Living in the Pacific Northwest has its benefits, but access to the tools for manufactured spend on credit cards is not one of them. Attentive readers will have picked up by now that it is virtually impossible to buy Vanilla Reloads in Seattle. There are no CVS stores in the entire state of Washington …or Oregon, Idaho, or several other states for that matter.

Walgreens carries Vanilla Reloads, but they demand cash. Not even a debit card will suffice. I have spent days driving to the (very) few Plaid Pantry and Valero outlets nearby, and they also turn up dry. So we have to be resourceful here. I tried the Wells Fargo prepaid card, but the option to load it with another credit card will end on May 1. I have actually considered making my brother and sister additional cardholders so they can buy Vanilla Reloads on my behalf now.

But how long will that last? CVS already caps many Vanilla Reload purchases at two per transaction. I laugh at the stories I read about people’s “territories” and hiding cards behind other brands to save them for future use. It seems like an awful lot of effort, even if Vanilla Reloads are sold nearby.

There Is Another Way

I am not the first to break the news that Federal Reserve guidelines now require that all prepaid gift cards have a PIN (Hat Tip to Million Mile Secrets and this FlyerTalk thread started by jk2). But I don’t think it’s gotten nearly the attention it deserves. This is BIG NEWS in the Pacific Northwest where we have no other easy options, and it could be good news for others, too, as I discuss near the end.

As luck would have it, Daraius found that Kroger supermarkets were already carrying PIN-enabled gift cards when he checked. QFC, one of Kroger’s brands, happens to have a large presence around Seattle and Portland. He was only able to find a $100 gift card, but I have never failed to find stacks of $500 cards at several nearby QFCs. I just got back yesterday from Walmart after setting the PIN on my phone and successfully loaded the entire balance onto my Bluebird with zero complications.

That is the one condition. You need to have a Walmart nearby to load the cards in person. But that I have. It may be a 15-20 minute drive, but CVS is hours by plane. So here’s what to do, step-by-step.

Step 1: Look for cards issued by US Bank National Association.

This information is printed on the back. The cards normally look like they have a big wrapped present on them, with a Visa or MasterCard logo. Get $500 cards if possible to reduce your cost.

Step 2: Pay with your preferred method.

My clerk at QFC asked for a photo ID, but that was all.

Step 3: Set the PIN.

Call 1-866-952-5653. Press 1 to continue in English and then press 2 for “other enquiries.” You’ll be asked to enter your card number followed by the pound sign. You’ll also be asked to enter the three-digit security code on the back. Finally, you can press 3 to set a PIN.

Step 4: Use like any other debit card.

The most logical place to buy $500 gift cards is at QFC. There are many locations, it counts as a grocery store for bonus purposes, and it has no problem taking credit cards. I have not found a nearby office supply store that carries $500 cards; they are all now capped at $200. This can still be a good deal as you’ll learn below.

Remember that you can load up to $1,000 per day and $5,000 per month onto your Bluebird card. Because these gift cards function as standard debit cards, you will need to visit a physical Walmart location and use either the Walmart Money Center ATM or visit one of the clerks at the register or customer service desk.

Choose One or More Cards for Manufactured Spend

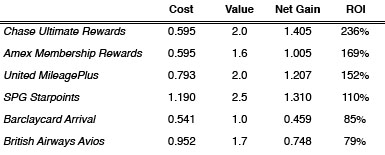

Here are some of the better cards you should consider using to purchase Visa or MasterCard gift cards (I’ve seen some American Express gift cards, too, but have not yet tried them). I am assuming each $500 card will have a $5.95 activation fee, which will be the cost of your miles in addition to any time or other inconvenience.

Starwood Preferred Guest American Express — 1.19 cents per point

1 point per dollar on general purchases = 500 points

British Airways Visa by Chase — 0.952 cents per point

1.25 points per dollar on general purchases = 625 points

United MileagePlus Club Visa by Chase — 0.793 cents per mile

1.5 miles per dollar on all purchases = 750 miles

Ink Bold Visa by Chase — 0.595 cents per point

5 points per dollar at office supply stores = 1,000 points ($200 card maximum)

Premier Rewards Gold American Express — 0.595 cents per point

2 points per dollar on grocery purchases = 1,000 points

Barclaycard Arrival World MasterCard — 0.541 cents per point

2 “miles” per dollar on all purchases, plus 10% rebate on redemptions = 1,100 miles

Each of these points currencies has a different value, so being cheapest to earn is not the end of the conversation. I can usually get 2.5 cents per point in value from SPG’s Starpoints, so my “return on investment” is about 1.3 cents on every point earned through manufactured spend, or 110% (net gain divided by cost). Using valuations like this, I created the table below. You may disagree with my exact numbers, but I think we will be close enough that the order remains relatively unaffected.

From the table, we learn that the greatest return on investment comes from Ultimate Rewards, Membership Rewards, and MileagePlus, though Starwood Preferred Guest remains a reasonable alternative.

There are caveats here. Membership Rewards and Starpoints are good values, but you don’t want to risk an American Express financial review by getting greedy. And to get such a low cost for Ultimate Rewards points, you have to buy five times as many gift cards in lower denominations. Lots of plastic to carry around. Personally, I would likely use those points with United, and it may be easier to accept a higher cost for the sake of convenience using the MileagePlus Club Visa at a grocery store.

Could you have bought Visa and MasterCard gift cards before? Yes, and load them onto an American Express for Target prepaid card. But we don’t have those here, either. Only a handful of stores participate, and they’re in eastern Washington, several hours away. None are in Oregon. Plus, you’d still have to pay additional fees to load the card. Adding a PIN to gift cards makes it easier to rely on local retail partners and also take advantage of Bluebird’s better features like bill pay and writing checks.

I hope this gets you started thinking about new opportunities for manufactured spend, especially those of you living in areas where it has not recently been practical. If nothing else, the opportunity to buy gift cards at a variety of locations and with a variety of cards can help reduce the likelihood of fraud alerts and financial reviews.