Most credit cards that include airport lounge access specifically exclude this benefit from additional cards issued to authorized users. Only the primary cardholder enjoys access, which is understandable. If you were to just buy a lounge membership, only the member would have access.

Only a few lounge networks provide discounted memberships for a spouse — still an extra charge. American Express provides access to its Centurion Lounges and to Priority Pass lounges for authorized users, but those users also need to pay a fee, currently $175 for up to three additional users.

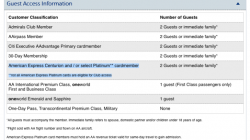

That’s what the recent news from American Airlines and Citi is so significant. Authorized users on your Citi AAdvantage / Executive WorldElite MasterCard can now enjoy the same lounge access benefits even when not traveling with the primary cardholder. (HT to One Mile at a Time) These benefits include the ability to guest other travelers into the lounge and the ability to access Alaska Airlines Board Rooms when traveling with Alaska or American.

Because there is no fee to add an authorized user, this could be a compelling reason to keep the card if the annual fee is coming up. Personally, I use my card almost exclusively to enter the Board Room since I’m based in Seattle, but my wife can’t get in when she travels by herself. I didn’t even bother adding her as an authorized user because I knew she wouldn’t be able to get in.

Citi AAdvantage Executive or Citi Prestige?

I’m still not convinced that I should keep the Citi AAdvantage Executive card. The alternative would be to get the Citi Prestige card, which doesn’t come with an Admirals Club membership but does allow you to use the Admirals Club when traveling with American. In addition, it includes a Priority Pass Select membership that admits you and a guest for free to participating lounges, including the Alaska Airlines Board Room. This is different from most Priority Pass Select memberships that include no complimentary access or access for just the primary cardholder.

In other words, I could get the Prestige Card and still get access to the Board Room or Admirals Club when I fly with Alaska or American — pretty much the exact scenario I face today. I would lose the ability to visit the Admirals Club when I’m traveling on a different airline, but this happens rarely. My wife still wouldn’t be able to visit the lounge without me, but this also happens rarely.

What I would gain with Citi Prestige card are several other valuable benefits, including a $250 annual airline fee credit, the ability to refund the fourth night of my stay when I book a hotel through Citi, and the ability to earn ThankYou points that I can redeem like cash on American Airlines — even codeshare flights on Alaska Airlines and others. For me, those far outweigh the benefits of a second Admirals Club membership.

Great Deal for Some, Meh for Others

The big news today is that if you and your significant other are both frequent travelers, you can now pay for one card and effectively get two membership fees. The $450 annual fee on the card is the same as the renewal rate for an Admirals Club membership if you are an American Airlines customer with no status. If you have status, the lounge membership is discounted as low as $350 for Executive Platinum members, but that only covers one person.

So, I think this is justifiably big news. Just not for me. Better options still exist for families with just one frequent traveler or who nearly always travel together.