%.

Spirit Airlines systemwide route map as of May 7, 2013. Image courtesy of spiritair.com

Still, Spirit probably won’t heed much notice to JetBlue’s expansion efforts, adopting the mantra, “if it ain’t broke, why fix it?” Expounding on that, Spirit is likely satisfied with the status quo of its Fort Lauderdale operation, particularly in the international arena, leaning on the belief that there will still be plenty of sustainable demand for its lower-end product even as JetBlue continues to flex its muscles and flood the market with additional capacity that appeals to a higher-end type of traveler.

Taking all of this together, the expansion efforts made by JetBlue reflect more on the principle that there is room for all three carriers to coexist in South Florida, rather than shifting market dynamics. American, LAN, TACA, Avianca, and the remaining legacy players will appeal to the high-end of the South Florida to Latin America market out of Miami. Spirit will cater to the bottom end, and JetBlue can fill the gaps somewhere in the middle. Each will be able to walk way with something from the table without fear of siphoning too much away from the other.

The reality is, Spirit knows that expanding in the continental U.S. is a much higher priority for them rather than exhaust efforts by deterring passengers away from JetBlue as it expands at FLL. There is still TONS of low-hanging fruit available to exploit in busy metropolitan area city-pairs that are ripe for a new low-fare carrier entrant. This will hold especially true given that two major mergers are still in progress (Southwest and AirTran and American and US Airways) as consolidation will result in reduced Available Seat Miles (ASMs) at cheaper fare prices, which is basically a nod in Spirit’s direction to enter and scoop up the low-end traffic the legacy carriers will not cater to.

Moreover, as long as this strategy continues to pay dividends for Spirit, (which it has considering its net income has risen 200% between 2008 and 2012 since transforming to an ultra LCC), then it really has nothing to fear. When you’re able to rapidly expand your network without taking a major hit to the bottom line, the world is your oyster.