Many people like to use a referral service like Big Crumbs or Ebates to earn cash back on purchases they would have made anyway. This is very similar to the shopping portals set up by airlines that provide miles; the only difference is that Big Crumbs and Ebates give you cold, hard cash.

Big Crumbs in particular is a favorite of some frequent flyers who like to use it to make purchases on Expedia and earn $2.80 for every flight. Other travel bookings earn a percentage, but air travel is a fixed credit. But I don’t like to do this because of my hesitation when booking air travel through an online travel agency (OTA). If anything goes wrong, the airline points to the OTA, the OTA points to the airline, and you’re stuck in the middle going nowhere.

Back when airlines started their own websites in the ’90s, it wasn’t uncommon to see booking discounts for using their websites. 1,000 miles or perhaps some kind of discount was to be expected since you were saving them the commission they otherwise had to pay travel agents, both the humans and the online startups. Those are largely gone, which means the only real incentive for booking with an airline is the caution against irregular operations that I mentioned above.

Continental Airlines, now part of United Airlines, created a service around 2005 or 2006 called the Continental.com Club, which would provide you with $5 credit for every flight purchased online. It originally cost $10 to join but was later increased to $25 per year. I never knew about this program since it never really got much advertising behind it, at least recently with the merger going on. However, it could be a good deal if you were booking more than five flights year year, earning some cash back above and beyond the membership fee.

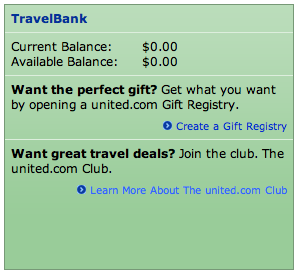

I’m happy to report that the Continental.com Club has been rebranded, like most things merger-related. For an annual fee of $25, the United.com Club will provide a $5 credit to your Travel Bank for every ticket you purchase. This includes tickets purchased for other people, so encourage your family members who don’t travel very often to let you book their tickets for them. Those $5 credits add up quickly, and the Travel Bank is essentially a digital gift card that you can use at any time to help pay for future travel.

Help Friends Help You

I like the idea of using my Club membership to pay for my travel as well as other people’s tickets. While you could use this as a way to meet the minimum spend requirements when churning credit cards, I am lucky to have the no-longer-offered United MileagePlus Select Visa card, which provides 3X redeemable miles on all purchased through United.com as well as 1X elite qualifying miles (there is a cap of 5,000 per year on the EQM). Usually it’s not too hard to work in the suggestion that they let me book the ticket if I’ve already provided help finding them a good flight.

If I planned on purchasing 20 tickets totaling $5,000 for myself and 10 tickets totaling $2,500 for Megan (this is in-line with our requirements to requalify for 1K and Gold status this year) then that would be $150, 22,500 RDM, and 5,000 EQM. Assuming I also purchase 10 $250 tickets for my family members during the course of the year, I would get another $50 plus 7,500 RDM. With Megan and I possibly getting married next year, I like where this math is heading! The Travel Bank credit and extra miles could probably be used to pay for a couple tickets for people who otherwise wouldn’t be able to afford to come.

If you don’t like using or don’t have the United Select card, you can also use the American Express Premier Rewards Gold card to earn 3X points on airfare and transfer them to various partners–although not to United. I would also recommend using the Chase Sapphire Preferred card. Although you would only get 2X points, they can be easily transferred to United or several other partners, and like American Express Membership Rewards points, they can be transferred to other peoples’ accounts. That flexibility, and the ability to use them with an airline you already clearly prefer to fly, helps compensate for the reduced bonus.

I would NOT recommend using the Continental OnePass or new United Explorer cards, which have relatively paltry card benefits. Anyone with elite status is not getting much from these cards, and it is the frequent travelers who likely have elite status who are probably going to get the most benefit from the United.com Club.

The Terms & Conditions for the United.com Club are very obvious boilerplate stuff, so I’ll leave you to read them online. However, you should be aware that (1) only U.S. residents, including territories, are eligible to become United.com Club members and (2) the $5 credit is not awarded until after the itinerary has been flown, just like RDM and EQM.

FAQs from United’s Website

How much does it cost to join?

Annual membership is available for only $25 (subject to change). With the $5 you get back every time you purchase a ticket at united.com, you’ll quickly find value in your membership.

How do I enroll?

It’s easy – select Join the united.com Club, sign in to your MileagePlus® account and fill in the enrollment form. Start saving when you become a united.com Club member. Learn more about the united.com Club. Not a MileagePlus member? Enroll in MileagePlus now.

If I purchase a ticket for another person, do I get the credit?

Yes, as long as you are signed in when you make the purchase. A $5 united.com Club credit will be deposited in your TravelBank when travel is completed on any ticket purchased at united.com.

Can I use my credit toward any flight?

Yes. Credits are deposited in your TravelBank and may be applied to any air travel purchased at united.com (excluding MileagePlus award travel).