Chase announced new rules last week that affect the ability to transfer your Ultimate Rewards points to an outside loyalty program such as United MileagePlus or Hyatt Gold Passport. It’s important to note that these rules DO NOT affect your ability to transfer Ultimate Rewards points between different cards within Chase; the consequences are for external transfers only.

However, given the hard line that Chase has taken on people who abuse its transfer rules in the past, it’s important to stay informed. My Chase Sapphire Preferred card was shut down a couple years ago because I made a transfer to my then-fiancee. Since she wasn’t my spouse — yet — Chase flagged it and didn’t provide much opportunity for appeal. (They did let me keep my points by moving them to my Ink Bold business card.) I suppose the good news is that it means it’s been long enough I can reapply for the new 50,000 points signup offer.

Here’s the message I got from Chase in the secure message center:

We are making changes to the Chase Ultimate Rewards® point transfer program.

Here are a few things you need to know:

Starting November 15th, when you transfer points to participating frequent travel programs, you can only transfer points to yourself or an owner of the company who is listed as an authorized user on your card account.

If you previously saved your frequent travel program numbers on Chase Ultimate Rewards, you will need to reenter them.

Please make sure the name on your Chase account matches the name on your frequent travel program accounts.

See? That’s not too bad! I would really view this as a clarification of the existing terms and conditions. If Chase doesn’t want you transferring Ultimate Rewards points to and from other people’s cards, then they certainly don’t want you transferring them to other people’s external loyalty programs.

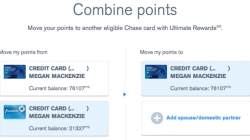

You’re still granted one other person to share with. While internal Ultimate Rewards transfers can only be with a spouse or domestic partner, this new rule on external transfers doesn’t mention anything about being a spouse. Instead that person must be an authorized user. If your spouse or domestic partner isn’t already an authorized user on your account, I recommend you add him/her to avoid any potential issues with Chase in the future.

My dad contacted me with a more specific question about matching names, even if you don’t transfer to an authorized cardholder. He goes by “Don” on his credit card but “Donald” on his frequent flyer accounts. I’m not as concerned about that issue. I think a computer would be intelligent to match the nickname, and if it got flagged for review the case manager would probably understand the potential confusion. That’s not the kind of fraud that Chase is trying to avoid here. But if you have a more drastic name difference, such as if you go by your middle name, then I highly recommend you correct that as soon as possible.