Although I don’t spend nearly as much time talking about it, I do some credit card churning just like most bloggers and frequent travelers. It’s an inexpensive way to pad your miles and points balances, and in my experience it has actually increased my credit score significantly. Given the recent news that the Chase Sapphire Preferred Visa’s sign-up bonus will be decreasing, I finally FINALLY got some members of my family to sign up for one while the 50K bonus Ultimate Rewards points are still available. The biggest source of their resistance–which is still a concern–has been how to keep track of all these cards I churn. Megan has the same worries, although they’re lessened somewhat since I keep track of her cards for her (we usually sign up for the same cards anyway).

You have to make sure you pay off the balances, you have to reach the minimum spending thresholds (if any) on time, and you have to cancel those cards that you don’t really want to keep before the annual fees kick in. It’s a lot to keep track of, so how do I do it?

The short answer: I just do it in my head. Really, I don’t think it’s very hard, especially since this is a topic I’m reading about frequently. I have the bonus requirements mostly memorized, and if you really want to know how old your account is, just look at the expiration date on your card. That’s usually good enough. I check Million Mile Secrets for most of the current deals, but I also pay attention to what other bloggers write.

The long answer: It’s pretty close to the short answer. I do use the credit pulls database at CreditBoards.com to get an idea of which credit bureaus the banks will call to get my information. It’s best to avoid too many pulls from any one bureau. I also take a look at the cards I have and try not to focus too much on one bank at any time. The rule of thumb with Chase is that you shouldn’t apply more than once ever six months, but I’ve gotten approved at five and four months in my last two applications.

Pay Your Bill

Finally, the biggest issue is just making sure that I pay my balances. One of the first rules of using credit cards–especially rewards credit cards with high interest rates–is to only spend money you actually have in the bank. Use it like a debit card you pay later. When I get an email alert or a paper bill in the mail, I pay it immediately because I already have the money in the bank. I think Wells Fargo has a particularly convenient online bill pay service, but they’re all pretty much the same and cost nothing.

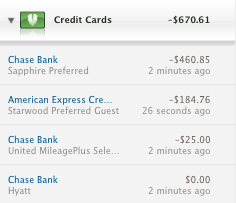

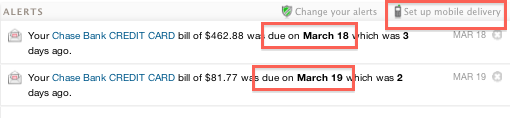

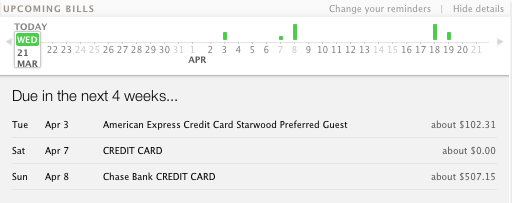

If I should forget, then we have a potential issue. Sometimes emails are lost when you get 50 or 100 in a day, or a paper bill gets thrown out with the recycling. That’s why I also use Mint, an online service from Quicken that will pull all your financial account information and display it in one place. It’s a nice way to keep track of my expenses so Megan and I can reconcile our accounts each month. It also watches your credit cards and will alert you when bills are due. It does this in more ways than one, so I usually pay attention.

I try only to carry two or three cards at a time so I don’t have six cards to keep track of. If I’m not spending on them, there won’t be a bill. Megan, being a woman, carries a purse with a giant wallet that has every credit card she owns. I think that’s a bad idea. She’ll make minor charges on each one and ends up with six bill payments every month.

Canceling a Card after the Bonus

When it comes time to cancel, I just get a feeling. I double check that we’ve held a card for at least six months before canceling by looking at our online statements to ensure we’ve received six of them–this usually requires seven months of activity. If you hold a card for less than six months, some banks will take the bonus back. And then after that I cut up the card and throw it away.

It might make sense to keep better records of the cards I’ve opened and closed. True churning involves applying for the same card over and over. This is mostly gone with banks like Chase, although a few banks will still let you do it and even let you apply for the same card while the first one remains open! But I don’t play that game. I don’t open enough cards each year to have come close to running out of options, and I think it’s slightly unethical to take advantage of every loophole. (Whatever that means. I realize there are probably a lot of ethical contradictions I haven’t explored here, but it’s how I feel.) I figure if I get to a point where I really need to know the last time I opened and closed a particular card, I can get that information from a credit report.

No binders full of credit cards, current and expired. No sticky notes with reminders taped around the card. No instructions written with a Sharpie that this card earns 3X on travel and that one earns 2X on dining. It’s just more work than I care to put into this particular endeavor. I earn my sign-up bonus. I earn some category bonuses, even if some are less optimal. And I pay the fees on cards that actually include some useful perks, like Hyatt’s complimentary Gold Passport Platinum status and United’s 3X RDM and 1X EQM on purchases.

So, if you wanted to know how I keep things strait, it’s really quite easy. I don’t let them get complicated to begin with. I’m pretty sure I’m getting at least 50-75% of the miles as anyone else with far less aggravation. So I hope that convinces some of you who are still on the fence about churning credit cards. You don’t have to jump in and apply for six of them in your first go. You don’t have to apply for another four every three months. Start small, figure out what you can handle, and stick to that.