Last week I confirmed that Marriott would be going ahead with an effort at rebranding its three “separate but equal” loyalty programs (Marriott Rewards, The Ritz-Carlton Rewards, and Starwood Preferred Guest) under a common banner. Marriott Bonvoy, a new name with the same benefits, will also result in changes to Marriott’s credit card portfolio with American Express and Chase. These two card issuers each had a relationship with one of the two merging companies, and both relationships were retained. But it’s time to clean house and align the new brand with a new card portfolio.

Chase will be primarily focused on new applications for the entry-level and premium personal cards while Amex will focus on new applications for the super-premium personal and business cards. All cards, however, will continue to be available to existing cardmembers even if they are not open to new applications.

Changes to Marriott and Ritz-Carlton Cards from Chase

Marriott has three co-branded credit cards issued by Chase. These are associated with the Marriott Rewards or The Ritz-Carlton Rewards brand. Here’s how the new names will be aligned:

- The Marriott Rewards Premier Plus Card will become the new Marriott Bonvoy Boundless Card

- The Marriott Rewards Premier Plus Business Card will not receive a name change as far as I’m aware, presumably to avoid confusing with the Amex business card

- The Ritz-Carlton Rewards Card will become the new Ritz-Carlton Card (note the branding is associated with the hotel and not the loyalty program)

- Chase will introduce a no-fee personal card for Marriott Bonvoy this summer as a step down from the premium Marriott Bonvoy Boundless Card

New applications for the Marriott Rewards Premier Plus Business Card will be discontinued, and applications for The Ritz-Carlton Rewards Card have already ceased for several months.

However, both of these cards will get some new perks to match those being offered for the business and super-premium cards that are being maintained by American Express (see below). Specifically, the business card will offer the chance to earn a second annual free night award after spending $60,000 and the Ritz-Carlton Card will offer the chance to earn a $100 property credit for eligible stays of 2+ nights booked at The Ritz-Carlton or St. Regis hotels.

Changes to Starwood Preferred Guest Cards from American Express

Marriott has three co-branded credit cards issued by American Express. These are all associated with the Starwood Preferred Guest brand. Here’s how the new names will be aligned:

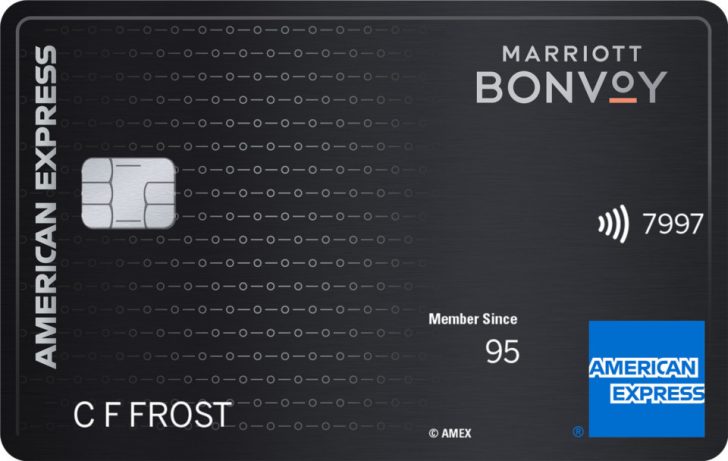

- The SPG Luxury Card will become the new Marriott Bonvoy Brilliant Card

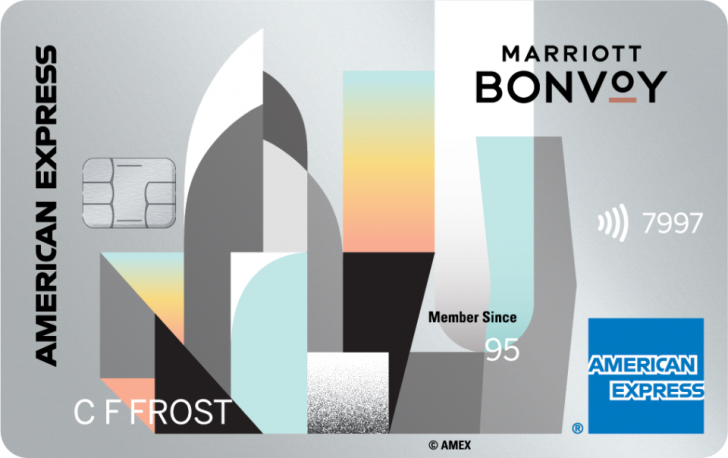

- The SPG Credit Card will become the new Marriott Bonvoy Card

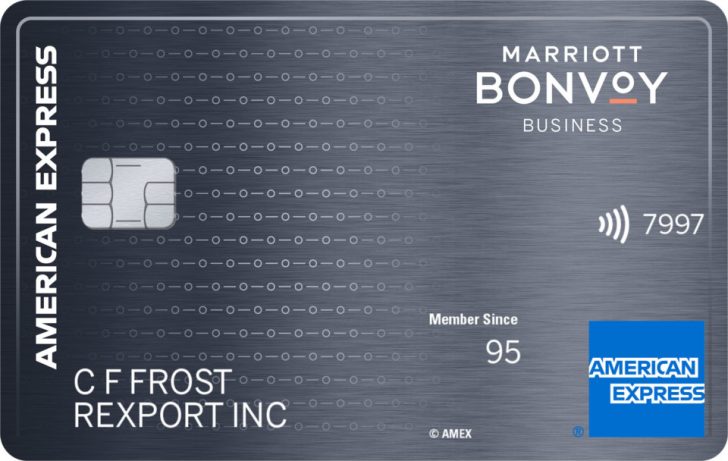

- The SPG Business Credit Card will become the new Marriott Bonvoy Business Card

A few benefit changes will be coming with the new names to make these cards even better. I’ll focus on the Marriott Bonvoy Brilliant and Marriott Bonvoy Business cards here and discuss the Marriott Bonvoy American Express Card at the end of the post.

The Marriott Bonvoy Brilliant card will also include a $100 property credit for stays at The Ritz-Carlton or St. Regis hotels. You must book a two-night stay or longer using a special rate code. This is very similar to a benefit on the Hilton Honors Aspire Card from American Express. (Both cards also offer an annual statement credit, though Marriott’s is for room charges and Hilton’s is for airline incidentals.)

The Marriott Bonvoy Business Credit Card will include an additional free night award beginning on March 28, 2019. This will be awarded after spending $60,000 or more annually on the card. Yet again I see some parallels with the Hilton Honors Business Card from American Express (though that one has a lower threshold of $15,000). Bad news: the business card’s annual fee will go up to $125.

15 Nights Credit toward Elite Status

All of the Marriott Bonvoy cards issued by American Express and Chase will include credit of 15 elite nights that will help members reach the next elite tier. This is kind of a mixed bag for people with cards that already include status or who already plan to earn status by reaching a spending threshold. Note that this kind of credit doesn’t count toward lifetime elite status, and you only get one credit of 15 nights. You don’t get 30 or 45 nights for having multiple cards.

New Card Offers from Amex and Chase

I think the name changes and benefit enhancements would be enough, but American Express is also running a promotion by temporarily increasing the sign-up offer on these cards for new applicants.

Between February 13, 2019 and April 24, 2019, eligible new card members who sign up for the Marriott Bonvoy Brilliant American Express Card or the Marriott Bonvoy Business American Express Card can receive 100,000 points after spending $5,000 in the first three months of card membership. Chase will be offering something similar when the Marriott Bonvoy Boundless Card is launched.

Similar offers were made last year, and I took advantage of both, but they had since dropped down to 75,000 points. I recommend you take another look at the 100,000-points offer if you haven’t already applied. Remember you and a spouse can each apply, and you can transfer 100,000 points per calendar year if you need to consolidate points for a big redemption.

Changes to Starwood Preferred Guest Credit Card

The existing, entry-level SPG American Express card will be rebranded as the Marriott Bonvoy American Express card, and it will be closed to new applicants after February 12, 2019. You can keep the card if you already have it, but Amex and Marriott understand some people are a little frustrated with the card since the program changes.

The old SPG Amex earned 1 SPG Starpoint on everyday purchases, and that was bumped up to 2 Marriott Rewards points after the merger. Unfortunately the conversion rate between points was 1:3, which means you’re still earning less on everyday purchases.

Beginning on February 24, 2019, existing Marriott Bonvoy American Express Card Members who signed up before January 23 will get a special offer. You can register to earn 25,000 points for every $25,000 in eligible purchases on the card, up to four times for a maximum of 100,000 bonus points. That could effectively restore the everyday earning rate under the old SPG program but only if you reach these thresholds.

This is based on the total amount of purchases starting from when the card member registers through the end of the year, so don’t make any big purchases yet! Additional information will be sent to card members by American Express.