MileWise is one of several travel startups that presented at the LAX Frequent Travelers University as part of a new MilePoint investment program.

I had heard about MileWise several times through a few of its employees, and it’s about time I sit down and write this review because they really have some amazing potential!

Basically, MileWise tracks award space, searches traditional revenue space, and then does the comparisons to figure out if you’re better off using miles and points or cash to book your next trip. In fact, it can even track you miles and points balances through its relationship with AwardWallet. (I’ve reviewed AwardWallet previously. If you want to upgrade your account for free, one of my readers has provided a code for the first 15 people to use it: “free-ktefdt”. Thanks, Sahil!)

Accounts

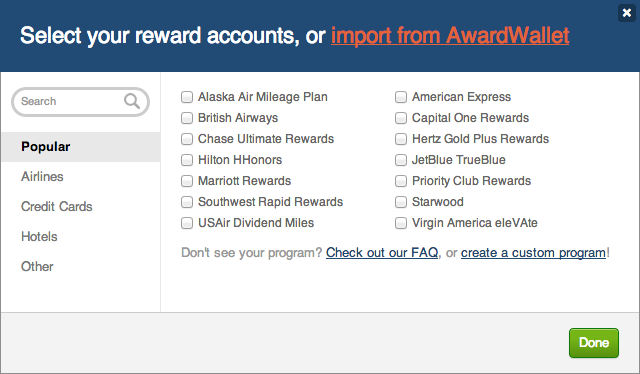

I set up a new account on MileWise and the first step was adding all my award programs so MileWise knows how many miles I have and what I can do with them. You can reach this page at any time by clicking on the Accounts tab at the top of the page.

Since I already had an account with AwardWallet, I just clicked the “Import” button. …Unfortunately, this feature wasn’t working at the time. After discussions with the MileWise team, it appears mine was an isolated incident.

At least I got to try out the live tech support at the bottom of the screen, which functions much the same as it does on Hipmunk. Response time was good, and I can say that eventually the process worked and all my accounts were imported.

In the meantime, I added a few accounts manually for testing purposes. The process was as simple as it is on AwardWallet. Enter your account number and password, and the information is loaded. After the import feature began working again, the edit tool was useful to clean up the results, which are imported without the same organization you find on AwardWallet. I had to do things like remove my Groupon account and distinguish my accounts from Megan’s. Use the nickname feature to rename any account.

Non-supported programs have to be added manually. These currently include United, Delta, and American Airlines. In fact, MileWise won’t even search for their award space nor will it search for normal revenue space offered by American. This is a serious drawback for me, but to be fair, it is not within their control. Let’s hope they manage to workout a successful business relationship soon!

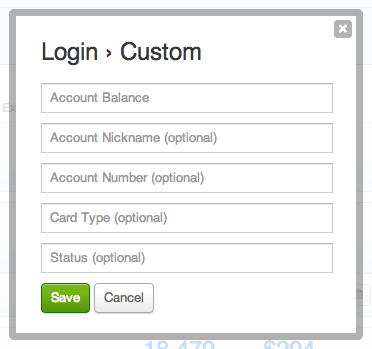

But you can at least track your balances in these “forbidden” programs. After opening the window to add new programs, click on the link to “create a custom program.” A blank entry will appear in your account summary, and opening this will allow you to edit account balance, account number, status, and other features. You can do the same thing with supported accounts if you don’t want to share your password.

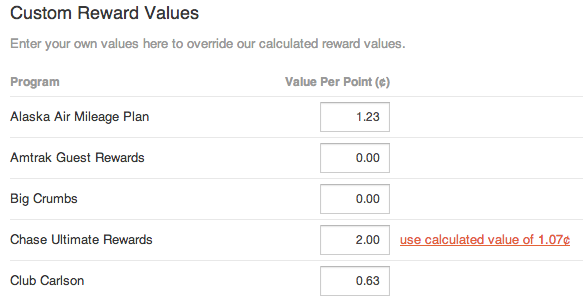

Once your accounts are loaded, MileWise uses its own calculations of the value for each point or mile in different programs. I didn’t see much to disagree with. US Airways seemed a bit high at 2.15 cents per mile, but then again the program’s restrictions are offset by a very generous award chart. Custom programs don’t come with the point value preloaded. To add a value or change an existing value, choose “Advanced Reward Options” in the right navigation menu or the “Settings” link at the top. Not all programs have pre-calculated values yet, so you’ll probably need to do this anyway.

This opens a large survey asking for more information about how you travel so MileWise can improve its suggestions. It reminds me a bit of a dating website questionnaire. Scroll to the bottom and you can find the option to modify mile and point values.

With the essential account features set up, let’s move on to the two other major tabs, Search and Explore.

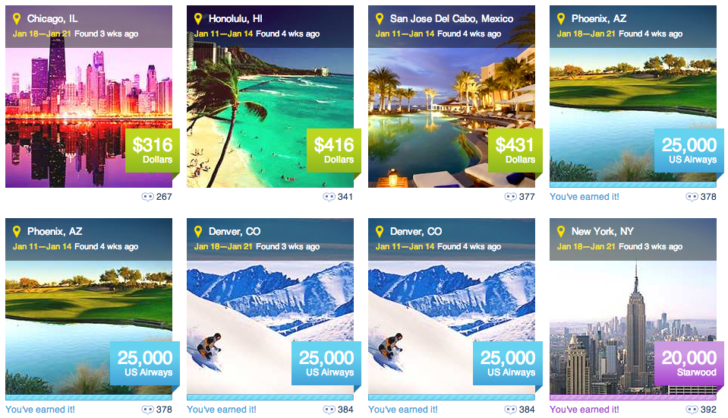

Explore

Explore provides example trips found by recent users. There is a mix of cash bookings and award bookings, speaking to MileWise’s ethos of finding you the best compromise between earning and burning. You can change your origin airport at the top and even limit it to search types of destinations (sun, ski, etc.)

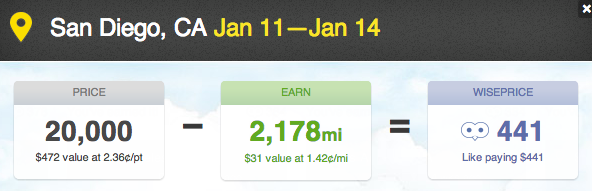

In small type below each picture is a pair of owl eyes and a number. This is the “MileWise price,” a calculation that trades off the cost of the trip–either cash or the value of the points/miles used–plus any additional fees and minus the value of the additional points and miles earned. It’s best explained using examples from the MileWise site, so I’ll pick two:

This flight from Seattle to San Diego over January 11-14 costs 20,000 SPG Starpoints, which MileWise has calculated are worth 2.36 cents per point, or $472. However, I’ll earn 2,178 miles, which are worth 1.42 cents per mile, or $31. This means the final “cost” is $441.

The problem is that on my Accounts tab, Starpoints are worth 2.89 cents per point. I didn’t even change this value (it’s the default), so I’m a bit confused why I’m getting something different on the Explore tab. I also don’t know which program those earned miles will go into, so this information, while well intentioned, is a bit useless.

Part of the problem is that MileWise has had a few issues recently updating these results. After seeking more information, I learned that these are, in fact, results for available flights and not flights found and booked by other people. I later found evidence of more recent queries, and MileWise says it has addressed this issue so that outdated results are less common in the future. It also needs to be spelled out which miles I’m earning. If those 2,178 miles go into my highly active United account, I will value them very highly. If they go into a program I never use, a few thousand miles are relatively worthless by themselves.

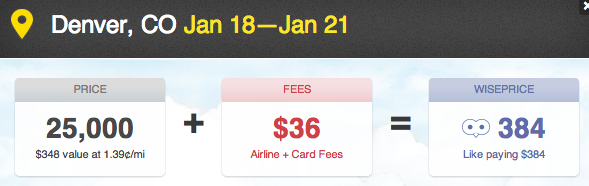

Here’s another example of a US Airways flight to Denver. Now it costs 25,000 US Airways Dividend Miles and $36 in fees. No additional miles. So with an assumed valuation of 1.39 cents per mile, the total trip cost is $384. Again, we see a problem where MileWise is using valuations other than what I specified in my Accounts tab.

I find the concept of the Explore tab very exciting. The current execution leaves me wanting more, but I’m glad to hear the issues are being resolved. Out-of-date information is a big reason I don’t use Kayak’s fare alerts. By the time the email hits my inbox the next day, the best deals are usually gone.

Search

Lets move to the final tab, Search, which is probably what I would use more often since I have a knack for ignoring recommendations. I originally tested this feature with a trip to Amarillo but later realized this was unfair. Despite the program participation restrictions I mentioned earlier, MileWise searches award space using points from the following programs:

- Alaska Airlines

- British Airways (Avios)

- JetBlue

- Virgin America

- US Airways

- Air Canada

- Air France

- ANA

- Lufthansa

- Qantas

- American Express (Membership Rewards)

- Capital One (Venture Rewards)

- Chase (Ultimate Rewards)

- Citibank (ThankYou Points)

- US Bank (FlexPerks)

- Starwood

MileWise will consider transfer opportunities, like moving 20,000 Starpoints into an airline account, and then taking advantage of the 5,000 bonus miles to book a 25,000-mile award flight. However, the restriction against United award search prevents it from doing something similar with, say, transferring 25,000 Ultimate Rewards points to United.

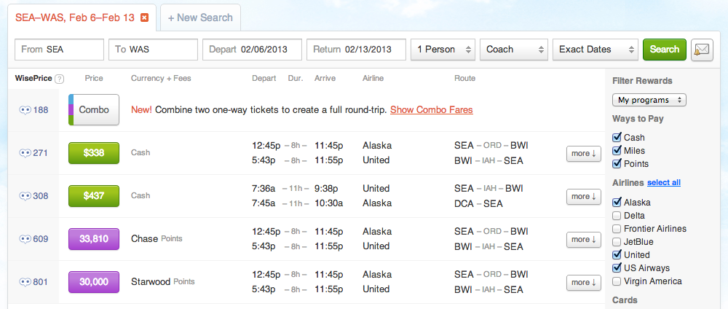

So I did a new search from Seattle to any of the three airports near Washington, DC. I excluded a few airlines I didn’t want to fly and was left with this. During the search, I’m reminded that results are color-coded: green = cash, blue = miles, and purple = points. “Points” in this case mean hotel or bank points like Starpoints, ThankYou points, and Ultimate Rewards points, that can be used with fewer limitations than traditional airline miles. Remember, these still earn you airline miles because they book into revenue space, but they are technically awards.

I found four main results: two cash options using United and Alaska airlines, an option using Starpoints, and a Combo fare. Combo fares are MileWise’s way to say you can book one type of trip on the outbound and a different kind on the return. In this case, both directions were cash (just separate reservations), but they could also include things like mixing a one-way award and a one-way cash ticket.

Again, you can see that there is a list of prices and a list of WisePrices next to it. The WisePrice indicates that all of the cash options are superior to the two points redemptions without me having to do the math on my own. If you click on the More tab with the downward arrow, you can see additional yet similar results.

The more I use it, the more it appears this interface functions very similarly to Hipmunk, even including the “New Search” tab at the top that lets you run a second search without closing the old one. When you click to book a fare, it gives you the same options to book with the airline or Orbitz. But one nice addition is that it also provides alternative points redemptions for several other programs that weren’t visible on the first page, giving you one last chance. Why weren’t these options listed earlier? I think it may be a case of over-simplification, which will hopefully be corrected in time.

Unfortunately, there doesn’t seem to be any way to specify certain connections and flights as you would with Hipmunk using ITA’s advanced routing language. However, MileWise will let you set fare alerts so you can be notified when a great deal appears.

Conclusion: Is MileWise a replacement for AwardWallet?

I’m not sure I would go that far. MileWise has done a lot of cool things to make tracking my accounts even easier than it was with AwardWallet. I like the cleaner interface, for one. Finding relevant information about my accounts is a lot easier with MileWise. Being able to track mile/point values along with balances also gives me a better idea of how much I’ve accumulated.

But you can’t have one without the other. MileWise is using AwardWallet’s technology to collect and store most of this information. The predicament, as I see it, is that AwardWallet makes MileWise much better, but I don’t see what MileWise does for AwardWallet. Over time this may hurt AwardWallet’s traffic. Maybe they would be better as a single company.

What I’m looking forward to seeing is an improvement in the number of partners MileWise is working with. Adding one or two of the major legacy carriers will go a long way to making this service more valuable than it already is. Right now, because of the programs I follow, I won’t be getting the best value out of its award and flight search tools. Some of you may find better luck. I think that MileWise may have better and more diverse revenue streams available to it that will give it a better position when negotiating a business relationship, assuming the airlines demand to be paid for access.

Finally, I really hope MileWise adds hotel search in the near future (I’m told this is coming later this month). Flights are great, and I know it makes sense to start with them. Using miles to book award flights is complicated, so they’ve made it easier. A bigger reason may be that booking flights earns smaller commissions than booking hotels, but customers still earn miles. If MileWise added hotel search, the traditional relationship is that the agent collects a fat commission and the customer gets no points or stay credit. That would not win MileWise many fans and undermines its current strategy. It will be interesting to see how MileWise resolves the issue, which I’ll explore more thoroughly when I review PointsHound.