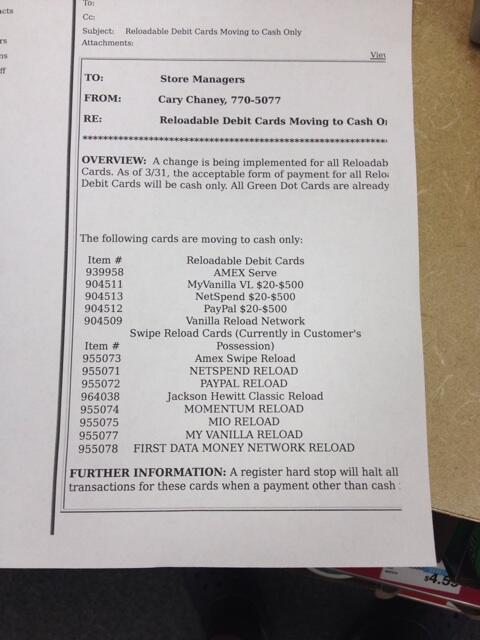

The news is looking grim for manufactured spenders. The reports of CVS stopping the use of credit cards for Vanilla Reloads and other prepaid debit card products tomorrow seems to be true according to memos in stores around the country. Many people are going around to multiple stores in their area today to finish out what’s been an 18-month spell of using credit cards for Vanilla Reloads at CVS.

Why is CVS enacting this policy NOW?

Long time readers of this blog will recall that my first ever post to Hack My Trip was in late 2012, when I posted an interview with Walla.by founder Matthew Goldman.

If there’s one person I can trust about how prepaid and reload networks work, it’s Matthew. He used to be the Director of Retail Strategy at Green Dot, which is a major prepaid card provider. In fact, it wasn’t until Green Dot put a huge sign on the outside of their building that I realized that I actually work across the street from their headquarters. Needless to say, the CVS down the street definitely doesn’t take any credit cards for Green Dot products.

Matthew wrote a great post on Why Manufactured Spending is a Problem For Retailers — it’s really worth a read if you’re curious about this stuff. He’s also answering questions in the comment section, so don’t miss that.

All this aside, there’s one party we haven’t mentioned who hates this. That is regulators. Whenever a bunch of funds are moving around in odd ways it presents a risk for money laundering. The folks doing manufactured spend tend to say, “hey, I’m not a criminal, so it’s OK.” That’s an overly simplistic look.

So while the travel hackers are bending the rules, there are real fraudsters and criminals who are using this exact same setup to steal and launder money. For example, you can steal a credit card number (e.g. from the Target breach), then buy a bunch of reloads, then get cash from the credit card. This fraud problem is going to end up with InComm or CVS in the end. That’s not good.

No retailer, especially as large public one like CVS wants to be responsible for crime and fraud and I imagine this whole setup has been costing them some real money.

I agree that those of us doing manufactured spending aren’t criminals, but it’s hard to verify that, especially for regulators. Office Depot shut down Vanilla Reload purchases with credit cards after 6 months, so I’m surprised CVS allowed us to go for 18+ months (and even increased the limit from $1,000 to $5,000 per day halfway through that spell). I think CVS ending credit card purchase was inevitable and tomorrow just happened to be the day.

Matthew also points out that while Green Dot products explicitly disallow credit card purchases, he would often go to different drug stores and find that compliance was weak (and I know that for a fact, as a certain local drugstore sold me MoneyPaks with a credit card for a long time). It may be the same for some CVS stores and Vanilla Reloads, so tomorrow’s policy may not go into effect for a while at your local store.

I’m not sure this is the END of the Vanilla Reload game. When I was in charge of merchandising for Green Dot, I used to travel around from drug store to drug store to monitor compliance with GDOT and retailer policies. Let’s just say it was weak.

In the end, there will always be ways to earn miles and points for cheap. We just have to keep a lookout for the next opportunity.